C&I Leasing: Whenever a company reports profits backed by strong operating cash flows it excites my senses. In a world where profits and cash mean two different things, you will be foolhardy to rejoice whenever a company declares profits without backing it with some cash.

In its recently declared 2017 results, C&I Leasing did just that. The company reported a 19% rise in profits to about N1 billion. Operating cash flows after paying suppliers, salaries and other expenses was a healthy N9.9 billion cash. The company went to work with the money and spent N7.7 billion on operating lease assets. On Marine Equipment it splurged N5.9 billion and on cars and trucks another N1.8 billion. By the time it was done spending, it had about N2.1 billion left to spend on other things such as debts and maybe dividends.

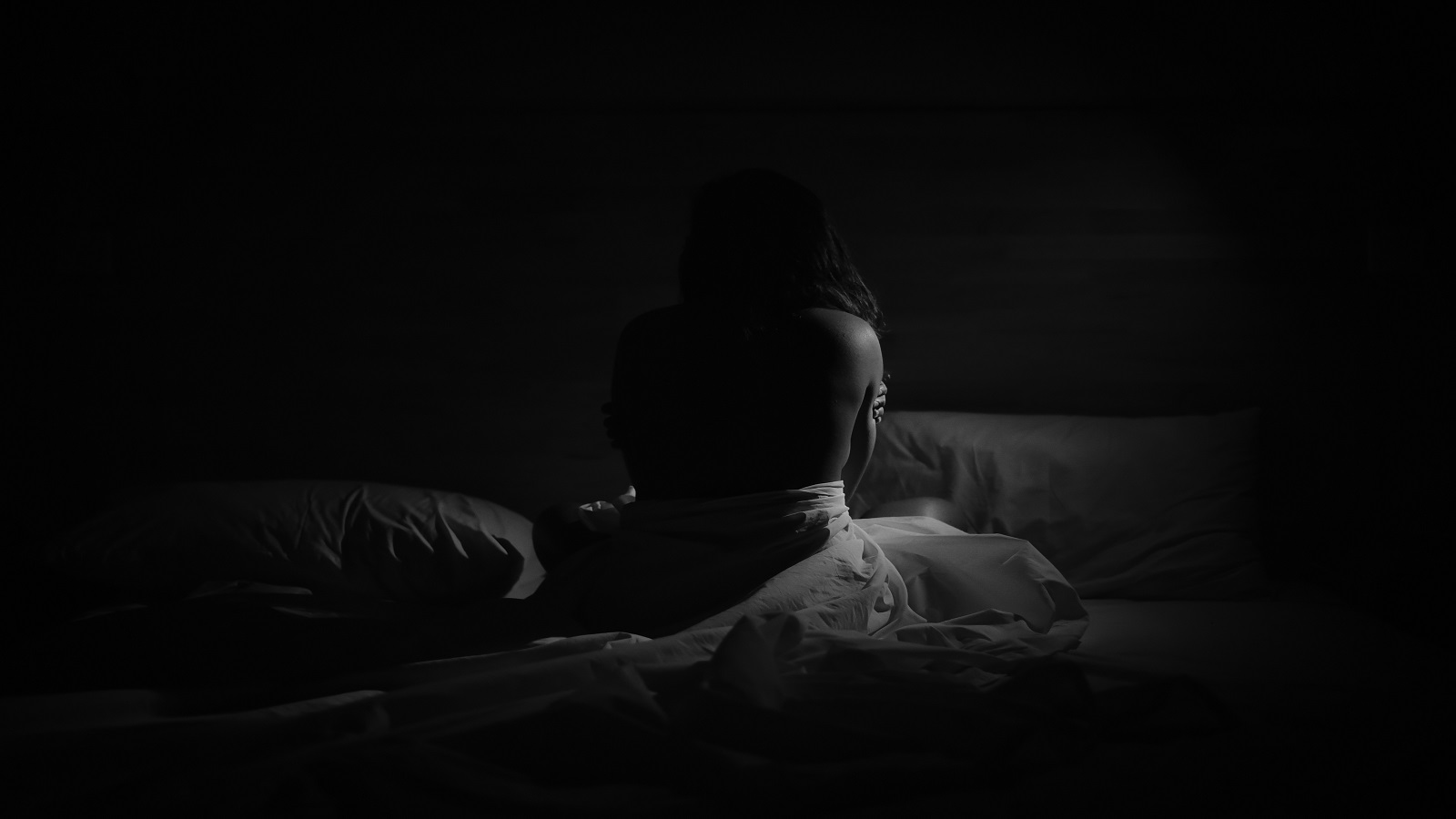

But C&I Leasing ended the year with just N119 million out of which was N72 million, the opening cash balance at the beginning of the year. From the N2.1 billion left after spending on new assets, C&I Leasing generated just N17.8 million in extra cash. Dig a little bit further up the results and it’s easy to see what had happened. The company is basically in bed with debt.

The company has a Balance Sheet size of N45 billion out of which N35 billion made up of all kinds of debt. The interesting thing about its debt profile is not just that it is 3.5x its equity it is the number of people that the company is owing. C&I owes just about every category of debtors from banks, bondholders, tax authorities, suppliers and even retirees. It’s a long list that can make any perennial borrower proud. Who are these creditors you may wonder? So I’ll give you a little run down.

For banks it has owed, Access Bank, Diamond Bank, Citi Bank, FCMB, GT Bank, Fidelity Bank, First Bank, UBA, Zenith Bank, Standard Chartered Bank, FSDH Merchant Bank, Absa Bank, Lotus Capital, Stanbic IBTC and Intercontinental Bank – Cedi. That is about 15 banks by my count.

It also owes another N9.6 billion to “Individual Clients” and “Institutional Clients” as at 2017. In fact, its individual clients are owed about N6.9 billion. Loans from Institutional Clients include those from Bank of Industry, B.V. Scheepswerf Damen Gorinchem, a Netherlands Based lender. How a company deals with this multitude of lenders is stuff made for MBA Classes and their case studies. I have been analyzing company financials for about 10 years now, but I have not seen anything like this before. Even the folks at Oando should be proud of this.

It is interesting to note that despite these complex web of lenders, C&I Leasing has somehow managed to meet its debt obligation. It does this by outright paying off the debts when they are due or kicking the can down the road as its typical with Nigerian businesses. Rather than register a default, they negotiate with their banks and roll over the debts by restructuring with new terms and tenor. This creates a win-win situation where the bank avoids to book a loan loss provision, earns some new fees and the company in return gets a breather on its cash flows. In all this, someone suffers, and that person is you the shareholder.

Apart from the paltry dividends, it pays to its shareholders, its share price was before now nothing to write home about. Between 2015 and 2017 it traded flat at 50 kobo before it more than doubled to N1.9 between 2017 and as at this week. The rally, which is typical of Nigerian stocks probably has little to do with its fundamentals.

In fact, a dilution of its shares is very plausible considering that it has about N2.2 billion in deposit for shares which if it converts can amount to about 1.2 billion units. The deposit for shares is a $12.48 million coupon convertible notes which it received from Aureous LLC Africa (yet another creditor).

If this crystallizes, (of which it will because C&I has agreed to convert it) the shareholders could give up 43% of shareholdings to Aureos LLC Africa, the holders of the coupon convertible notes. Some analysts believe this perhaps explains the recent rise in its share price as these dynamics typical paves the way for a new round of equity raise.

Bottom Line

C&I Leasing is an example of truly Nigerian dream and one should give the Vice Chairman Emeka Ndu credit for founding this company and keeping it alive since 1991. His profile perhaps explains the dexterity to which it has been in bed with debt over the years. However, it is time it reduces its reliance on debt in exchange for patient capital. There is increased competition in this space and some of the newer leasing companies are not quoted, have patient capital, scaling gradually, nimble and aggressive at chasing new and existing businesses. C&I leasing has the experience, brand name, and economies of scale to still muscle them out. Unfortunately, these all amount to nothing, if it cannot shake off its weakness….its flirtation with debt.

I completely agree with this analysis. Add to this the weak earning power the company has, the extremely thin margins it has to deal with and the below average returns on equity and you’ll understand why one ought to run from this enterprise for now.

Good job sir.

Brilliant analysis sir. Now to all you have said, add [a] very weak earning power in relation to enterprise value, [b] razor thin net margins and [c] below par returns on equity. These are reasons that have been making me flee from this company for years now.

Good job sir.

Hi Ugo, Please do you do trainings on shareholding and finance investment etc?

Hello, Nene. I know your question is directed at Ugo. But i guess it’s know harm to state here that i do trainings.

The good news is that the company is still afloat, doing great and perfectly managing its business and debts. Enriched with excellent and top master managers, our money is surely in safe hands. In the business world, who can do business with debts. C&I Leasing is an indigenous company that should be highly praised for doing excellently well even with the harsh Nigeria business environment.

In the business world, who can do business without debts

I think that Ugo doesn’t quite get the business of the company. They are a growing and significant service provider to companies like Shell, NLNG, Chevron, PZ, Huawei and Exxon Mobil. They own 17% of the local subsidiary of BW Offshore, the 2nd largest FPSO operator in the world.

As an oil and gas player, I am impressed enough with the gains and progress they have made in transforming the business. O yes, they are debt heavy but who wouldn’t be if you grow your balance sheet from N17b to N45b? The challenge for the company will be to find patient capital in this IPO-challenged market.

On the whole, I will vote with the company and buy more shares. They have made steady progress over the last 5 years in exiting unprofitable businesses like car distribution and even retail leases.

I have read the annual reports for the last few years and it does appear that C&I have put a lot of history behind it. If you look at all the losses that they have written off over the last few years up till 2016. This probably explains the spike in their profitability in 2017.

I think that deeper analysis will confirm my findings.

@Ugo, wouldn’t it have been better if you do an analysis of Lagos State and Nigeria budget financing and understand the term ‘leveraging’ before you start doing your amateur analysis. Do you even understand the type if business C&I Leasing does? The are into leasing and a bulk of their obligations are in the form of operating lease backed by corresponding assets on the other side of the b/sheet. Did you consider their receivables of over N10billion before you consider their CP? Men, you need to learn this fundamental techniques from the gurus before misleading the public. Anyway, you’re a blogger and only concerned about website traffic and not objective analysis.