Nigerian pension funds earned an annualized 16.37% average return for the period ended December 31, 2017 compared to 11.56% the prior year, a new data analysis from Quantitative Financial Analytics has shown.

The APT RSA Pension fund was the best-performing among the RSA category of funds for the period, with an 22.24% return, followed by the 19.85% return produced by the Crusader RSA Pension fund. 8 of the 19 RSA funds being tracked by Quantitative Financial Analytics produced returns that beat the industry average of 16.37% while the rest produced returns below the industry average. All but one RSA fund produced returns in the double digit.

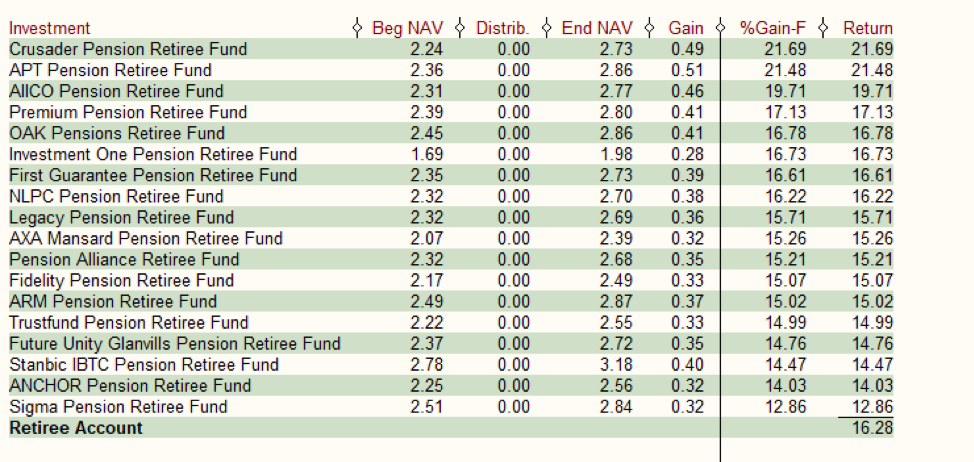

The Retiree fund category followed closely the trend and pattern of the RSA funds recording an average return of 16.28% compared to last year’s average of 12.42%. Crusader Pension Retiree Fund took the lead by producing 21.69% return while APT Pension Retiree Fund came second with 21.48% return. 7 of the 18 Retiree funds recorded better returns than the industry average and all the Retiree funds closed the year with double digit returns.

The gratuity fund category, occupied by funds managed by Pension Alliance (PAL) recorded an improved performance in 2017 as the Pal Emenite and Pal Guinness funds produced 16.5% and 15.1% return respectively compared to their 15.04% and 13.74% returns in 2016.

Though the pension funds did so good in 2017, they were walloped by the NSE Pension index which produced a whopping 70.3% return. Whether the index is a good bench mark for pension funds is still subject to debate.

While most pension funds are predominantly invested in fixed income funds, the NSE pension Index fund is an equity-based index. Comparing an equity-based index with a fixed income-based portfolio looks like comparing apples and oranges. According to analysis by Quantitative Financial Analytics, Nigerian pension funds have about 74% of their assets allocated to Government Bonds and Treasury bills with only 10% invested in domestic and foreign equity securities.

APT Stands out

APT Pension fund has really stood out over the past few years as the top performer taking either the first or second positions in the performance table year after year. In 2015, it took the second position in the the RSA fund performance chart with 31.86%, in 2016 it came second again with 12.58% topping the Retiree fund category with 14.99% performance.

While it is not very apparent why APT does so well, it looks like it has to do with their asset allocation strategy. APT seems to be the only pension fund that has a double-digit allocation to the stock market with about 13.75% of its RSA assets allocated to equities while 12.81% of Retiree fund asset is also allocated to equities. The industry average allocation to equities in 2017 was 10.33%. According to available information on their website, APT pension managers over see the pension accounts of about 120k registered RSA members.

This is a biased report. What happens to the NPF Retiree fund?

How do you report when your website isn’t updated?

@Muhammad Dutse

This report is as objective as the available data can be. NPF RSA Fund returned 14.09% in 2017 which puts it at the 16th position out of 19 RSA funds. As at the time of our analysis and reporting there were no available pricing or valuation information on NPF Retiree fund, that was why it was not included in our analysis. I just saw that you have uploaded the data for Feb/March 2018 and we would include going forward. However, for a more credible and meaningful analysis, we require about three years worth of data, could you please send me the pricing for NPF Retiree fund from inception to info@mutualfundsnigeria.com.

Are the return calculations gross of fees or Net of fees? if they are net of fees, the comparison will benefits some that others. Some PFAs have lower custodian fees than the other because of the size of their fund. It will be appropriate to measure them all gross of fees. This is what GIPS recommended.

Thanks for your comment and observation. The return calculation is net of fees. You are correct on the recommendation of GIPS but we are handicapped by the availability of data and besides, we are presenting the performance based purely on the NAV of the funds and we are not doing attribution analysis of the funds as at yet but someday we will get there

Good comment, thanks

Can you buy into any of the funds as an investor.