Cement Company of Northern Nigeria (CCNN) has overtaken Unity Bank, to emerge the best performing stock on the Nigerian Stock Exchange (NSE).

CCNN is currently up 105.3% year to date. Unity Bank takes second place with a 98.1% gain. Caverton takes third place with an 86% gain, year to date. The NSE is up 6.63% year to date.

Investors may have decided to cash out from Unity following private equity firm Milost Global’s termination of a proposed $1 billion investment.

The company is also the best performing stock year to date in the cement sub-sector. Dangote Cement is up 6.52% year to date. Lafarge is the laggard in the space with a 6.44% dro.

FY 2017 results drove the rally

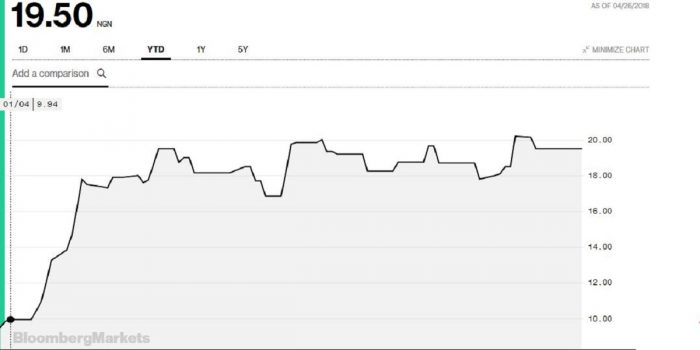

Investors may have keyed into the stock due to the massive increase in profit recorded last year. For the 12 months ended December 2017, revenue was up 35% from ₦14 billion in 2016 to ₦19.5 billion in 2017.

Profit before tax jumped 141% from ₦1.7 billion in 2016 to ₦4.2 billion in 2017. Profit after tax increased by 157% from ₦1.2 billion in 2016 to ₦3.2 billion in 2017, the highest in the company’s history.

CCNN also declared a dividend of ₦1.25 per share amounting to ₦1.57 billion, for the 2017 financial year.

The company’s superlative results were majorly due to a 46% increase in average price per tonne rose by from ₦28.8 million in 2016 to ₦41.9 million in 2017.

Cement Company of Northern Nigeria Plc (also known as Sokoto Cement) was incorporated as a limited liability company on the 15th August 1962 and commenced business operation in1967.

CCNN was listed on the Nigerian Stock Exchange on the 4th October 1993.

BUA International Limited controlled by Isyaku Rabiu holds a 50.72% stake in the company through Damnaz Cement Company Limited a wholly owned subsidiary.

The principal activities of the company are the manufacturing and sales of cement.

I had earlier analysed this stock in Feb, 4, 2018 on my personal finance blog – https://nigerianstockstobuy.com/best-performing-stocks-nigerian-today/ – this stock will be among the top performer this year, there is a competitive advantage CCNN is enjoying that no cement company has right now.