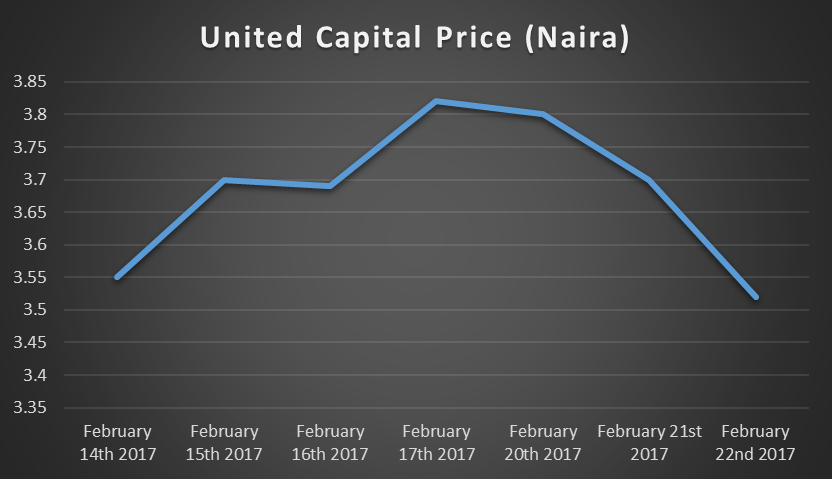

Nairametrics| United Capital’s share price dropped for the 4th straight day as investors continued taking profits ahead of the company’s marked down date of 3rd-6th March 2017. It has now lost about 10% of its value since it reached a high of N3. 82.

After its market down date, the dividend per share of 50kobo will be deducted from its share price. At a current share price of N3. 5 per share, the share price will immediately drop to N3 per share. This perhaps is the reason why investors are dumping the stocks in exchange for profit taking. But could this be a bear trap?

A bear trap occurs when a stock that has been rising steadily is expected to experience a pull back or has indeed started falling. It is often a false signal and can be a risky proposition for short-sellers or people afraid that the share price will keep dropping and as such rush to sell. Assuming the drop is a temporary blip, then the implication of course is that the stock will rise again leaving those who sell to regret selling or buy high nevertheless. United Capital has a bit of recent history about being a bear trap.

Source: Bloomberg

The red arrow above was around the time United Capital marked down for dividend last year. As you can see the share price started creeping up and has gained over 150% since then. For those who held on to the stock since last year, they have gained a dividend of about 14% (based on that share price) and over 150% on capital gains. That was a classic example of a Bear Trap! But will it perform same this year? The 2017 first quarter results will provide a better indication of if it can or not. This is why investing can be fun, after all no guts no glory.

For those who wish to still buy the stock, a potential divided yield of about 12% based on current share price