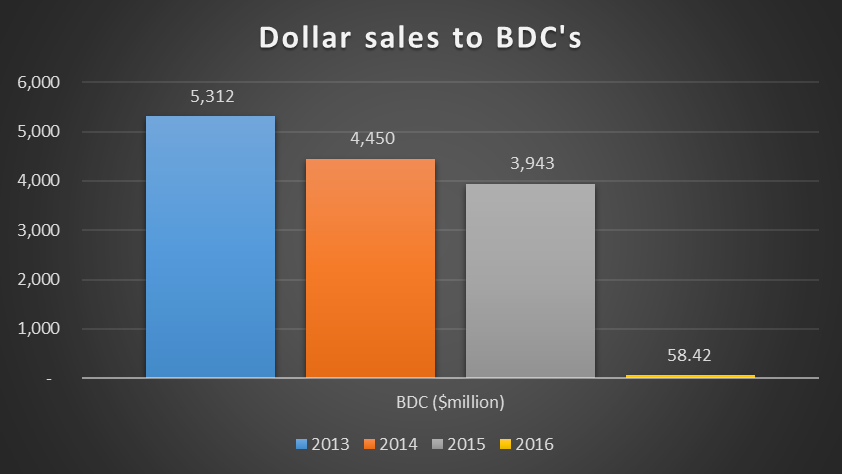

Nairametrics| The exchange rate between the naira and the dollar hit an all time low last week dropping to N516 at the black market. The disparity between the official interbank rate and the parallel market rate is now as high as N216. The spread signifies one thing, SCARCITY. Spare a thought and look at the chart below;

Nairametrics Research

From selling as much as $5 billion per annum to BDCs, Nigeria now sells as low as $58 million per annum, according to 2016 CBN actual figures.

Why the drop?

[read more=”Keep reading” less=”Read Less”]

The CBN introduced a policy in January 2016 that banned the sale of forex to BDC’s to nearly zero. At the time it took this decision the black market rate was around N350. The reason according to the CBN was due to the arbitrage BDC operators were accused of perpetrating. According to the CBN, they bought dollars from the CBN and then went to the black market to sell at a wide premium (N350-N197).

[visualizer id=”97532″]

Unfortunately, in taking that decision, the apex bank only aggravated scarcity. In trying to solve an arbitrage problem they starved the retail end of the market of dollars and thus widened the spread, which they sought to narrow, even further.

Sales to BDC operators was re-introduced late last year after a meeting with the CBN. However, liquidity to them was still minuscule compared to prior years as the chart above depicts. The CBN is obviously still scared of arbitrage and in doing so continues to worsen the entire forex situation. Even the flexible exchange rate policy it introduced has failed to work as we explained in that article.

The flexible exchange rate policy has also failed because the CBN keeps tight control of the forex market when it is supposed to allow the forces of demand and supply dictate prices. Allow the exchange rate to float so that the Naira may find its true value against other world currencies. Introduced policies that rather than work against a pure naira float, will address infractions, loose ends and entrench the confidence the market so desires. Only then can we solve the larger elephant in the room…SUPPLY. I’ll explain the supply issues in a subsequent post.

[/read]

CBN created a beast called the BDC and fed it with dollars during good times

Forgetting that to keep a beast from coming to bite u back in the rear, you must continue to feed it

The naira is responding appropriately to the fundamentals of demand and supply relationship with price.