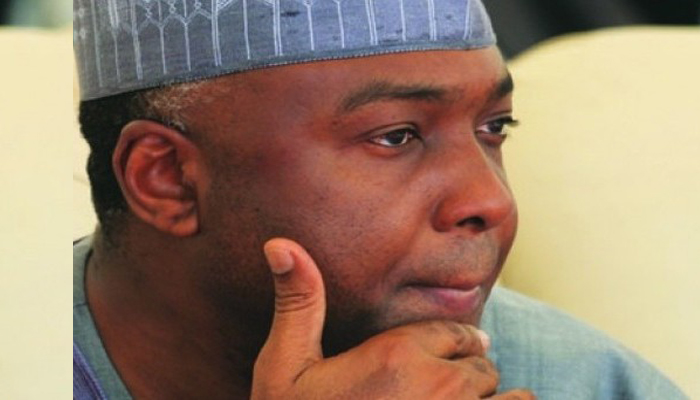

Nigeria’s upper chamber has turned its searchlight on the trade of bitcoin and other cryptocurrencies in the country. This was raised in a motion by Benjamin Uwajumogu, the Senator representing Imo North constituency.

The Senate also mandated the Central Bank of Nigeria (CBN), Securities and Exchange Commission (SEC), as well as the Nigerian Stock Exchange (NSE) to embark on enlightenment campaigns on the risks involved in their trade. In addition, the Senate’s Committee on Banking and other Financial Institutions has also been instructed to look into the viability of bitcoin, and possible regulations of its trade. CBN Governor Godwin Emefiele had last week likened the trading in cryptocurrencies to gambling.

Why is the Senate interested ?

The upper chamber joins countries around the world that have expressed concern about trading of cryptocurrencies. Regulators have struggled to draw boundaries because they are unsure about classifying cryptocurrencies as an asset or a currency. The absence of regulation has also led to several unscrupulous characters raising funds through Initial Coin Offers and disappearing with them. Several exchanges across the world have also been hacked.

The warning may fall on deaf ears

Nigerians have embraced trading of cryptocurrencies due to the massive profits that were made last year. Bitcoin which is the biggest coin by market capitalization surged from $1000 to $10,000 last year. Clamping down on trading bitcoin and other cryptocurrencies, will only drive markets underground and encourage ponzi schemes the Senate is trying to prevent.

There is more to cryptocurrencies

Though the senate’s concerns are reasonable, trading of cryptocurrencies is just one part of an emerging industry. Blockchain, the underlying technology on which bitcoin and other cryptocurrencies run can be applied to various aspects of the economy. The various exchanges in the country also employ staff, especially in the ICT industry. Know Your Customer (KYC) and Anti Money Laundering (AML) regulations are also applied.