In mid 2016, First Bank revamped her USSD banking service in a bid to further drive financial services to the financially excluded and underbanked.

USSD is a GSM Mobile Technology trend that is redefining the way we make payments and other value added services as an emerging economy.

It enables users to conduct specific banking transactions with any kind of mobile device, as long as it can access a GSM network and without need for internet connectivity.

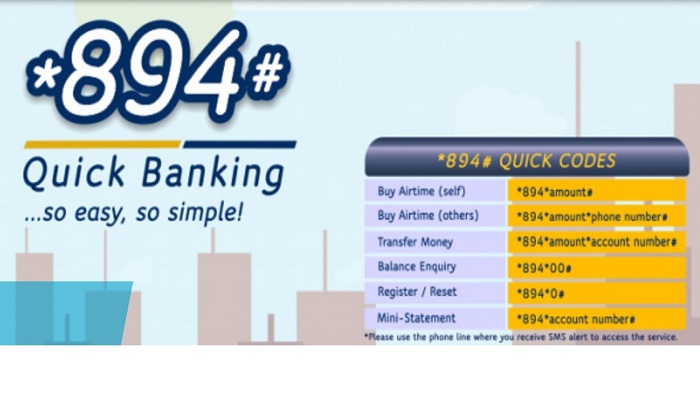

FirstBank’s USSD banking platform, which can be assessed by dialing *894# on a mobile phone was designed to execute basic transactions. In developing it, the bank is aiming to provide digital products that would be appropriate for different markets or segments of users. Its greatest advantage over other banking channels is its ability to reach what we can term the bottom million market – that is, users of financial services who reside at the base of the banking access pyramid due to the fact that they are often low-income earners who are unable to access technology.

USSD is able to easily take financial services to them because its usage flexibility enables it to be functional on both the simplest / cheapest mobile devices, and the higher technology smart phones and tablets. It also tackles the problem of accessibility, where these users cannot visit a bank because they live far from the cities where the banks are located. It further gives them the convenience advantage. Because of this capability, USSD is being touted as the most effective communication technology available to provide financial services to low-income individuals.

By deploying this technology, First Bank is expanding the frontiers of financial inclusion even further. Smartphone apps, which attempted to drive inclusion have seen limited success because it requires an internet connection, which is still expensive and excludes a vast majority of low-income users.

Another segment of users that First Bank is aiming to reach are the underbanked. These are customers who already have access to banking services and technology. For this group, the bank’s offering takes convenience and reliability even further. Although the use of smartphone apps and debit/credit cards to pay for shopping, food, petrol, bills, mobile and data top-up is now widespread, there are times when internet connection is weak or spotty to the point where banking applications become unstable. USSD comes in handy here as well because it uses GSM network channels to transmit data.

In other words, as long as you can make and receive phone calls and text messages, you can make a bank transaction.

What can you currently do on the *894# platform?

The service requires you to have a FirstBank account with a linked debit card, and the phone number with which you receive SMS alerts. You will also need to dial 8940# to get started. Some of the transactions you can execute on the platform include transferring money to any bank in Nigeria; airtime recharge for self and for others; Check your account balance and Get a mini-statement.

According to the bank, the bouquet of offerings on the platform is huge. So beyond the aforementioned services currently being offered, the Bank is at the point of deploying Bill Payment, Retail/Merchant payment, Account opening, BVN linking/BVN enquiry and a host of other services. These services put together will cater for all customers. Given that variety is the spice of life, we believe that as Bank of first choice, our customers should be able to transact with ease using the 894 Quick codes.

The USSD service is expected to become a product that will also complement the mobile app platform when customers don’t have access to the internet. The product will also see more exposure, especially towards customers in the areas where internet penetration is low, and to customers who don’t use smartphones or purchase internet access at all.

The fast-paced application of technology to consumerism is revolutionizing the way people consume goods and services, and how they pay for it. Banking halls are becoming empty in the face of growing use of banking apps. The offices of Cable TV providers like DSTV and utilities like EKEDC and IKEDC are also becoming less crowded due to the proliferation of payment solutions. Everything gets sorted out with the click of a button. It goes without saying that customers want their payment technology to be able to provide all these services. There’s absolutely no need to settle for less.