On the 20th of March 2017, Forbes published its latest Billionaires list, featuring the richest people on the plant. Today, I will be focusing on the 5 richest people and highlighting 5 key business lessons that can be learnt from them:

- Mark Zuckerberg

Mark Zuckerberg is the Chairman, Chief Executive Officer, and Co-Founder of Facebook. He currently has a net worth of $56 Billion, making him the 5th richest person in the world.

Mark has always been focused on connecting the world and today, Facebook stands as the world’s largest social network with 1.86 billion active users. The secret to Facebook’s rapid expansion is a unique culture and management approach called the ‘Hacker Way’.

“The Hacker Way is an approach to building that involves continuous improvement and iteration. Hackers believe that something can always be better, and that nothing is ever complete”

The Hacker Way is an extremely open and meritocratic culture that not only welcomes innovation but enforces it. This approach has led to the continuous expansion of Facebook and seen Mark’s fortune increase by $11.4 billion over the last 12 months.

Lesson: Focus on innovation

Always create a unique company culture with strong emphasis on innovation. Focusing on innovation will help you satisfy your clients’ needs in the most progressive way possible while staying ahead of your competitors.

4. Amancio Ortega

Amancio Ortega is the Founder and 60% stakeholder of Inditex, the world’s biggest fashion group consisting of 7,200 stores in nearly 100 countries across brands like Zara, Bershka and Massimo Dutti. He currently has a net Worth of $71.3 Billion, making him the 4th richest person in the world.

The key to Amancio’s success is a unique business model that has been dubbed ‘Fast Fashion’, it is governed by two key principles: giving customers what they want as quickly as possible. ‘Fast Fashion’ is built on a formula of endless renewal, with clothes displayed for only a few days before they are taken off the rails and replaced with newer designs.

Amancio does not base his inventories on fashion shows, he tracks bloggers and listens to customers instead. By making his customers the centre point of his business, Amancio has been able to identify a quick and efficient strategy to attract customers and keep them interested.

Lesson: Aim to attract money, not pursue it.

Every business model should include a strategy that makes it not just unique but also attractive; focus should be placed on what people want and how EXACTLY they want it.

3. Jeff Bezos

Jeff Bezos is the Founder and CEO of Amazon, the world’s largest online shopping retailer. He currently has a net worth of $72.8 Billion, making him the 3rd richest person in the world.

Over the course of his 53 years on earth, Jeff has gone from quitting a well-paying job on Wall Street to launching Amazon (an online bookstore), to losing millions in investments (pet.com and gear.com) and failing at ‘Amazon Jewellery’, to launching Kindle and successfully trialling Amazon’s air drone delivery service.

A major key to Jeff’s success is experimentation with new trends. Jeff’s entrepreneurial path is full of business ventures aiming to capitalize on innovative trends like the internet and drone technology. Experimentation has served Jeff well so far, he had the best year of any person on the planet, adding $27.6 billion to his fortune.

Lesson: Don’t be afraid to experiment.

In any business, experimentation for the sake of improvement should never be undermined. Experimenting is the ultimate way to transform an idea into reality – it’s the mechanism by which great new insights translate into new markets.

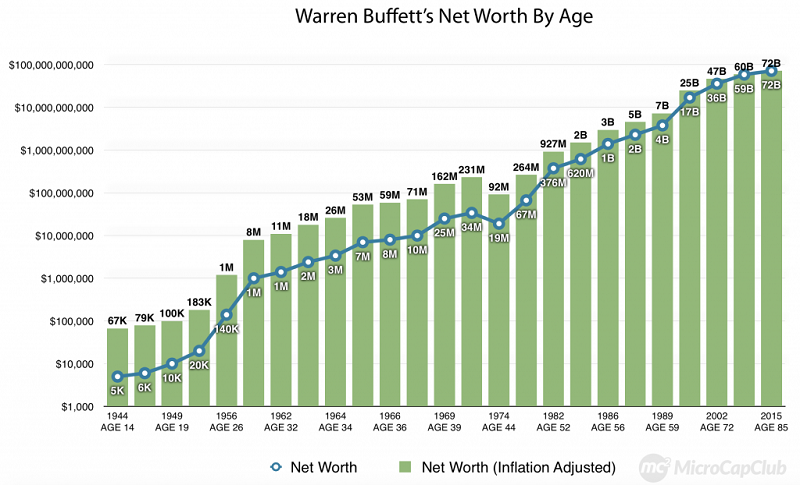

2. Warren Buffett

Warren Buffet is Chairman and majority shareholder of Berkshire Hathaway Inc, a multinational conglomerate holding company consisting of companies like GEICO, Mars Incorporated, Coca-Cola and Kraft Heinz Company. He has a current net worth of $75.6 Billion, making him the 2nd richest person in the world.

Warren always had a knack for making money. From selling used-pinball machines at the age of 17 to running one of the world’s most successful conglomerates at 87, Warren’s life is full of successful entrepreneurial ventures.

So, what’s his secret? It’s his ability to stay focused on the long-term goal regardless of what is happening in the market. Warren understands the power of exponential growth and this is evident in his life as he takes small incremental steps to further his cause.

Lesson: Keep a firm eye on the long-term.

Avoid being overwhelmed by outside forces that affect your focus, don’t let fear or greed change your business values. Focus on making small but effective business investments that will take you closer to your long-term goal, one step at a time.

- Bill Gates

Bill Gates is the Founder of Microsoft and the richest man in the world, with a current net worth of $86 Billion.

Bill is the number one richest for the fourth year in a row, and the richest person in the world for 18 out of the past 23 years. The reason behind Bill’s consistent record at the top is his intense competitive drive.

From a young age, his family encouraged competition. It didn’t matter what it was, there was always a reward for winning and there was always a penalty for losing.

An industry executive recalled that after he showed Bill a game and defeated him 35 of 37 times, when they met again a month later Bill won or tied every game. He had studied the game until he solved it. That is a competitor.

Lesson: Be competitive

There is very little room for sentiment in the business world, a lot of the time you will need to buy or bury the competition just to stay ahead. “Be obsessively focused on your competitors while ignoring them” i.e. don’t constantly react to every move they make, but be ruthless in your approach to identify and improve on it what they do right.