Financial inclusion is increasingly recognized as a cornerstone of economic development and social equality.

By ensuring that individuals and businesses have access to useful and affordable financial products and services, societies can make significant strides towards greater economic stability and increased public welfare.

Financial inclusion refers to the availability and equality of opportunities to access financial services. It involves ensuring that everyone, regardless of their wealth or background, has access to essential financial services such as savings, loans/credit, insurance, and payment services.

The goal is to remove the barriers that exclude people from participating in the financial sector and to provide them with the resources needed to improve their lives.

Benefits of Financial Inclusion

- Reducing Poverty and Boosting Economic Growth: Financial inclusion is a powerful tool for poverty reduction. It enables the poorest and most vulnerable in society to step out of poverty by giving them the means to manage their earnings, invest in their futures, and buffer against financial shocks.

- Empowering Women: Access to financial services can lead to greater economic empowerment for women, allowing them to start and grow businesses, invest in their children’s education, and improve family well-being.

- Promoting Financial Stability: By expanding access to financial services, financial inclusion can also help stabilize the financial systems by diversifying the consumer base and increasing the volume of deposits and the pool of investable funds.

- Encouraging Innovation in Financial Services: The drive towards financial inclusion spurs innovation, as financial institutions develop new products and services to meet the needs of previously underserved markets.

Despite its importance, achieving financial inclusion faces several challenges:

- Lack of Infrastructure: In many rural areas, there is a significant lack of banking infrastructure that can offer financial services to the populace.

- Regulatory Barriers: Overly stringent regulations may prevent financial institutions from offering services to the unbanked or underbanked populations.

- Financial Illiteracy: A lack of financial literacy can be a major obstacle, as individuals may not understand how to use financial services effectively.

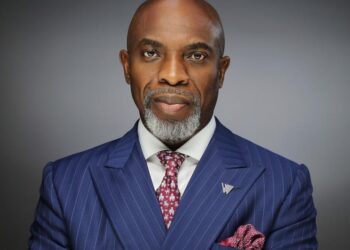

As a leader in Nigeria’s banking sector, Wema Bank has taken proactive steps to address the issues of financial inclusion with innovative solutions and as Wema Bank celebrates its 79th anniversary, it’s an opportune moment to reflect on the bank’s significant contributions to financial inclusion in Nigeria.

Through pioneering initiatives like ALAT, the introduction of the *945# service, and agency banking, Wema Bank has consistently demonstrated its commitment to expanding access to financial services across the nation, particularly for those in remote and underserved areas.

ALAT by Wema, Nigeria’s first fully digital bank, has been a game-changer in the banking industry. This innovative platform offers a branchless banking experience, enabling users from all over Nigeria, especially in remote locations, to access banking services. Features of ALAT include:

- Easy Account Opening: Users can open an account from their phone or computer without visiting a bank branch.

- Seamless Transactions: ALAT users enjoy a smooth, user-friendly interface for all their banking transactions.

- Automated Savings: The platform provides tools that help users plan and automate their savings, promoting the habit of saving for financial security.

Recognizing the need to cater to those not proficient with digital technology, Wema Bank introduced the *945# USSD service. This service is crucial because it:

- Ensures Accessibility: Allows people without internet access or advanced digital devices to perform banking transactions such as transfers, bill payments, and airtime purchase.

- Supports Inclusive Banking: Makes financial services accessible to the elderly and others who may find technology daunting, ensuring they are not left out of the banking system.

- Expands Reach: Enables banking transactions in local languages, helping to bridge the language barrier in diverse communities.

Wema Bank’s agency banking initiative extends financial services into areas lacking physical bank branches by partnering with local businesses who act as bank agents. These agents are equipped with POS terminals and mobile devices to offer:

- Basic Banking Services: Such as cash deposits and withdrawals, facilitating daily financial activities in the community.

- Account Opening and Loan Services: Helping to grow the financial inclusion net by bringing more people into the formal banking fold.

- Financial Advisory Services: Agents also educate customers on financial products and best practices for managing money.

A crucial component of Wema Bank’s strategy for promoting financial inclusion is its commitment to financial education. The bank understands that knowledge is power, especially when it comes to finances. Therefore, it:

- Conducts Workshops and Seminars: These are aimed at individuals at various levels of society, from school children to adults, teaching them about savings, investments, and wise financial habits.

- Develops Educational Materials: Provides resources in print and digital formats to help people understand the importance of financial services and how to utilize them effectively.

- Partners with Educational Institutions: Collaborates with schools and colleges to integrate financial literacy into their curricula.

Financial inclusion is vital for sustainable economic growth and equitable development. As financial systems evolve to include more of the underserved populations, institutions like Wema Bank play a pivotal role in shaping a financially inclusive society.

Through its initiatives, Wema Bank not only contributes to the financial well-being of individuals but also drives broader economic progress across Nigeria. The continued efforts in this direction are crucial for achieving an inclusive financial system that can elevate entire communities and foster the economic resilience needed to face future challenges

As Wema Bank looks to the future, it continues to innovate with the goal of ensuring that every Nigerian has access to financial services. The bank plans to expand its digital offerings, enhance its USSD capabilities, and increase the number of agency banking partners. This ongoing effort is aimed at ensuring that the bank not only contributes to Nigeria’s economic growth but also plays a pivotal role in creating a more inclusive financial environment.

Wema Bank’s 79th anniversary is not just a celebration of years in business but a reflection on the profound impact it has made on financial inclusion in Nigeria. Through its innovative services and commitment to educating the public, Wema Bank has demonstrated that a financial institution can indeed be a powerful force for social and economic improvement.

As it continues to break barriers and forge new paths, Wema Bank remains at the forefront of providing inclusive financial services that cater to all Nigerians.