Nairametrics| The Nigerian Stock Exchange has published its data on Local and Foreign portfolio transactions in the Nigerian Stock Exchange.

[wpdatachart id=82]

The first chart shows foreign portfolio inflows into the NSE for the period 2013 – 2016. From a high of about N1 trillion in 2013, foreign portfolio transactions have dropped to as low as N540 billion. We do not know if any adjustment has been made for exchange rates between the periods. One will hope foreign portfolio transactions creep above N800 billion this year.

[wpdatachart id=83]

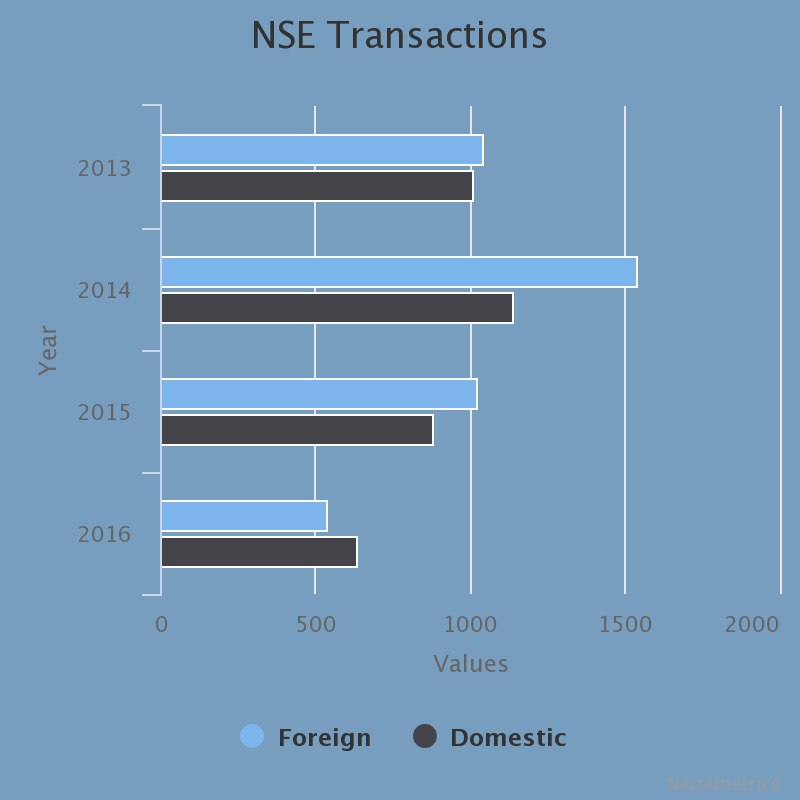

The second chart shows the total transactions on the NSE including domestic and foreign. Again another major drop in transactions for the year. From a combined N2 trillion a year, it has dropped to just above N1.1 trillion more than a 56%.

Transactions in the Nigerian Stock Exchange largely influence the direction of the All Share Index. The higher the transaction value the higher the possibility of the All Share Index gaining traction.

Most of my comments are geared toward young Nigerians Africa have suffered through foreign invasion from arabs and Europeans,and the trans-atlantic africa slavery by Europeans and this subsequent colonization by European.I HAVE SEEN 2 COMMENTS I MADE IN AUGUST ABOUT NIGERIAN ECONOMIC AND ANOTHER COMMENT,the main issue is not about me personal,i do not hoped to influenced govt policies,i was aiming for those who cares and makes a BETTER CHOICE IN THEIR LIVES.

HUMAN ACTION AND BEHAVIOUR ARE THE SAME THROUGH THE HISTORY OF MANKIND,the process of decision making involves more than reasoning.i.e at least 3 action,if you omit these level of action,you are bound to make mistake, and if you makes this mistake,there is no going back,once you put gabbage in,the process and the output will be gabbage.

I was aiming to change perception for some Nigerian OR MAYBE SOME GOVT OFFICIALS IF THEY CARES.reasoning (the power,strenght,propriety,right or wrong,morally right or wrong) depends on the strength of your spirit.all knowledge you seek in newspaper or university are all in public domain,therefore KNOWLEDGE IS NOT INFORMATION.when you acquired this knowledge and information,YOU MUST INTERPRETE IT THROUGH YOUR SPIRIT/SOUL.

ANOTHER AIM OF MINE TODAY 25/02/17,is that I thought nairametric would have deleted my comment,by now made in august,because my comment have been overtaken by lack of action BY GOVT,and give more power to themselves to do their job for the country.SO SOME OF MY COMMENTS,WERE AIMED AT GOVT POLICIES,AND ARE AIMED FOR THEM TO ENRICH THEMSELVES SPIRITUALITY,that will transfer into action for the country,BECAUSE I DOUBT THEY WILL CARRY OUT THEIR ECONOMIC PLAN OR STRATEGYmy brothers and sisters in Nigeria,you can see this govt made at least 3 economic plan not to only re-float the economy,but also to bring things together.E.G..like an industrialist want to built a factory,but he have no money,no land,no personnel to run the factory,this industrialist may not have the intellect capacity,but an idea in his brain.THIS IDEA WILL DIE IN HIS BRAIN.MANY YRS LATER IN HIS LIFE,HE WILL SAID “WHY I DI NOT DO THIS BEFORE,OR WHY I DID NOT THINK THIS BEFOREmy fellow Nigerians the world is yours for taking,do not be afraid.we all do calculated risk, takes some form of risk to make our lives better.

What prompted me,today, 2 months have been hell for the govt,because,i have read the dollar is 400 naira today,coming down from 503 naira to 1 dollar.it means the governor had a choice before and today, and he is destroying the mighty naira.if he is saving the naira,he is not appling the right plan.he could go from supply angle, without dipping into oil forex earning.IF HE THINKS HARDER