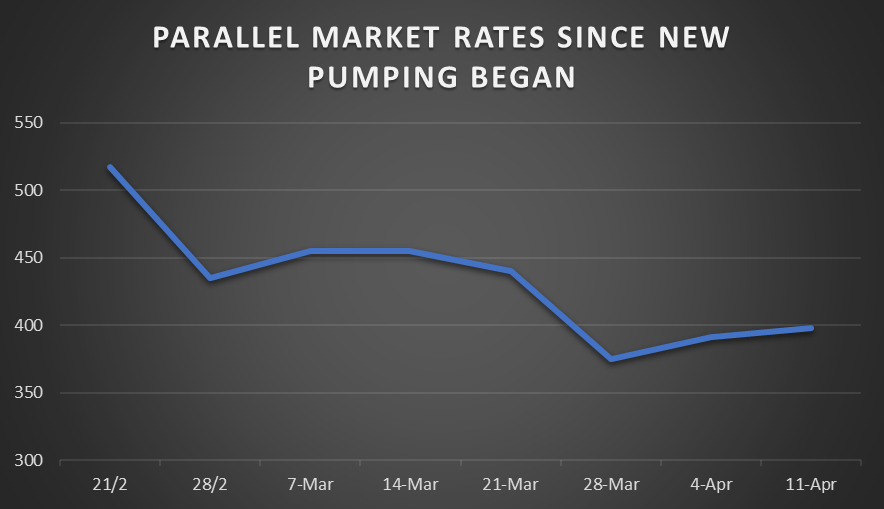

Nairametrics| Since the Central Bank of Nigeria rolled out its revised forex policy on February 21st 2017, the initial success of the policy seemed to justify it. Within a month of its introduction, the Naira gained 100 points or 30% of its value in the parallel market. However, certain analysts kept warning that the actions of the CBN would garner only temporary success, unless a full float was sanctioned. One of these is the International Monetary Fund (IMF) who, to the ire of most Nigerians, last week, said that the Naira was over-valued by as much as 20%. As ridiculous as that sounded, it seems the IMF could be right. The graph below shows exchange rates in the parallel market since the CBN revised its policy.

As observed, within the first week of the announcement of the revised policy, the Naira strengthened by as much as N80 to a dollar. This was expected as the sudden injection of hitherto scarce dollars into the market created a sell frenzy among dollar owners. As simple economics dictates, this resulted in the sharp drop experienced within the first week.

Subsequently, the parallel market stabilized at around N450/$1. This was until March 21st 2017. The Monetary Policy Committee rose from its meeting with rates unchanged and the CBN governor pledging to further support the Naira with more interventions. At this point, the CBN had pumped upwards of $1 billion into the forex market. Once again, a flurry of activity met this news, and the Naira gained in the parallel market and sold for as low as N375/$1. Murmurs of dollar glut were beginning to arise and banks were starting to reject dollars offered them by the CBN.

Buoyed by its gains as at this point, the CBN on March 28th announced a revaluation with new rates for commercial banks and Bureau de Change operators. This proved to be their undoing as a reversal began.

Gradually, the Naira rose from N375 steadily for 2 weeks, and is now selling at about N400/$1. Unlike in previous cases, no new announcements of the CBN could strengthen the Naira. From increasing the amount BDCs could sell to opening a special window for SMEs, the parallel market seemed unshaken.

The argument of the CBN is that the weakening of the Naira was due to forex scarcity, caused by speculators who hoarded dollars. If that is true, then that problem has been solved as there are more dollars than can be handled. Simple economics says that higher supply of a commodity should lead to lower prices of that commodity until a certain breakeven point is reached. The Naira seems to have reached that point. If that is so, then N400/$1 represents a 26.8% increase over the N315/$1 used in the 2017 budget and 31.4% more than the N306/$1 interbank rate. This means the IMF was right after all.

Based on my personal evaluation of the trends within the Nigeria currency(naira) and the proclamation from the IMF that the naira is overvalued, i dismissed that assertion because of lack of reasonable reasons from the IMF that the naira was overvalued. Enough of this manipulation of Nigeria’s economy by foreign powers! Judging from the economic structure of Nigeria, by any standard of measurement, naira should not exchange for N300 to the dollar! something is politically wrong from the exchange by whoso may be responsible for the valuation. Nigeria, export crude oil and other products to the outside world and judging from the man power and applicable resources on the ground Nigeria naira should exchange maximally for approximately N200 to the US dollar! You and I know who the culprits are that are manipulating the Nigerian currency! The so called exporters and importers of commodities and strongly aided by unpatriotic Nigerians in power. I commend the efforts of the Buari administration for waging war against corruption in the country. Nigerian naira has unprecedented devaluation because of its cheapness in the international markets. Imaging, an individual Nigerian having the connection to cat away billions of naira without working for it! There foreign partners in crime, work hard to illegally transfer the money to foreign accounts at any rate to the detriment of naira. This has always been the issue that kill the strength of naira. The unpatrotic roles played by the Bureau de Change operators should not be forgotten. The Central Bank of Nigeria should not relent in it efforts in combating the on holy activities of these ventures. I strongly implore President Buari to continue to pursue his goals and objectives realistically without looking back as to whose programmes are gorged. Enough of the unwholesome manipulation of the progress of the”largest African economy”!

I would say your analysis is cursory and primary. The pressure on the black market is also as a result of lack of supply as also corruption. Since the cashless policy of the CBN; the naira has been going through serious downward pressure but none of you so called “analysts” seems to have a clue. People now change naira in dollars which is easier to launder. You would see unreasonable demand of tens of millions of dollars off record transaction through the black market, not my an importer, nor a legitimate demand; now you say the naira is overvalued; how so when someone comes looking for tens of million of dollars on a market that doesn’t have the capacity; it’s certainly obvious what would happen. Politicians and politically exposed people sell houses while requesting for dollar cash payments, keep dollars at home & launder foreign currencies; evidenced by recent recoveries of cash yet you analysts don’t seem to think that way. How can someone bring over 250million into a market to buy dollars and you don’t think the rate would go up, this black market was meant to service little needs from hundreds of dollars to few thousands not millions as have been evidenced and may I dear say the cash recoveries so far are just a tip of the iceberg. You so called analysts also don’t seem to talk more about inflation that would arise from complete currency floatation which wouldn’t be recovered from as you’re dependent on more dollars and if the supply feels an umbrage at a small short term issue the flee exacerbating the exchange rate further south and what you seem worried about is short term dollar transactions for FPI not FDI. Nigeria needs FDI as FPI would go just a matter of time. We need long term and not short term solution not theses Western analysis which is meant to favour them because of the money they wish to make. Western analysis can’t solve static economies problems rather worsen it or leave it as it were. China became a king not by western analysis and advise. We need to look for a model that helps us while using western fundamentals not control or analysis.

SEE THE SO CALLED PARALLEL MARKET IS A HAVEN CONTROLLED BY ILLEGALLY ACQUIRED NAIRA THAT IS ALWAYS AND WILLINGLY CHANGED TO DOLLARS AND OTHER CURRENCIES TO REDUCE BULK AND BLOCK TRAIL. CBN WILL NEVER BE ABLE O CONTROL THIS.

WHAT CBN SHOULD DO IS TO OPEN WHAT MAY BE CALLED DOMICILLIARY ACCOUNT WINDOW (OF COURSE LINKED TO BVN DOM ACCOUNTS) WHERE INDIVIDUALS AND COMPANIES ARE ALLOWED TO BID AND BUY FOREX THAT IS FUNDED FROM THEIR FORMAL NAIRA AND FOREX ACCOUNTS. THIS WILL LEAVE THIS TRADITIONAL BLACK MARKET SOLELY NOW FOR THE ILLICIT FUNDS- THEY CAN THEN TRADE NAIRA AT 1,000 TO THE DOLLARS IF THEY WANT , TO HIDE THEIR NEFARIOUSACTIVITIES