[wpdatachart id=134]

Oando Plc tops chart

Data collated from the annual report of select publicly quoted companies in Nigeria shows Nigerian companies generated a revenue per employee of N63 million in 2016 compared to N51 million generated in 2015.

The Revenue per Employee is basically the total revenues generated by a company divided by the number of employees it has. It is a term used to measure the productivity of the employees of an organisation as well as how much they help contribute towards generating revenues for that company.

Revenue per employee is often preferred to profits because is unaffected by management and board decisions as per its cost of capital, how it allocates resources, efficiency at managing cost etc. all of which affects profitability. Revenue per employee is also viewed from one industry to another, rather than inter company. It is always meaningful to compare a company with another within its industry.

As depicted in the chart above, Oando and all the other oil and gas firms top, make up the first 6 because of high volume nature of oil and gas industries.

Note: all figures in the tables are in millions of naira

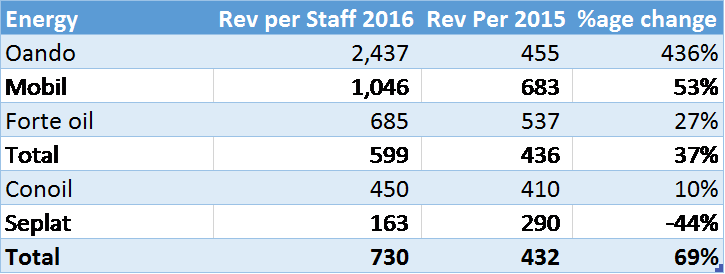

Energy Industry

The energy industry is associated with high turnovers but lower margins due to the volume of consumption of oil and gas related products. It is thus not a surprise that they top the list of industries with the highest revenue per employee. At, N730 million per staff, Energy employees increased their revenues by 69% compared to the N432 million recorded a year earlier.

High on the list was Oando, who saw their staff contribute a whopping N2.4 million a 436% increase from the N455 million reported a year earlier. Total Plc and Mobil also recorded significant rise in the revenue per staff figures. Seplat was the only loser with 44% of its revenue dropping per staff, a situation mostly attributed to the inactivity in its main export lines, Forcados Terminal.

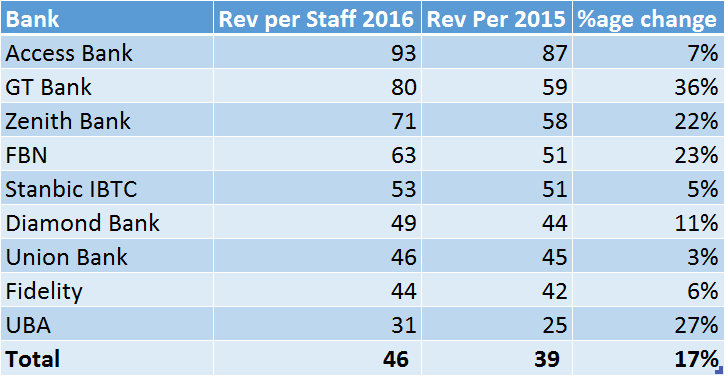

Banking

Access Bank topped the list of banks on our list with a revenue per staff of N93 million compared to N87 million a year earlier. However, GTB reported the highest growth in 2016 with a revenue per staff of N80 million up 36% from the year before. UBA staff had the least revenue per staff of N31 million while Union Bank recorded the lowest growth of 3% to close 2016 at N46 million. Zenith Bank and First Bank, two of the remaining Tier 1 banks have their staff generating N71 million and N63 million respectively.

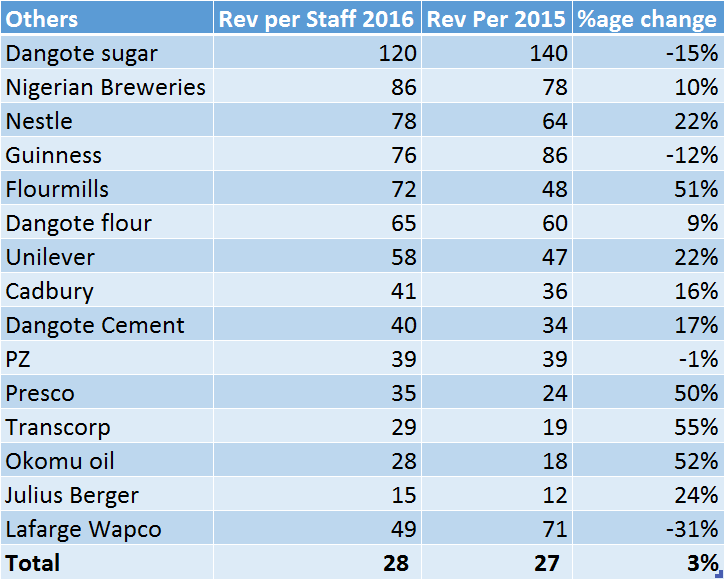

Others

For other major Nigerian companies cutting across the consumer goods index, industrials, agriculture, construction and conglomerates, they achieved an average of N28 million per staff in revenue just 3% increase from the N37 million achieved a year earlier. Dangote Sugar topped our list with a revenue per staff of N120 million in 2016, representing a 15% drop from the N140 million achieved a year earlier. Dangote Sugar was also number 1 last year. Dangote Cement its sister company and by the largest company within the Dangote Family, generated N40 million per staff. The largest percentage rise in 2016 was Transcorp Group, which recorded a revenue growth of 55% to N29 million per staff compared to N19 million a year earlier. Lafarge Africa recorded the single largest drop of 31% to N49 million, compared to N71 million a year earlier.

Why this matters

As explained above, revenue per staff is only used to determine how companies utilize their most important asset, human capital, to optimize revenue. Even though industries like the Energy sector have an advantage due to the volumes associated with their trade, the revenue per staff also helps them set a benchmark for how much they can pay their staff relative to their competition and the potential revenue they can generate. One might argue that a company’s wage bill per staff should never be up to or more than its revenue per staff. If it is, then the company is highly unproductive and will never make a profit.

Why nairametric re-caption this as a company with the most profitable company or they are they saying the most profitable public list company in Nigeria or not ?.

I do not knows what is the purposes of this research ? is it to enlight us or informs us.nairametric can do better.it does not uplifts your imagination as to.who are researcher are ? and what are their plans for ngeria.to totally destroy nigeria massively and their purposes,but nothing is new in Nigeria,the federal govt allows a foreign countrye.g the Turkish set up a secondary school and university to promote Turkish agenda in Nigeria,through espionage and mental slavery,and President Buhari said Nigeria is not negotiable.In north Nigeria,we have kids healthy children are forced to beg for foode.g the alhamaraji.

If Nigeria security agencies do not know,e.g this civil war in Syria can be prevented.The causes of this civil war are caused by foreigners,the americans and the Turkish and Saudis Arabia are providing support,covert operation.military support to the ISIS and the other rebel groups in Syria,while Putin of Russia and Iranian and the mujahedeen are supporting president assard of Syria.The Syrian,,they had an aggrement before the civil war by all parties,if and when president assard dies,their will be a multiple political parties in syria

Curious to know how attrition during the accounting period is taken into consideration?