The Emir of Kano, HRH Sanisu Lamido Sanusi delivered a speech last week titled A Plan to Restore Confidence, Direction & Growth at the Savannah Centre for Diplomacy, Democracy & Development – Abuja. The Emir and immediate past Governor of the CBN proposed interesting solutions to Nigeria’s economic crisis. He also did a postmortem on Nigeria’s current economic situation and in his usual eloquent manner laid out instructive criticisms of Nigeria’s handling of the economy.

In one of his major criticism, Emir Sanusi accused the Buhari Government of contravening the CBN act 2007 (section 38.2) which limits how much the FG can draw from the CBN. See his remarks below’

The CBN-FGN relationship is no longer independent.

- In fact one could argue their relationship has become unhealthy.

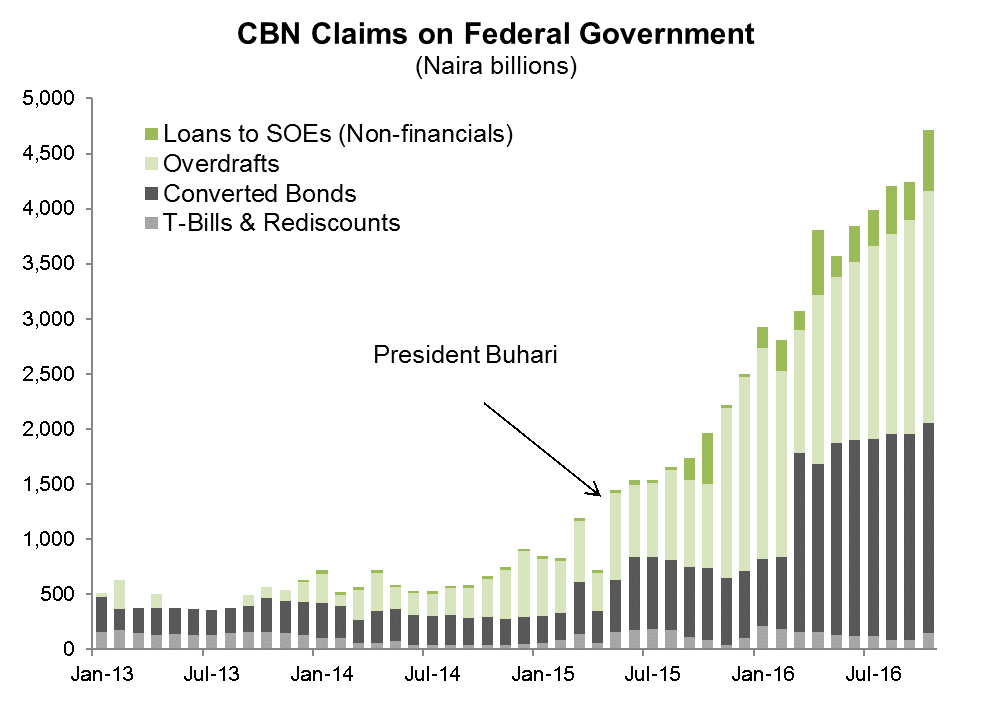

- CBN claims on the FGN now top N4.7trn – equal to almost 50% of the FGN’s total domestic debts.

- This is a clear violation of the Central Bank Act of 2007 (Section 38.2) which caps advances to the FGN at 5% of last year’s revenues. The overdrafts alone are equal to more than 10x that prescribed limit, and are growing every month.

- Has the CBN become the government’s lender of last – or first – resort?

As the chart above depicts, the government of Buhari has consistently overdrawn its balances with the CBN. From slightly under N1.5 trillion it has now increased borrowing to N4.5 trillion within a year. These of course are borrowing channeled mostly into recurrent expenditure with little hope of getting it back except via taxes.

The Nigerian Government is also not letting any of this blow away without a response. The Senior Special Assistant to the president on Media and Publicity, Garba Shehu responded with a rash of tweets. Here they are

With every respect to the Emir, you know he is my ruler, bcos I'm from Kano. He doesn't have his facts as far as those issues are concerned.

— Garba Shehu (@GarShehu) December 3, 2016

With every respect to the Emir, you know he is my ruler, bcos I'm from Kano. He doesn't have his facts as far as those issues are concerned.

— Garba Shehu (@GarShehu) December 3, 2016

The overdraw does not exceed 1.5 trillion. It is incorrect to say, as he did that the account was overdrawn by 4.5 trillion.

— Garba Shehu (@GarShehu) December 3, 2016

But even assuming that he was correct. This is a govt that has money in excess the amount he mentioned in the Treasury Single Account, TSA.

— Garba Shehu (@GarShehu) December 3, 2016

It is just like you, a bank customer operating two accounts, one in the red & the other, well funded to the point that it can at any time…

— Garba Shehu (@GarShehu) December 3, 2016

…wipe the indebtedness on the other. Would any bank manager lose their sleep over this?

— Garba Shehu (@GarShehu) December 3, 2016

This, I am told is what the IMF found at the CBN and they said it is perfectly normal.

— Garba Shehu (@GarShehu) December 3, 2016

Who is right or wrong?

First of all, the Government through Garba Shehu failed to admit that there indeed is a law that caps CBN’s lending to the FG to 5% of preceding year’s revenue. Last year, the FG made about N2.4 trillion in revenue which at 5% amounts to N120 billion. However, the Government has currently borrowed over N4 trillion. Garba Shehu claims the government has money (about N4 trillion) in TSA deposited with the CBN, which according to him means net net, they are debt neutral or at least not at the N4 trillion Sanusi claims. His premise has two major faults.

The law is the law

As you can see from above, the act specifically refers to 5% of previous year’s actual revenue of the Federal Government and not the cash flow of the FG deposited in the TSA. Based on this, the special assistant to the FG is flat wrong on assuming this meant 5% of government’s cash flow including of course the TSA. His example of netting a funded account on an overdrawn sister account is not correct especially when a right of set-off is not clearly stated. A right of set-off means a lender has the right to set-off any debt owed by a debtor against any funded account of the debtor in its possession. The CBN as far as we understand does not have that right.

Even if they had

And even if they had, it seems counter intuitive that the Government will borrow over 4 trillion at interest rates as high as 16% when it has money in TSA it can use? Isn’t that a clear misstatement of what the real issues are? The fact that the government cannot access the TSA clearly indicates that they might need appropriation to spend money that was not budgeted which the TSA partly represents. Thus it’s easier for them to borrow from a (in)dependent CBN than to approach a National Assembly that won’t listen to them.

The latest spat between the Garba Shehu and Emir Sanusi clearly highlights how recalcitrant this government is at taking sound economic advice. Sometimes in trying to defend policies that are clearly out of touch they sound inept and bereft of simple economics.

These arguments are likely not going to blow over anytime soon. We expect the Minister of Finance to respond, especially as regards the $30 billion borrowing. Garba Shehu already alluded to that in his tweets. One thing is for sure. no right thinking investor will buy Nigeria’s Euro Bond offering with the foreign exchange currently immersed in stong and under hand capital controls.

I have said it before the so called TSA fund is a ruse. Just like u rightly pointed out. How can Govt have trillions in TSA (yielding no interest) and use it as a collateral to borrow money at over 16%. This is sheer fraud incompetence and corruption to say the least