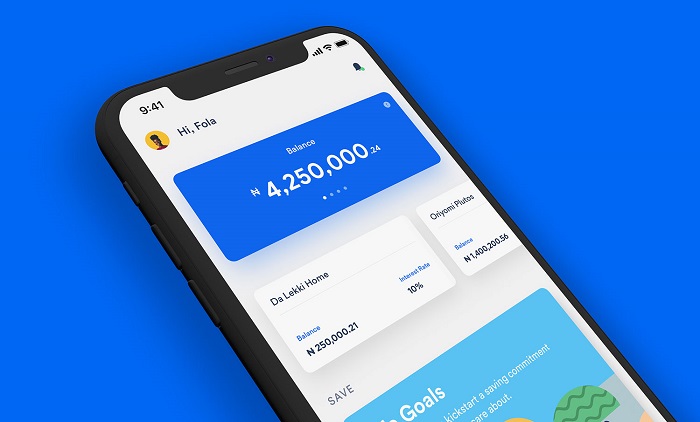

ALAT, Nigeria’s only fully digital bank, has released two exciting new features: quick short-term loans and a virtual dollar card for paying online internationally.

ALAT Loans are accessible to all ALAT customers through the bank’s Android and iOS apps.

The ALAT Virtual Dollar Card is a non-physical, dollar-denominated debit card designed for online payments. Like ALAT Loans, the card is available to all the bank’s customers through its apps.

In addition, customers of the bank can now connect other Nigerian bank accounts to their ALAT profile on the app. This makes moving money around a lot easier for people who use multiple bank accounts.

The feature is one of several ways ALAT users can fund their account. Other ways are through local and international bank cards, and by transfer.

Speaking on the launch of the new features, the bank’s Chief Digital Officer, Mr. Dele Adeyinka expressed his team’s passion to make banking even easier for everyday people.

“A bank should do more than just keep money safe. That’s the bare minimum. The way we see things at ALAT, that bare minimum is no longer acceptable. We believe that these new features will further show the world that banking can and should be relevant to people’s lifestyles,” he said.

ALAT, has been well-received since its launch in May 2017, with over 200,000 accounts opened and over 1.1 billion naira in deposits as at February 2018.

ALAT is a branchless, paperless bank which provides financial services through its Android, iOS and web applications. It was designed in response to the growing needs of Nigerians for a financial institution that understands their needs, responds quickly to them and helps them save money.

ALAT is powered by Wema Bank, the first and longest-serving truly indigenous Nigerian bank.

The future of banking is digital, and Wema Bank is backing this belief by ditching the corporate dogma and taking proactive steps towards bringing tomorrow’s banking to the today’s customers.

Beyond ALAT, the bank continues to champion innovation and leverage technology in breaking barriers plaguing conventional banking. It pioneered the use of card control in Nigeria, an in-app tool that allows customers lock their payment cards from a mobile device. It also formed part of the pilot banks to successfully deploy M-cash, a mobile service that allows merchants receive payments by dialing a simply code. The Bank continues to improve on its *945# USSD Banking service and enhance its online and mobile banking apps to ensure it offers a seamless service across all its banking channels.

About WEMA Bank Plc

Wema Bank, the pioneer of Nigeria’s first fully digital bank ALAT, offers a range of retail, SME banking, corporate banking, treasury, trade services and financial advisory to its customers. Wema Bank operates with a National Banking Licence, with a network of over 136 branches and service centres across Nigeria, backed by a robust ICT platform.

The Bank is one of the few Nigerian banks with NPL ratio below 5% with a robust coverage ratio (including risk reserve) of over 100% in the face of asset quality pressures across the banking industry

More information can be found at www.wemabank.com