- Nigerian banks added just 61 net new jobs in the last one year to September 2017. This takes total banking sector jobs to 82,531

- Banks increased hiring in the third quarter of 2017

- Banks also relied heavily on contract staff for employment

Nigerian Banks have added net jobs amounting to just 61 in the last one year between September 2016 and September 2017, according to data from the National Bureau of Statistics.

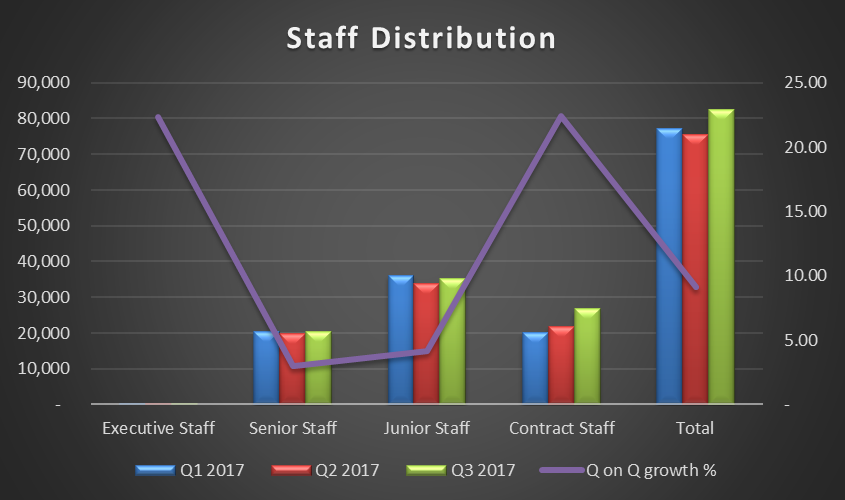

This translates to a total banking sector headcount of 82,531 as at the end of Q3, 2017 compared to 82, 470 in the corresponding period in 2016.

On a quarter on quarter basis, this compares to a total payroll count of 75, 607 at the end of June 2017, representing a 9.16% increase, the highest rise from any quarter since 2014 Q2 (when the NBS began tracking this data).

Nigeria exited an oil price induced recession in the second quarter of the year, after reporting about 6 quarters of negative GDP growth rate that started in 2016. As the economic situation in the country worsened, unemployment situation in the country took a nosedive, resulting in a massive downsizing by corporates, particularly banks.

The banking sector led the pack shedding a net 4,940 in 2015 alone and another 2,302 jobs in 2016 (2016 Q4 data was excluded). In total, Nigerian banks lost about 8,751 jobs to the recession which ended in the second quarter of 2017.

Banks however recovered by adding whopping 6,924 jobs in the third quarter of 2017, the second highest job add since Q2 2014, where 9,990 jobs were added.

Increased reliance on contract staff

Bank hiring in 2017 also showed significant preference towards hiring contract staff. At 26, 723 staff, representing a 22.3% increase banks seem to have shifted focus to cheaper manpower.

Based on the data banks now have 197 executive staff, 20,420 Senior Staff, 35,191 Junior Staff and 22, 673 contract staff.

HR experts contacted by Nairametrics provide a number of reasons why this may be so. For example, to increase market share in the retail banking space, banks rely more on contract staff to market their products.

Significant investment on mobile apps, ATMs and other technological advancements also mean routine banking operations are now handled by lowly skilled workers making it unnecessary to retain staff on permanent contracts, which are significantly more expensive.

What is driving the recruitment

The economy however turned the corner in the first quarter of 2017 following a rash of CBN policies that improved investor confidence for the naira. Nigerian banks have since then raked in billions in profits from forex revaluation and transactions, helping them mitigate losses arising from rising non-performing loans.

The year 2017 has also been a remarkable year for Nigerian banks, earning over N400 billion from treasury bills alone, a short-term security instrument sold by the CBN on behalf of the government. With interest rates as high as 17% for most parts of the year, banks have raked in billions in tax-free income further consolidating their dominance in he economic landscape.

Bank profits for the first 9 months of 2017 currently top N520b billion and is expected to top N600 billion by the end of the year. Nairametrics research project profits could be up by as much as 30% by the end of the year.

In terms of Balance sheet size, banks also reported a stronger balance sheet in 2017 compared to 2016. Balance sheet size of the top banks are at N31.3 trillion compared to N29.6 trillion in 2016. All of this may have culminated in the commercial bank’s willingness to increase head count in the third quarter of the year.

There also exist a likely qualitative factor that may have influenced hiring in the 3rd quarter of the year. While bank hiring has improved this year, it is important to note that we do observe seasonal effects.

We observed that banks typically hire more or fire less in the third quarter of the year. This follows a significant downsizing at the end of the year.

Cautious optimism

Despite the increased hiring recorded in the third quarter of 2017 and robust profits, the Nigerian banking sector has added net jobs of just 61 in this year alone. If you also consider the fact that banks typically downsize in the 4th quarter of the year, then it is likely that we may end the year with a net job loss for the banking sector.