As is customary ahead of the start of its two day monetary policy retreat for September 2017, the Central Bank of Nigeria (CBN) released the personal statements of members of the monetary policy committee (MPC) from the July meeting. In one of the statements, Dr. Doyin Salami, stated that the apex bank has been running a piggy bank for the Federal Government of Nigeria (FGN).

At the heart of the claim, which mirrors a similar complaint by the ex-governor Sanusi Lamido Sanusi in late 2016, is the marked rise in CBN’s loans to the FGN which stood at N5.2tr in July 2017 going by data from the CBN. However, having examined more data from the CBN, I think it would be important to state that growing FG borrowings from the CBN is only half the story and piecing the other half would help place things in proper perspective.

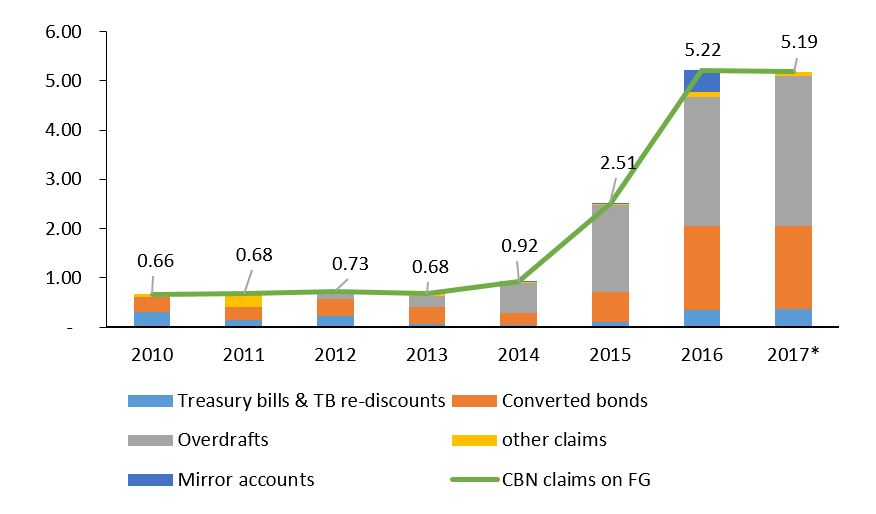

In financial accounting, the balance sheet ‘balances’ when assets equate to the sum of liabilities and equity. From a banking perspective-as the CBN accounts are kept- a loan to another party in the view of a lender is an asset and going over CBN’s monthly balance sheet data available on its website, CBN loans to the FG are positioned on the asset side of CBN’s balance sheet. Looking back, from under N600bn in 2010, FGN borrowings from the CBN have climbed on an average of 45% per annum over the last seven years to over N5tr.

As a share of CBN assets, its loans to the FGN rose from under 8% to 20% in 2017. The big jumps occurred in 2016 and suggest that faced with a steep drop in oil revenues, the Nigerian government turned to the CBN to bridge funding shortfall with a marked rise in the volume of overdraft facilities made available to the FG by the CBN. On the face of the data, it would appear that Dr Salami’s accusations are correct.

Figure 1: CBN loans to FG: Components

Source: CBN * As at July 2017

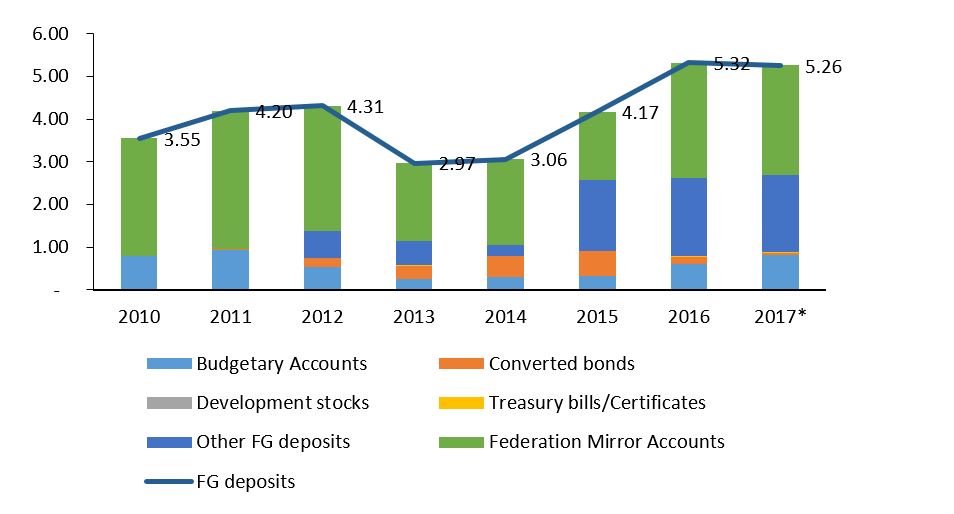

However, as stated earlier, in a balance sheet, all assets (including loans in this case) have to be financed from either liabilities or capital. In the case of a bank, this would be primarily via deposits and then from borrowings or equity. So what is the corresponding deposit item on the CBN balance sheet for the loans it is providing to the FGN? Looking at the liability side of CBN’s balance sheet reveals it clearly – FGN deposits.

As the banker to the FGN, and following the implementation of the Treasury Single Account (TSA), the CBN is the natural domicile for FGN deposits. Gleaning through the numbers reveals that FGN borrowings look like a cash backed loan as effectively the FGN borrows against its own deposits with the CBN. Looking at trends, after holding steady then declining in 2014-16, FGN deposits jumped in 2015 as the TSA effectively sequestered all deposits from the banking system into the CBN to N5.26tr. Hence, the FG is merely taking an overdraft facility against its own deposits.

Figure 2: FGN deposits: Components

Source: CBN * As at July 2017

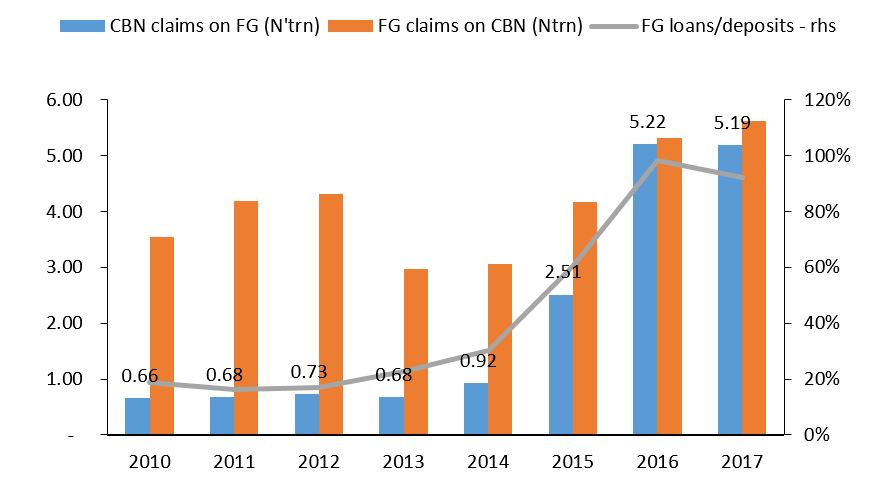

Combining both FG deposits and loans together places things in a proper context – from a little under 30% of its deposits, prior to the oil price shock, the FG is now borrowing against most of its deposits to the CBN with the 2016 number at a record high of 98%. Viewed from this light, and keeping the balance sheet perspective in mind, there appears to be nothing wrong on a net basis. However, there are likely to be concerns raised from an income statement perspective, where one would need to match the incremental CBN claims to the FGN against statutory requirements in the CBN Act 2007 which mandate that ‘the total amount of,…, advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government’. What is unclear is whether the advances referred to are net or gross sums and this suggests that the matter might be subject to legal interpretation. From a ‘substance over form’ standpoint, in my opinion, a net basis sounds more realistic in the light of TSA implementation.

However, this would also imply that the finance ministry is not immune from accusations of poor treasury management as clearly they are unable to manage cash flows in a manner that limits FGN reliance on overdraft facilities. The way to look at these borrowings is that they are cash backed loans; this reflects an inefficient liquidity/treasury management operation by the finance ministry as it does not have sufficient control over its own funds and expenditure. Cash management ought to be the bread and butter of the finance ministry but on the evidence presented, it appears its merely an allocation and spending unit and less serious on planning.

Figure 3: FGN borrowings and deposits with the CBN

Source: CBN

From the data and analysis presented, the claim of unrestrained CBN deficit financing appears to not be something worth worrying about. However, what would follow is the Dr. Salami’s claim that these borrowings to plug a bulging FGN deficit being funded via CBN’s aggressive liquidity tightening from the financial system. Cue the now generic crowding out argument against the FGN. Also, as the data shows, the FGN is merely borrowing against its own deposits, though this is inefficient as new money is not being created.

The real worry however is that the CBN securities issuance which was ostensibly borne out of the desire to curb NGN liquidity to defend the Naira has reached worrying levels. I hope to address this exhaustively in another column. For now, what is sufficient is that we understand what is going on with regards to FGN and CBN relations.