Nairametrics| I’m sure by now if you are a regular visitor to Nairametrics, you know we love treasury bills. We’ve had a special affection for it since 2013 and wish we had all the money in the world to buy it.

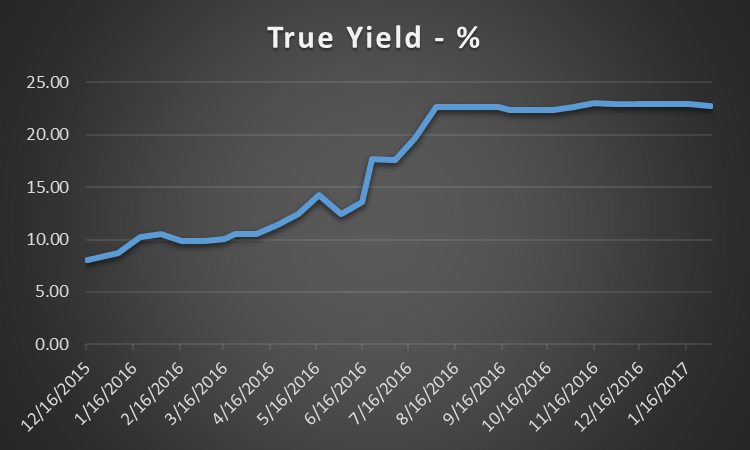

Source: CBN/Nairametrics Research

The thirst for more treasury bills has even shot to an all time high in the past few months considering how rewarding it has been. Flash back to January 2016, Treasury bills were trading for as low as 9% for a one year fix. Today it is an astonishing 22% (more than double). But there is a reason why rates are sky high.

As the chart above depicts, the Nigerian treasury bills rate is obeying a rule the market loves. The rule is wherever inflation goes, I go provided I stay higher. The CBN has been borrowing hundreds of billions since last year via treasury bills at an average interest rate of about 16.6% for a 364 days note. And to continue to attract buyers it offers mouth watering rates that attract pension funds, banks and even insurance companies, thus crowding out other sections of the private sector. Treasury Bills rate will therefore continue to trend higher than inflation rate if the government is to continue to attract the sort of bids it gets.

At such give way rates, you can’t blame any bank from choosing to invest in T-bills than to lend to that small business owner. In fact, small businesses are probably better off investing in treasury bills too.

A friend recently asked if this wasn’t already looking like a ponzi. Fortunately it isn’t, as Ponzi schemes typically do not have an underlying asset that generates the returns from where these loans will be repaid. The Nigerian government has one, which is oil and non-oil revenues.

However, an introspective look suggest there are obvious similarities. For example, the CBN repays a matured Treasury Bills by simply rolling it over, which in this case is borrowing the same amount again from the same group of lenders and/or new ones. Only difference is that it comes at a cost and a significant one at that. For example, a N100 billion Treasury Bills sold a year ago at 9% but maturing today can be rolled over but at a higher yield of 22%.

So, in that sense it sounds a bit like a ponzi considering that the government can continue to rollover the loans to perpetuity. It’s also not unique to Nigeria as that is also how most Western countries borrow and repay their loans. The most important thing is that you have a plan and revenue stream that will see meet up with the interest obligations as well as repay the principal someday.

Unfortunately, that interest element is where the problem lies. A 22% yield on Treasury Bills will be paid by Nigerians in this generation and maybe those who will come later. The only hope is that by the time we are ready to pay, the rates may have dropped for the government. As a retail investor looking to discern all of this, you are better off jumping on the band wagon as this opportunity may never come again. Time to invest?

Wow! I have been wondering how can I make some money investing and I came across your site, glad I’m not so late .. Jumping on the wagon!!

Could I be to late here, even though i live on the other side of world (Aussie)?