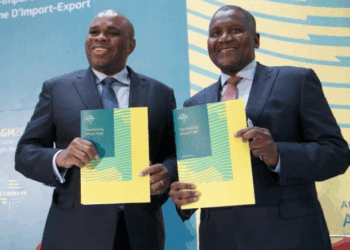

Last Friday (June 30th 2017), AfreximBank announced that it had reached an agreement to provide a facility up to about $1 billion to Dangote Industries Ltd, the parent company of Dangote Cement and Dangote Sugar.

Dangote Industry Limited, owned by Africa’s riches man, Aliko Dangote is the engine that funds most of the billionaire’s investments across Africa. The MOU according to AfreximBank, provides for collaboration with Dangote Industries Limited in respect of proposed funding of transactions, which could involve the provision of short and long-term liabilities for trade-related projects in Africa. They also explained that the utilization of the facility would boost intra-African trade volumes, enhance continental value chains and increase production and export of goods and services across Africa.

What does this all mean and why is it important

- Firstly, an AfreximBank facility provides DIL with a funding pipeline that it could deploy to fund its expansion plans in East Africa.

- AfreximBank loans are also cheap, costing between 6% -8% per annum in fees and interest rates and are often tenured over a 4 years with an option for restructuring and extending the offer.

- With the funds, DIL can repay some of the expensive loans currently valued at over N370 billion.

- DIL loans are however cheap relative to the market with its most expensive interest rates priced at MPR plus 1%

- Dangote Cement’s 2017 Q1 interim result also shows it borrowed an intercompany loan of about N130 billion from Dangote Refineries Ltd. Payment for this loan is due December 2017 thus the AfreximBank loan could be utilized

- Dangote Cement also owes another N240 billion in net payment due payments to its creditors. The AfreximBank loan can also be used to defray some of these payments.

- AfreximBank loans are highly sought after by local companies due to its cost and tenure. The lender is also known to be flexible with repayments often giving borrowers room to operate during period of cash constraints.