Nairametrics| One of Nigeria’s leading palm oil producer, Presco Oil, released its 2016 full year results last week. The company reported a profit after tax of N21.7 billion, a whopping 772% higher than the N2.49 billion reported in the same period in 2015.

Astonishingly, the company’s profits of N21.7 billion was a good N6 billion higher than the N15.7 billion reported in revenues for the same period. This sort of results is often considered abnormal.

But for Presco, this is indeed the norm for some years now. The company chooses to comply with a financial reporting rule that allows it to capture any change in the value of its biological assets as a revenue rather than other comprehensive income.

By being classified as part of top-line revenue, Presco gets to capture the change in the value of its assets as a profit which it can distribute as dividends, rather than one which it cannot. Thus for Presco and its shareholders how it values its biological assets is worth taking note of.

Biological Assets Explained

- The International Financial Reporting Standards (IFRS) allows companies in the Agro plantation business to estimate the value of their biological assets prior to being harvested.

- For Presco, these are its fresh fruit bunches, which is where its crude oil palm, refined and deodorized palm oil, palm olein etc. are produced from.

- The company basically estimates the future value of the net cash flows derivable from the same of the FFB’s when they mature and discount it to today’s value using its weighted average cost of capital.

- It then also estimates determines the cost of disposing the biological assets and deduct this from the fair value derived.

- The difference between the fair valuation as at 2015 and the fair valuation of 2016 is reported a gain in value of biological assets.

- Presco’s biological assets was N30.5 billion as at December 31st

- It rose to N55.4 billion as at December 2016, thus a difference of N24.8 billion.

- That difference is the reason for the N21.7 billion reported as profits for the year.

- In 2015, Presco reported a gain in biological assets of N1 billion

- Presco explained this in detail in note 15 of its financial statements.

Why report it as revenue and not OCI?

- If the gain in biological assets was classified under other comprehensive income, Presco would be reporting a pre-tax profits of N6.5 billion.

- This in layman terms means the entire N24.8 billion was paper profits and is not representative of any cash in the bank.

- Presco understands this fact and humbly proposed dividend of N1.5 billion despite posting profits of N21.7 billion. Presco has paid about N1 billion as dividends for about 3 of the last financial years preceding 2016.

- Presco had about N1.79 billion as net cash in bank as at the end of 2016.

Key takeaways

- Presco’s adoption of IFRS 41 is in line with its principal activity.

- While it could as a matter of principle decide to classify biological assets separately from income, it did nothing wrong by choosing to go the IFRS way

- For retail investors, this provides a challenge especially when they want to determine the intrinsic value of the company

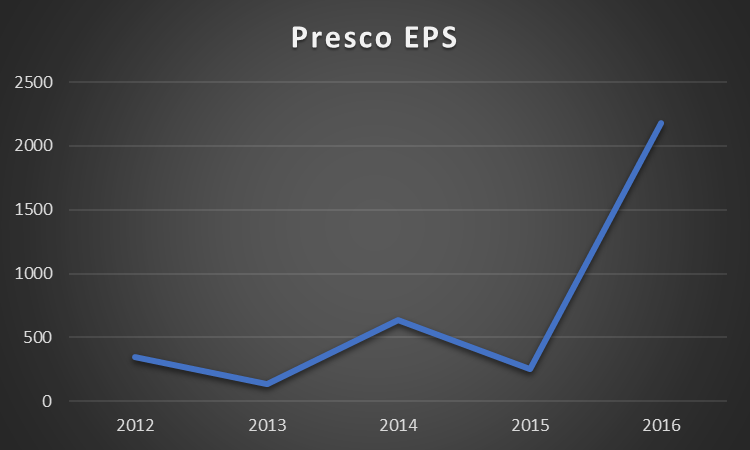

- For example, Presco’s earnings per share can be is haphazard making it difficult to rely on its price earnings ration should you want to conduct a snap valuation

- To get a better understanding of Presco’s performance one will have to discount the gains in biological assets for all the years and focus more on its operating profits and earnings before tax.

- It will also be prudent to include the changes in biological assets if it results in a loss.

Presco is currently trading closed on Friday at N46.7 and has returned about 16% in the last one year.