Austin Laz and Co Plc today released its full-year results for the 12 months ended December 2017. Turnover increased from ₦217 million in 2016 to ₦312 million in 2017. The company also made a gross profit of ₦494,000, a huge improvement when compared to a loss of ₦146 million in 2016. Profit after tax for 2017 was a meagre ₦315,000.

Capital infusion is badly needed

In acknowledgement of the dire situation the company is currently in, the board has laid emphasis on raising capital.

The directors are making serious efforts to introduce capital funds into the company which will enhance the financial capability of the company.

Red flags

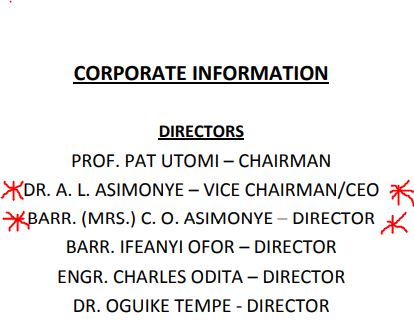

A closer look at the company’s results shows that it may have breached corporate governance rules. Austin Asimonye, the founder and Managing Director also doubles as Vice Chairman.

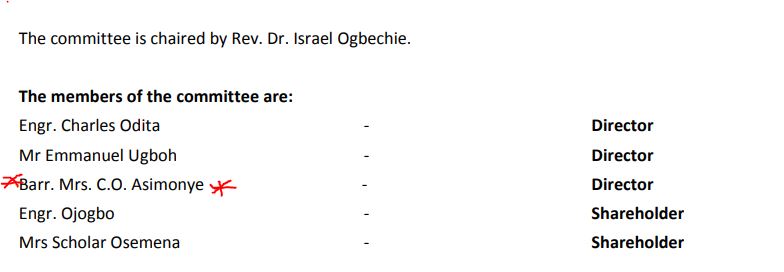

His wife, Barrister Mrs Obiageli Asimonye, who sits on the board, is also a member of the audit committee.

Any hope for shareholders?

Shareholders of the company may have to wait a while for dividends as it currently has negative retained earnings of N179 million. Corporate governance rules prevent companies from paying dividends while they have negative retained earnings.

Austin Laz & Co Plc Limited is an indigenous refrigeration, engineering, contracting and manufacturing firm. The company commenced operations with sales and services of refrigerators and air conditioners but has since evolved into manufacturing concerns with the fabrication of ice block making machines and aluminium roofing sheets.

It was converted into a public company via a special resolution dated 22nd December 2010 and listed on the Nigerian Stock Exchange on 29th February 2012.

Austin Laz closed at ₦2.09 in today’s NSE trading session, unchanged year to date.