Data from the annual report of the Bank of Industry reveal a total of N6.79 billion was spent as staff salary for the period ended December 2016, compared to N5.5 billion the year before. As such, the bank increased its payroll by a whopping 23% even as the country facing a crushing recession.

The Bank of Industry is a Nigerian government-owned entity that offers development loans at concessionary interest rates to small and large-scale industries regarded as priority areas by the government.

Staff compensation

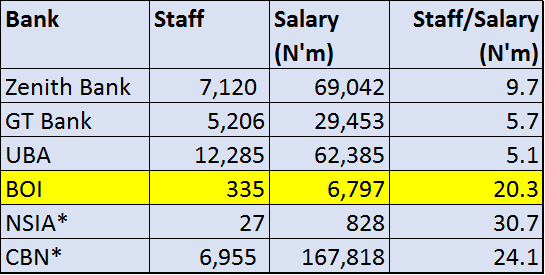

According to its 2016 annual report, the bank had in its payroll about 335 employees, compared to 318 the year before. Based on this, the average salary per employee comes to a whopping N20 million in 2016 alone. This is one of the highest we have seen in the financial services industry and for government-owned entities.

A breakdown of their staff salary also reveals about 141 (42%) of the staff earn above N9 million while about 291 (86%) of the customers earn about N4 million and above.

*As at 2015

When compared to some of Nigeria’s top commercial banks, the Bank of Industry appear miles ahead in terms of total staff salary cost per employee. However, it just falls short of CBN and NSIA which compensate better per employee. AMCON did not reveal its staff cost in 2016.

The employees of the bank also enjoyed about N1.2 billion in training and capacity building a figure that is 119% higher than what was reported the year before.

Directors

The annual report also reveals the directors of the company incurred an emolument of about N107.7 million for the period under review, compared to N80.6 million the year before. Waheed Olagunju is the Bank’s acting CEO. The Bank just has about four executive directors and three non-executive directors.

BOI also claims that it does not have any executive compensation, however it does admit that it incurred about N794 million in Key management compensation compared to N607 million in 2015.

The Bank of Industry also reported its employees currently owe about N652.6 million in mortgage loans.

Results

The employees of the bank also appear to justify their pay as the bank also reported a profit after tax of N14.5 billion for the period ended December 2015, representing a 67% drop in profits compared to the N44.6 billion profit posted a year earlier. It is important to add that the N44 billion profits made in 2015 was mostly due to an income fof N37.4 billion earned from the sale of its stake in WAMCO Nigeria Plc.

Bank of Industry’s annual report may have been much better in 2016 where it not for a spike in its operating expenses. The company reported an operating expense of N8.5 billion compared to N5.3 billion the year before suggesting a 60% increase. A closer look reveals an expense of N1.2 billion classified as “Business Development”, a significant increase from the N118 million incurred for the same expense line in 2015. We also observe a ,major increase in motor running and business travelling expense from N769 million to N1.49 billion in 2016.

What BOI does

The Bank’s mandate includes the provision of financial assistance for the establishment of large, medium and small projects as well as expansion, diversification and modernization of existing enterprises; and rehabilitation of ailing industries. The Bank also manages dedicated funds and through its subsidiaries, provides business advisory services, trusteeship, leasing, insurance brokerage, etc.