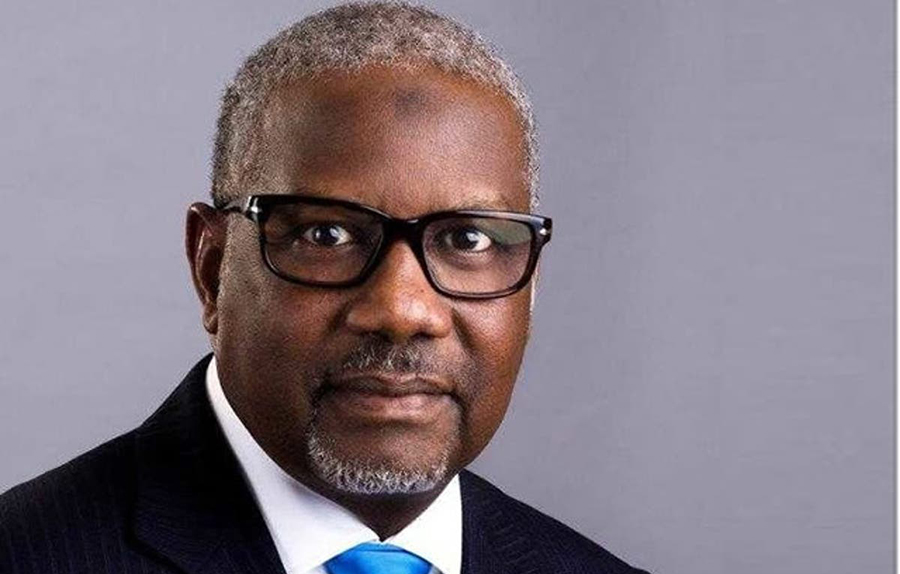

Commercial banks in the country are to implement provisions of IFRS 9 from January 1st next year. This was disclosed by the Director of Banking Supervision of the Nigerian Deposit Insurance Corporation (NDIC) Adedayo Adeleke during a workshop organized for financial journalists by the corporation in Kano.

Implications of the new standards

Banks in the country may have to embark on capital raising exercise in order to maintain their capital adequacy ratios. Fidelity and Zenith bank had earlier in the year raised Eurobonds, while tier two lender Union Bank embarked on a N50 billion rights issue. In addition to making more provisions, the banks in the country would have to make greater disclosure as well as measure assets at fair value, with changes in fair value recognized in profit and loss as they arise.

Profitability of banks could also take slight dip, as banks would have to make provisions for both impaired loans and loans they expect to go bad. Banks in the country have had a turbulent year due to the economy going into recession, and a drop in oil prices which has led to them taking provisions on loans granted the oil and gas sector.

What is IFRS ?

International Financial Reporting Standards (IFRS) are a set of global reporting standards issued by the IFRS foundation and International Accounting Standards Board (IASB). The IFRS was introduced in order to have uniformity in accounting data across the world.

Why was IFRS 9 introduced ?

IFRS 9 was introduced to replace a previous accounting standard, International Accounting Standards Board (IASB 39) which was considered and difficult to understand.