Truecaller, an app that helps GSM users identifying callers that are not in their phone book has revealed the countries where we have the highest spam calls.

It named Nigeria as one of the countries with the highest Spam calls, ranking it 9th in the world. South Africa was 5th and Egypt 10th as the only other African countries in the top 10. Here is an excerpt of the report on Nigeria.

True Caller blamed operators, Telcos, as the reason for the high Spam rate in Nigeria.

Top Spammed

Operators, the biggest spammers – Nigeria

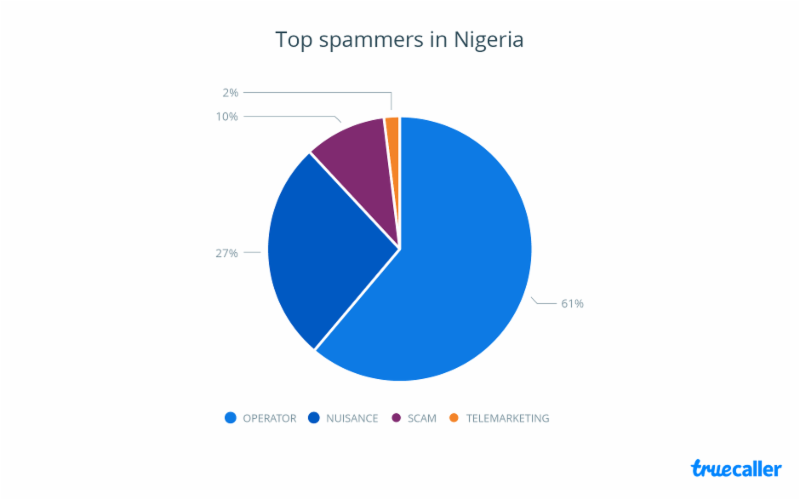

Like its regional partner, Kenya, Nigeria also has an issue with scam calls, but on a noticeably smaller scale comparatively at 10% of the reported total spam calls.

One major problem around spam calls in Nigeria are calls from operators, which amount to the majority (61%) of the total for reported spam calls. Operator spam calls involve telecom companies cold calling people. During these type of calls, call centre agents attempt to upsell data plans or push promotional offers to the public at large.

Another major spam call problem that Nigerians have to deal with (27%) is nuisance calls. These kinds of spam calls in general are unwanted and unsolicited calls that are a disturbance for users, or at the very least amount to prank calls and at worst, harassment.

Rounding off the spam call list in Nigeria are telemarketing calls at 2%, which are promotional calls from companies, surveys being done by analytics firms on behalf of their clients, political/robo calls, or new client outreach for services and subscriptions.

A closer look at spam calls in South Africa

Spam calls are big business in South Africa, as the direct marketing industry reported employing more than 150 000 workers, with the average call centre agent logging around 1 600 calls on a monthly basis. This amounts to South Africans being collectively bombarded by tens of thousands of spam calls each and every day. In fact, Truecaller app users already identify over 8.5-million local spam calls on a monthly basis.

According to the company’s Top 20 Countries Affected by Spam Calls in 2017 report, South Africa seems to have more of an even spread when it comes to who is spamming. With telemarketing (39%) leading the way, while financial services (24%) and insurance (13%) are the most known types of spam calls.

Unlike Kenya and Nigeria, South Africa only has 1% of its local calls marked as scam calls.

Other highly targeted African markets – Kenya

Kenya was a different case when compared to the other Top 20 countries listed in this research. Scam calls made up a whopping 91% of the reported spam calls. Scam calls are basically fraud attempts via your telephone, with scammers using a phoney scheme to swindle money from unsuspecting members of the public.

The rest of the listed spam calls were constituted by financial services such as banking product offers, unsolicited credit union calls or credit card companies cold dialling people.

Ways to counter spammers

Within South Africa, the Direct Marketing Association of South Africa, enables people to add themselves onto a list of non-contactable contacts, at least by members of this association. This list of no-go contacts is referred to as the National Opt-out Database.

In addition, more than 250-million people around the world are using apps such as Truecaller to see caller IDs and know who’s calling, even if the number is not stored in their phonebook. This app also enables users to block calls as well as SMSs and report spam callers and messages, allowing the larger community of users to avoid the spammers too.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg?resize=350,250)