Analysis of Zenith Bank’s 2016 Full Year Results

Commentary

- Zenith Bank Plc. (Zenith) kicked off the FY 2016 earnings season for Nigerian banks with its result release, which revealed 23% YoY increase in FY 16 EPS. The bank also announced a final dividend of N1.77 which beat our N1.65 call and brings total DPS to N2.02. Dividend pay-out ratio of 49% is below three-year trend average of 55% as the bank elected to bolster capital buffers with the stronger earnings. (CAR: +160bps YoY to 22.9%).

- FX gains power non-interest income: Over FY 2016, earnings strength owed much to FX related issues as Zenith recorded strong revaluation gains (eightfold YoY to N25.5 billion) and booked FX trading income of N20 billion (vs. a N2 billion loss in 2015). The revaluation gains largely stemmed from net long dollar positions following the 55% naira depreciation in 2016.

- Weak funding mix and monetary tightening swings interest expense higher: In contrast to Tier I peers (excluding Access), tight monetary policy and Zenith’s reliance on corporate funding translated to funding cost pressures. Over 9M 16, annualized WACF expanded 110bps from FY 15 with another 50bps uptick in Q4 16. In addition, a slower rise in asset yields as translation impact of currency weakness drove wider expansion in interest bearing assets drove NIM weakness.

- Power Sector and O&G stain asset quality: In line with the prevailing macro headwinds, asset quality deteriorated with NPL ratio climbed 80bps YoY to 3% largely on account of sizable jumps in O&G (eightfold YoY to N10 billion) and Power (N30.6 billion vs N0.5 billion in 2015). While O&G NPLs are not new given the issues with production and lower oil prices, the jump in Power NPLs reflect FX related issues.

Despite a 45% hike in tariffs in 2016, current electricity tariffs do not incorporate recent NGN depreciation and limited political appetite exists for fresh hikes. Importantly, while coverage ratio for the O&G book is at a healthy 1.4x, coverage on the power NPLs at 0.4x appears inadequate given the uncertainty over tariff outlook.

Zenith currently trades at P/B of 0.6x which is at premium to peer average at 0.4x. Last trading price of N14.84 is at a significant discount to our last published FVE (N17.74) which implies a STRONG BUY rating.

Results

Ratios

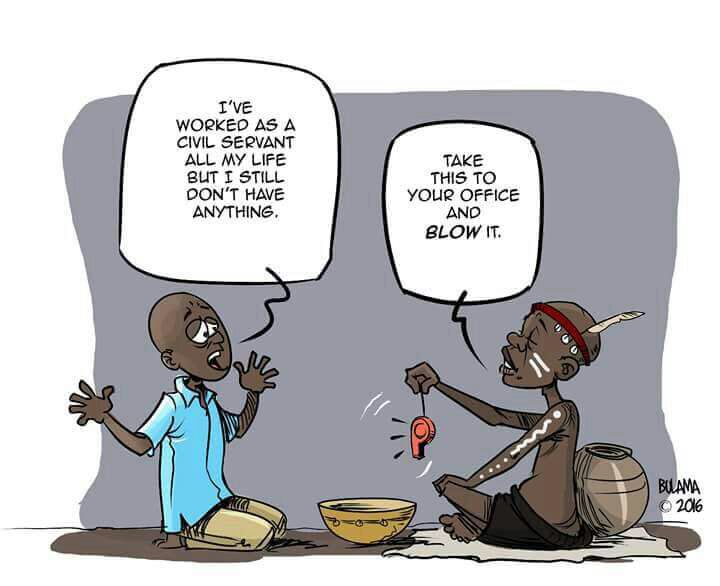

In a year (2016) when Fx crippled the whole system, a bank made came up from a loss in the previous year and made N20b in income in the same Fx trading…Fuel subsidy was the scam of the last regime, it appears we are having a Fx subsidy scam. Only the next regime would know and can say.

CBN is Zenith, Zenith is CBN, FX billionaire in a year. I believe this is window dressing result. If they claim to be making profit yoy, why do they keep sacking when the profit they are posting can cushion the effect of their operating expense and still return them to profit, though it went north a bit. The FX terrain is controlled by few for few like the notable Emir said.