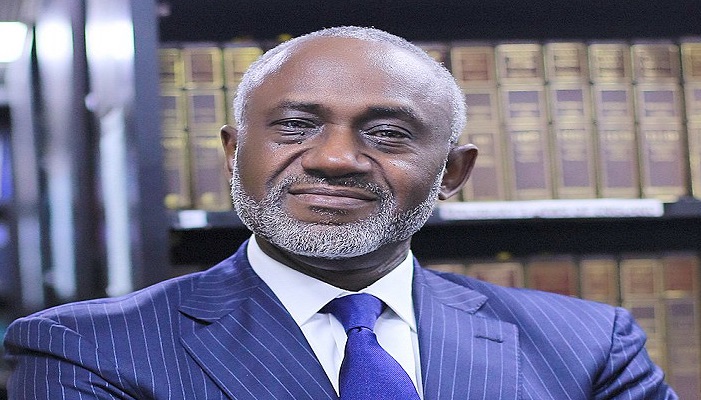

Gbenga is perhaps Nigeria’s richest lawyer. Described as a proper businessman and astute deal maker, Gbenga is the type of lawyer every Nigerian lawyer aspires to become.

Born on the 30th of March 1959, He is one of the founding partners and Chairman, Management Board of Aluko & Oyebode a full service commercial law firm in Nigeria.

An alumnus of Christ’s School, Ado Ekiti, he obtained his first degree from University of Ife now known as Obafemi Awolowo University in 1979 and was admitted into the Nigerian bar as a barrister and solicitor of the Supreme Court of Nigeria in 1980. He went further to bag a Master’s degree in Law from the University of Pennsylvania in 1982. He is also a member of the New York State Bar.

Gbanga started his career at an American law firm White & Case before moving to Gulf Oil now know as Chevron in Houston Texas. In 1992, he formed a partnership with Bamidele Aluko, Odein Ajumogobia and C.N Okeke to practice law in Nigeria. In 1993, he and Aluko broke out from the partnership and started Aluko & Oyebode which runs till date. His practice areas include oil and gas and power projects, foreign investment and privatization, telecommunications, project finance and aviation.

Gbenga is a highly rated lawyer with vast knowledge and experience in business and law. According to the International Financial Law Review IFLR 1000 (the guide to the World’s leading Financial Law Firm) he is one of Nigeria’s most prominent lawyers. Chambers Global another legal guide, also regards him as a consummate deal maker who has received pundits from clients and peer alike for his corporate expertise. This is clearly evident in the several accolades and awards he has received both individually and through his law firm.

Currently, in addition to his position as Chairman of Aluko & Oyebode, he sits on the board of several companies in various capacities including Nestle Nigeria Plc, Okomu Oil Palm Company Plc as Chairman, Asset Management Group Ltd as chairman, Combined Industrial Agro Consultants Ltd as Chairman, Timbuktu Media Ltd as chairman, Socfinaf S.A as director, Crusader Nigeria Plc as director, MTN Nigeria Communications Ltd as director. He is also on the Africa Advisory Committee of the Johannesburg Stock Exchange.

Some of the high-profile transactions he has been involved in include advising on the Brass LNG Project, the sale by Exxon Mobil Dil Corporation of its 60 per cent equity stake in Mobil Dil Nigeria Plc to Nipco Plc and the US$360 million Lekki Concession Infrastructure Project for the construction of toll roads and bridges in Lagos State which is the first major PPP initiative in Nigeria. He also advised on the US$1.25 billion financing of the Exxon Mobil Natural Gas Liquid II Project, the US$1.06 billion financing of trains four and five of the Nigerian Liquefied Natural Gas Plant Expansion Project and the development, financing and implementation of the first Independent Power Plant project in Nigeria.

Gbenga is a fellow of the Chartered Institute of Arbitrators and a member of the Nigerian Bar Association, the American Bar Association and the International Bar Association. He is a past chairman of the Nigerian Bar Association Section on Business Law.

Gbenga who was bestowed the national honour of Member of the Federal Republic in 2001 and the Belgian Royal Honour of Knight of the Order of Leopold is happily married to Aisha Mohammed-Oyebode, the daughter of late General Murtala Mohammed and they are blessed with children.

“OYe bobo” of Christ school fame is a quiet achiever and an astute diplomat