Issue on Offer/Summary On the 13th of September 2017, the Federal Government of Nigeria (FGN), through the Debt Management Office (DMO), rescheduled the bond auction for the 20th of September 2017.

Read: How to invest in FGN Bond

Hence, the DMO will be conducting the bond auction on Wednesday the 27thof September 2017. A total range of NGN120bn – NGN150bn is to be raised from the auction, through the re-opening of the FGN 5-year bond, FGN10-year bond and the FGN 20-year bond.

- 14.50% FGN JULY 2021(5-Yr Re-opening) NGN30bn – NGN40bn

- 16.2884% FGN MAR 2027(10-Yr Re-opening) NGN45bn – NGN55bn

- 16.2499% FGN APR 2037(20-Yr Re-opening) NGN45bn – NGN55bn

Current Yield Analysis

Investors’ reactions to Treasury bonds instruments have been somewhat bullish since the last bond auction (23rd of August 2017), as the average bond yield declined by 0.66% to close at 16.24% as at the 21st of September 2017. Buy sentiments were witnessed across all tenors, however, the MAY-2018, JUN-2019 and APR-2037 bonds remained the most attractive of them all.

Podcast: Investing in FGN Bond

On the 14th of September, 2017, the offer for Federal Government Roads Sukuk opened for subscription and will close today the 22nd of September, 2017. The Seven-year Ijarah Sukuk worth NGN100bn will be offered at a rental rate of 16.47%. We believe that this will further deepen the debt market in Nigeria, as more institutions begin to raise funds through this means.

Given the improvements in the economy so far, as shown by the 0.55% growth in Q2:2017 GDP and the moderating inflation rate, we expect investor confidence in the economy to improve in the near term. In line with this, we expect the yields in the fixed income space to moderate, as we already saw a decline in the discount rates in the last Treasury bills auction.

The Monetary Policy Committee (MPC) will be holding the fifth committee meeting on the 25th and 26th of September. The committee will consider the recent developments in the economy and decide the optimal strategy to achieve their goal. While we expect that the policy rate will be maintained, we also believe that rates will remain attractive for investors in the near term.

Bond Absolute and Relative Valuation

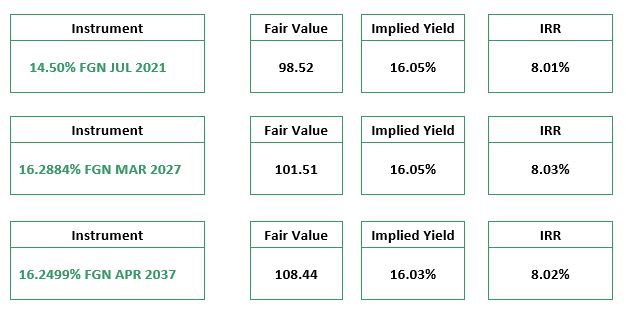

Valuing the14.50% FGN JUL 2021, 16.2884% FGN MAR 2027, and 16.2499% FGN APR 2037 re-openings with the current yield curve as the basis for discounting, we arrived at the following fair value, implied yield and an IRR for the instruments:

Our valuation gives a fair trading price ex coupon payment, the expected return on the bond considering its periodic interest payments and the expected return on the bond’s periodic payments. We analyzed the issues on offer given the current yield environment, market liquidity, as well as a review of the recent past auctions, whilst also introducing market sentiment factor into our valuation, on which we advise bid yield ranges for both issues on offer.

Source: Meristem

Want to buy? Contact Meristem

Wealth Management sulaimanadedokun@meristemng.com (+234 803 301 3331) olatunjiesan@meristemng.com (+234 818 3983727) damilolahassan@meristemng.com (+234 803 6139123) Tel:+234-1-4488260