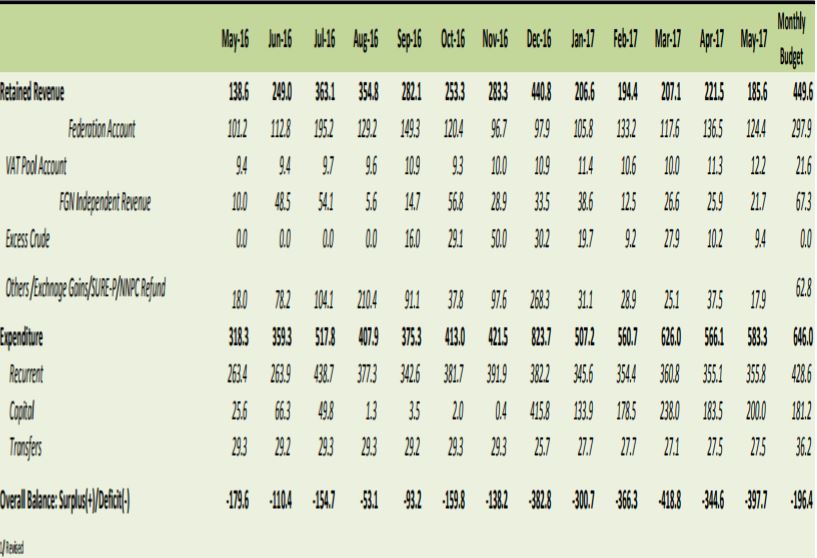

In the recently published May 2017 Central Bank Monthly report, Nigeria earned a total revenue of about N185.6 billion the lowest monthly collection since May 2016 when it collected N138.6 billion. The amount was a whopping 58.7% below budgeted estimated revenue of N449.6 billion.

It was also lower than the preceding month’s receipt of N221.48 by 16.25. Of the total receipt, Federation Account accounted for 67.0%, while FGN Independent Revenue, Others/Exchange Gain/NNPC Fund, VAT and Excess Crude recorded 11.7, 9.6, 6.6 and 5.1%, respectively.

On the expenditure front, the Federal Government spent an estimated at N583.32 billion, about 9.7% short of the provisional monthly budget estimate. Recurrent and capital expenditure accounted for 61.0 per cent and 34.3%, respectively, while transfers accounted for the balance of 4.7% of the total expenditure.

A breakdown of the recurrent expenditure showed that non-debt obligation was 76.8% of the total, while debt service payments accounted for the balance of 23.2% or N81.7 billion. This means for the month of May, debt servicing was about 44% of revenue.

The acting Vice President, Professor Yemi Osinbajo recently signed into law the N7.4 trillion 2017 Federal Budget out of which N1.8 trillion was earmarked for debt servicing. The Government also provided for local and capital debt borrowing of about N1 billion and N1.2 billion respectively.