After two years of pain, the real OPEC, the big boys, Saudi Arabia and Iran decided to act on proposed production cuts, sending prices up the charts. Barkindo’s diplomatic hustle and September’s Algiers consultations have set a tone for the November meeting but there were still doubters, including us. The premise of our doubts was Saudi’s rigid position on Iran’s quota, which was aligned with the toxic Middle Eastern religious and social conflicts of the last few years. At the end, Putin became an influential exogenous element in the game, just like everywhere else these days. An OPEC plus Russia/Non OPEC cut of about 1.5 mm b/d and 600 k b/d respectively may not be steep enough but it’s a crucial move away from the market share strategy of the last two years. Sadly, the impact on the market is not guaranteed for longer.

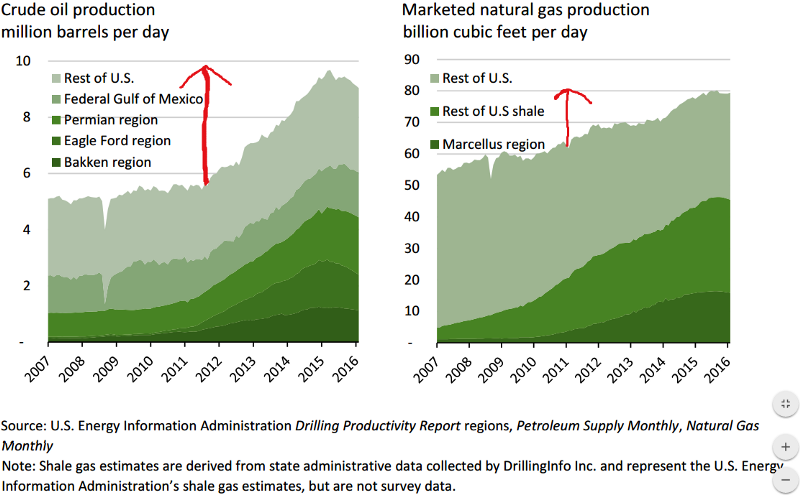

As we have often emphasized here, the landscape of oil supply has been permanently altered by US shale oil and a global slowdown in demand. US Shale oil production increased by about four (4) mm barrels per day from 2012–2016. That’s like the adding production two times that of Nigeria to the market. More so, the lightning speed of development and downward sloping cost efficiency of the shale oil developers is a specter the industry can’t just roll away. At $45/bbl, much of the operators in the prolific Permian, Marcellus, Bakken fields in the US will break even setting a peg for global oil prices. Wood Mackenzie even suggests that at $52, tight oil could be economical. With the unfettered exports of crude oil from the US, appointments Trump has made — Tillerson in State, Scott Pruitt at the EPA and Perry as Energy Secretary, be rest assured that shale is going to play a much bigger role in the years ahead and global prices may not rise beyond their economical cost. Shale is the new OPEC 2.0

Nigeria’s Lost Decade

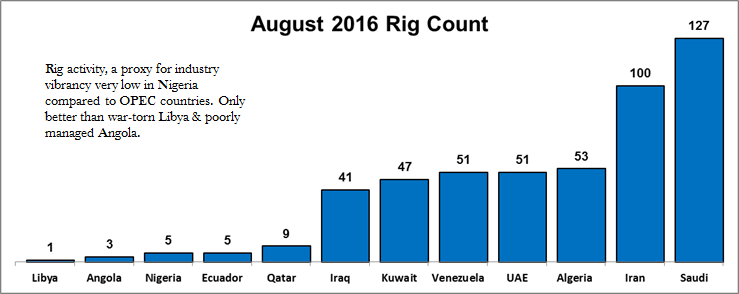

The Federal Government submitted its latest Medium Term Expenditure Framework on Tuesday and there have not been a few gripes about the optimistic assumptions — 2.2 million barrel per day (mmbopd) and oil price of $42.5/bbl. For us, our grouse is that Nigeria with the 2nd biggest reserves in Africa is stuck at these levels of production. The policy ‘stagnancy’, corruption, myopia and the social-political disruptions of the last decade has caught up with us. Now, the industry is in dire straits. As at August 2016, only five (5) rigs were active in Nigeria. Companies are culling their workforce remorselessly. Payment of half salaries is now a norm. Four years after reaching a peak of 2.6 mmbopd we are struggling with 2 mmbopd. That’s some classic regression.

We played ourselves big time!!

Why not? The Petroleum Industry Bill/OGIC has been on a mannequin challenge since 2005, subsidy reforms stalled, industry leadership unstable, while the Niger Delta challenge is now a permanent feature. Because we failed to solve these fundamental problems, we are grossly under prepared for the rapid changes in the industry. For every initiative in any sector we fail to implement because of politics or tribal bias, the pain is waiting for all of us.

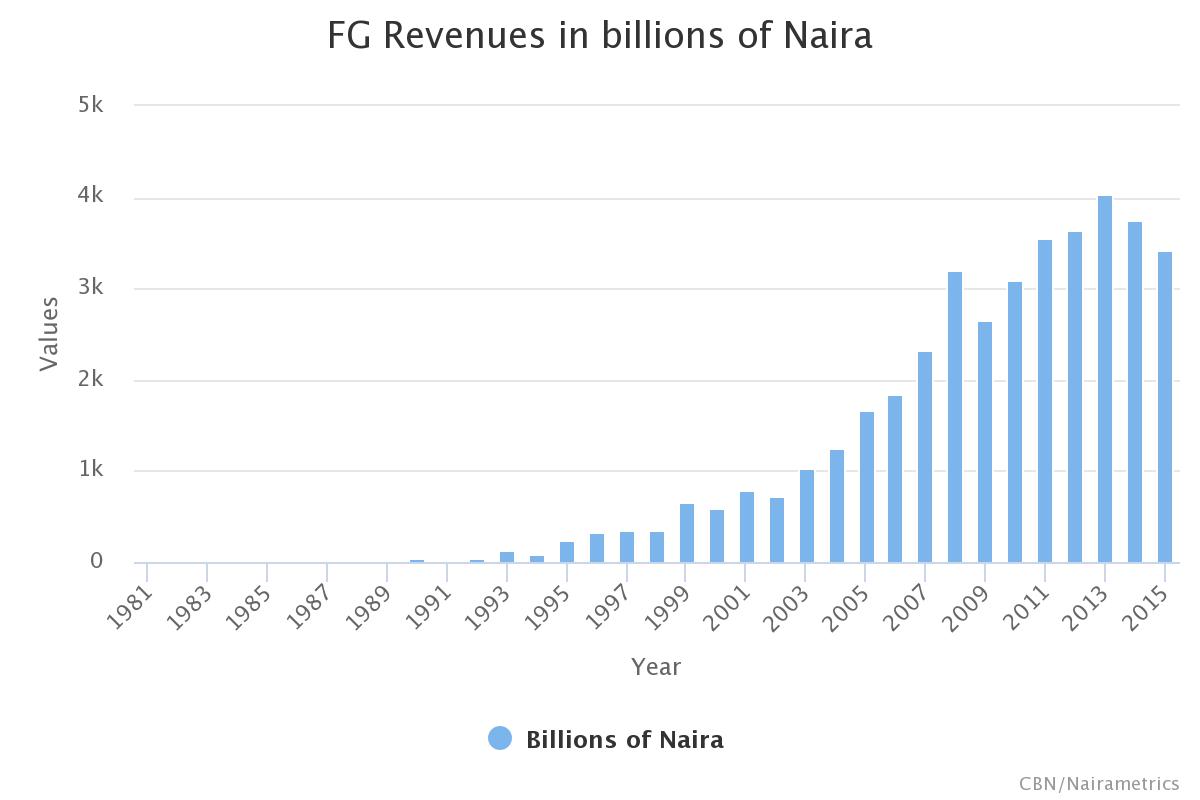

William Easterly said, “development is a political decision”. That’s why the baby steps in the Seven Big Wins agenda are critical. It’s not politically correct but the fact is that Nigeria is an oil dependent country and would remain so for at least another decade. In fact, you need oil money to diversify from oil. The roads, bridges, trains, silos, broadband infrastructure, sea ports, solar farms, taxes would all be built or underwritten by oil money. That’s why fixing the industry is critical. Nairametrics did a word count of Buhari’s budget speech and ‘oil’ occurred 26 times, more than the next most popular, ‘growth’. The guys at the Ministry of Budget know this fact.

Fixing the industry goes beyond just change in policies but also the deliberate decision by political leadership to exclude the operations of the oil industry, the golden goose, the seedlings, from the epidemic of corruption and incompetence. Politicians must recognise and set red lines for the oil industry. You want to enrich fellow politicians or fund the next elections? Fine, but not by interfering at the operational level, inside the trenches. That is killing the goose, the seedlings. It’s this toxic and unbridled strain of corruption that has severely constrained the industry and Nigeria at large. Most OPEC countries rank low on transparency metrics, are mostly undemocratic but their oil and gas industry still thrives. The leaders/rulers/politicians should have enough foresight to ensure that the industry is allowed to operate professionally. Once politicians cross that red line and start dipping down into the oil companies, it’s downhill. Ask Petrobras. Venezuela is in a biblical scale crisis but their industry is still churning out oil at 4 million bopd, double of ours.

Reform. Set a red line. The 7 big wins are a good start but the President must take the lead.

Trouble in Aje field

You remember the Aje field that made Lagos an oil-producing state, there is some little trouble amongst the owners. Let me explain why. In the oil and gas business, exploration and production of oil development and production is undertaken by many companies sometimes coming together in unincorporated ‘joint ventures’ (JV). It could be two to five companies at anytime. In many of the Joint Ventures in Nigeria, government through NNPC and the International Oil Companies are into JVs. So, if the JV wants to drill a well at the cost of $20 Million, the partners would provide the funds for this well according to their ownership stake. They also share the rewards in that same proportion too.

Seems one of the partners in Aje field, Panoro is contesting some of the planned development activities on the field and refusing to pay its share. Before you say Chinua Achebe, Panoro has resorted to arbitration. We know guys who have been involved in arbitration and we can tell you for free that its onerous and time-consuming. Are they broke?

Lesson: If you are interested in the oil business, be careful who your partners are. They determine how enjoyable or not the journey is.

Chevron’s ‘Dead Body’

Sometimes in January 2012, Nigeria had its ‘Macondo’ moment when a drilling rig working for Chevron caught fire offshore Nigeria killing three (3) people. It barely made the news and Chevron only got a slap on the wrist, if at all. In fact, if you google about the accident, you will find more resources from foreign sources than domestic. The rig, KS Endeavour kept burning for over 40 days just about 10 kilometres from the coast yet it was grossly under reported. Seems the news was killed in the Nigerian press. Sad.

We understand it was an accident but Chevron could have at least paid for the error as it’s done in saner climes. Thankfully, someone has filed a suit against Chevron in the United States. The case would have gone nowhere in Nigeria. I hope the good people of Bayelsa get a decent compensation for their pain.

Crude Oil Contracts

The bids for lifting Nigerian oil in 2017 were opened in November, 2016. Results should be out any moment. Watch out.

Rosneft Privatisation

It’s difficult not to respect Russia these days. While Saudi-Arabia is still wavering around selling some stake in Aramco, Russia has moved quickly to sell part of its second biggest oil and gas company. Rosneft surrendered close to 20% of itself to the Qataris Sovereign Wealth Fund and Glencore. Putin took the lead in this deal and the next week, Rosneft was on the market buying up another stake in the beautiful bride, Zohr field in Egypt. Now, don’t you love that? All of these with sanctions in place. Note also what the Qatari’s Sovereign Wealth is also being used for. Making investments and buying influence. That is the way of the world.

Nigeria, wyd?

QatarGas and RasGas

We try to introduce some of the relevant news around the world to this round-up just to provide comparison with ours in Nigeria. Few weeks ago, the proposed sale of government stake in NLNG was hotly debated then it went cold. The LNG industry is challenged and the prospects of growth are not as robust as the past decade. Hub and spot pricing, frontiers in Australia and the US has smothered the possibilities of huge profits. Qatar is the biggest producer of LNG with two companies QatarGas and RasGas. In response to the industry outlook, the government has decided to merge the two companies. Why have two companies for the same objectives? The merge would save costs, improve synergy and also create a monster company.

There is a tide in the affairs of men.

Which, taken at the flood, leads on to fortune;

Omitted, all the voyage of their life

Is bound in shallows and in miseries.

On such a full sea are we now afloat,

And we must take the current when it serves,

Or lose our ventures.

Dangote taps the Chinese

Early rumours about Dangote’s Trans Offshore Nigeria Pipeline were that Saipem was billed to handle it. Seems the Chinese got the gig.

Zhù tā hǎo yùn

Treasure Trove for Gas and Power Industry Lovers.

Let us show you guys a treasure trove this week. Click here and you will find tons and tons of presentations you might find useful. Thanks us later.

Big CEO on his way out?

One of our sauces hinted us today that the CEO of a major Nigerian oil and gas company is about to step aside. The company has investments in upstream and midstream gas. Is this a corporate governance necessity or the CEO wants a bigger challenge. We await official confirmation, if this is in any way true.

So much we can take today. See ya next time.

Visit Damola’s Medium Page