The CEO of First Bank Plc, MD/CEO, Dr. Adesola Adeduntan had a media parley on Wednesday, 20th of March 2018 where he laid out the bank’s vision for the future. Nairametrics Founder, Ugodre Obi-chukwu was in attendance and had a chance to ask a few questions which we believe our readers could be interested in.

For First Bank, the oldest corporate institution in Nigeria, it also wants to be the leader in the digital revolution that is increasingly changing the financial landscape of the country. Before we get to the key questions asked by Nairametrics, let us summarized the key strategic ambitions articulated for the bank by its CEO;

Attain No 1 In digital customers

and E-transaction volumes

Top 3 in customer satisfaction

35% growth in customers and number of accounts by 2019

Achieve 20% ROE by 2019

Achieve sub50% Cost to income ratio target by 2019

Achieve sub 10% NPLs by 2019

Now to the questions;

On increasing customers to over 30 million

We asked the CEO how the bank intends to manage customer acquisition cost typically associated with increasing the customer base of the bank

In response, he explained that the bank planned to leverage on its economies of scale which would enable it to increase customer base without increasing cost significantly. For example, it says the technological infrastructure it has deployed and plans to scale will ensure that it can cater for continuous customer acquisition drive without necessarily increase the cost per head.

One the rise of Digital Banking

We asked him about the increasing adoption of Digital Banking in Nigeria and in Africa and how First Bank intends to confront the impending threat of a disruption. We also asked if the bank will be considering setting up a spin-off subsidiary that will focus mainly on Digital Banking.

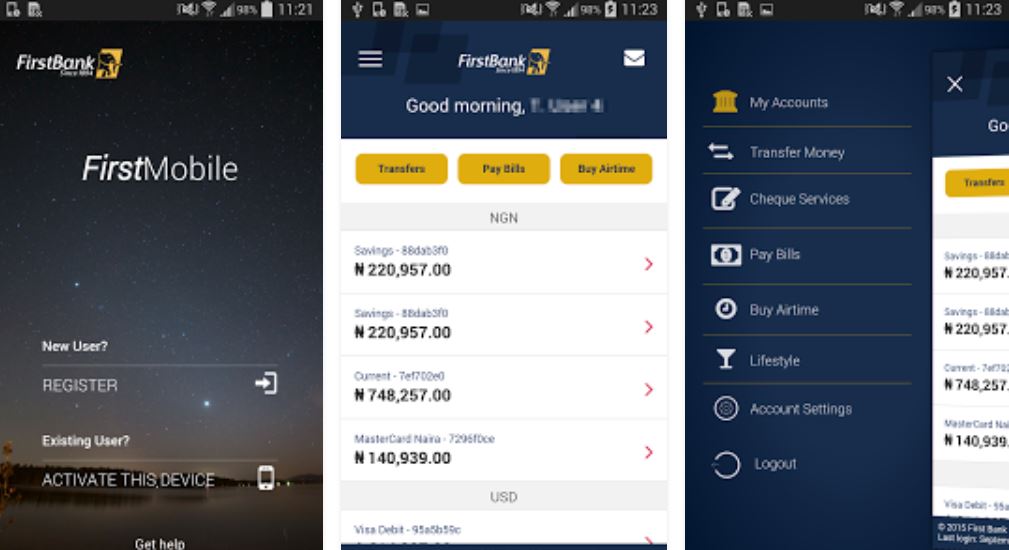

In response, Dr. Adesola Adeduntan explained that the rather than set up a new subsidiary for Digital Banking, it will build on the successes of First Mobile, its banking mobile application as a vehicle into full-fledged digital banking. He also highlighted the Digital Labs initiative that the bank is currently promoting as a venture that would give the bank access to innovation-driven product and services. He also explained that First Bank is already on track for this as nearly 80% of customer induced transactions are carried out online. He remarked that First Bank facilitated over N1 trillion in USSD transactions in 2017 and has repeatedly carted awards for its prowess in the e-business space.

On First Bank’s share price

The CEO was asked if the current share price of First Bank, trading at about N12 was rightly priced at an earnings multiple of about 19x when rival Tier 1 banks were still trading under 10x earnings multiple. We also wanted to know if he thought this was priced in already

In response, he argued that the current share price of the bank was justified and a reflection of the inherent value the bank has. He further explained that the bank’s Strategic Plans will even portend more valuation for the company. He said the bank’s market value had increased by over N150 billion in the last year when it traded at under N3 to the N12 that it currently trades at today.

On Non-interest income

Gleaning from some of the results that have been released, we pressed the CEO on the bank’s plans to grow non-interest revenue.

He responded by assuring investors that the bank was going to focus on growing its E-business assets an area where they believe they have significant upsides. He also explained that the bank is refocusing its overseas branches towards better operational efficiencies and profitability. For example, the China Branch will not only help facilitate trade with Nigerian businesses but with other African countries where they also have footprints in.

On hitting the N1 trillion in Gross Revenue mark

We asked if the bank was in the race to achieve N1 trillion in Gross Earnings seeing that rival Zenith Bank posted N745 billion in Gross Earnings for 2017 up 47% year on year. FBNH the parent company of First Bank reported

Dr. Adesola took a deep breath as he gathered his thoughts before answering this question. In response, he declared that the race to N1 trillion was still wide open and that First Bank was in it to win.

Other nuggets

The Bank’s foreign subsidiary will now report to its Group Executive, International Banking Group, Bashirat Odunewu.

The Bank will not be paying its holding company a dividend for 2017. However, this does not stop the Holding Company from paying dividends.

The bank currently does over 5000 transactions per minute on its ATM’s scattered nationwide. He claims the bank owns 25% of ATMs in the country.

Interesting to note that he said First Bank’s unique position as one of the few Nigerian banks that facilitate millions in transactions daily is significant to being a Systemic Important Bank.

They have also recruited a new Chief Risk Officer from the African Develop Bank who will be tasked to fix the bank’s risk assessment processes.

Finally,

At 12 per share (currently) First Bank appears to be overvalued. However, following this media briefing we believe the bank has a clear-cut strategy that could help sustain the current valuation at the very least.

For the bank to continue to maintain investor positive sentiments, it will hope that some of its plans continue to materialize in the first quarter of 2018. 2017 is more or less a transition year for this bank considering that it had to take provisions of most of its loans.

Restructuring a humongous bank like First Bank is not a walk in the park considering its cost and benefit dynamics and the length of time required to deliver. So the bank will hope that it has the right human resource in key positions that can help it attain these objectives.