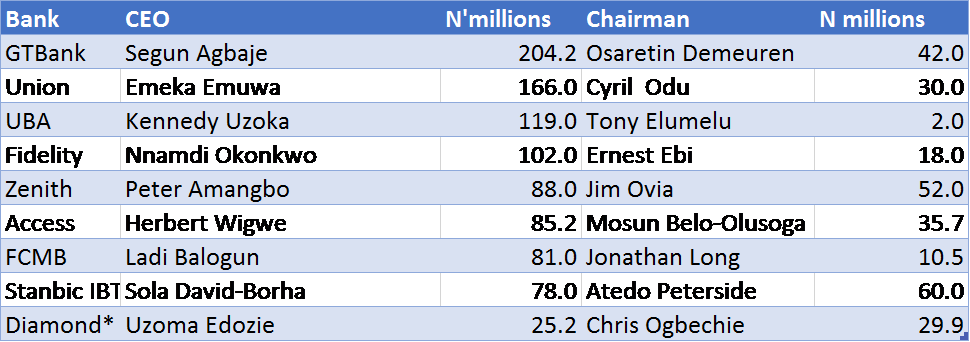

Here is a list of the highest paid CEOs of Nigerian Banks.

Chief Executive Officer

GTBank, the most profitable bank pays its CEO the highest. No surprises here, GTBank is miles ahead of its peers by several metrics, taking over 20% more than the next highest paid CEO. Although, n dollar terms, this is just under $700,000 [depending on which CBN window Mr Agbaje is able to access].

Second place is Emeka Emuwa Union Bank (after spending 25 years in Citibank), understandably so – a high premium would have been required to attract him from his previous life at Citibank to lead the transformation of UBN after the near collapse in 2009.

For UBA, the former CEO retired in July 2016 so I’m uncertain if that amount is annualized for Kennedy or the prorated amount from July to December. There’s a similar dilemma with Stanbic IBTC, if the highest paid is for Yinka Sanni (MD Stanbic IBTC Bank) or Sola Borha, but for the sake of this article, I’m going with Sola Borha.

The most interesting is Diamond Bank. By my rough guestimation, his salary is what a comparable assistant- or deputy- general manager earns at other banks so I’m curious at his modest compensation. I have a few theories – that I am only happy to share in private.

Side note: First Bank is not included in this because its audited financial are unavailable at the time of this report. I’m guessing it’s CEO earns somewhere north of the Union Bank amount, especially considering he was head hunted from Africa Finance Corporation where his compensation was most likely in denominated in USD. I reckon, First Bank must have made him an offer, he couldn’t refuse.

Compensation as a percentage of market cap

To decide which of the CEO’s are overpaid, the chart below shows the compensation as a percentage of the market capitalization and the results are fascinating.

There is no standard acceptable limit but for argument purposes, let’s assume 0.05%. Only Zenith, Stanbic, Access and GTBank are within this acceptable limit. From an overpaying standpoint, Fidelity and FCMB are compensating its CEO far more than they should.

Chairman

The compensation for the UBA Chairman jumps at you. Love him or hate him, but nobody does optics like Tony Elumelu.

To put in context, an executive trainee in UBA earns just as much, or probably more than the Chairman. When the CBN released it corporate governance rules that limited the tenure of bank CEOs, Jim Ovia, Tony Elumelu, Aigboje Imoukhede were the high-profile CEOs that the rule negatively affected. And today, Mr Elumelu has built a global brand.

This is a classic case of what you do when life gives you lemons; Tony Elumelu, easily the ex-CEO with the highest brand power, made the best cool-aid lemonade. Important to highlight that only Jim and Tony were in ex-CEO graduating class of 2010, while Aigboje is in class of 2013.

Mr Atedo Peterside, tops this “chairman” with N60m, in close second is Jim Ovia. Rumour has it that his office in Zenith Towers was never cleared during his hiatus from 2010 when he resigned till the return of the king. As a percent of market cap, only FCMB and Diamond Bank breach the 0.05% limit.

So there you have it, if you want to become CEO of a Bank, my advice is to send your application to GTBank, while if your dream is to become Chairman, no one can do you well like Stanbic IBTC. Insert caveat.

Your report is not correct. The highest paid CEO in 2016 was Sola David Borha (Former MD of Stanbic IBTC ).She was earning over 300 million per annum . Please look through Stanbic IBTC 2016 report very well

Hi Abiola, thank you for your comment. According to page 115 of the 2016 Audited Accounts available from the Stanbic Investor Relations site, the highest paid director earned N78m. Happy if you are able to point out where this N300m is. Thank you very much.

I saw this tourism app named “Eko Tourist” on Playstore designed by a Nigerian and it provides a complete tour guide to Lagos showing Places, People, Festivals, Events, Entertainment, Hotels, Hospitals, Brands, Beaches, Parks, Restaurants, Cinemas, Schools, and other things across Lagos City. It seems to be of great help, so I felt I should share. link https://cygeria.com