In this episode

The “Peak week”, “New Gas Policy

How much did NIPCO pay

Seven Energy and NDPHC Deal

Delta State is the new Power State

The Bedouin Oil Man

October 2016 has been good for the Nigerian petroleum industry. Lots of movement and positive news. So much that we were close to 2.2 million barrels until the boys struck again. That was a production peak in 9 months. Instructive to note that the attacks happened on the same day President Buhari was meeting representatives of the Niger Delta. We already anticipated this was going to happen as it was an opportunity for renegades and the underrepresented to air their voices. The Niger Delta challenge or if I am a little less politically correct, the Delta State problem doesn’t have the answers in any textbook.

Talking about peaks, Shell and Vitol also made very significant statements this week. They predicted that peak oil demand may be just be around the corner — five to fifteen years. So, listen, the world was once obsessed by the concept of peak oil supply. Some ‘experts’ once predicted that the world would run out oil. Hubbert’s model was the holy grail. There is even an ‘Association for the Study of Peak Oil’. As in people earned PHDs trying to prove why the world would run out of oil. Years later and here we are, the world is drowning in oil. The US EIA outlook argues that peak demand is still some 3 decades away but there is a consensus that demand for oil may not accelerate in the nearest future. In our opinion, the world would not be totally weaned of oil as some fantasies because for now there are no cheaper, reliable alternative transportation fuel but the strong growth in demand of about 60% in demand of the last 35 years won’t be repeated.

Companies are already preparing anyway. Many developing countries are not. Shell has been ‘remolding’ itself as a gas company rapidly in the last half a decade. Buying BG, a gas-centric company was part of the model. Huge investments in Floating LNG across the world. In Nigeria, they sold all the troublesome assets and scaled back to a gas rich corner of their acreage footprint. Chevron, Mobil are all shifting capital to gas and LNG projects. Are OPEC countries shifting strategies yet? Nigeria may need to carefully shift strategy towards gas development and export. Thankfully, the Minister has promised reforms on Production Sharing Contracts gas terms. It’s late but welcome. Time to start thinking about the future, not until another economic crisis reaches its peak.

New Gas Policy

At the Nigerian Gas Association’s conference on Monday, 31st October, the Minister announced that a new draft gas policy was ready and would be made available to the public for review.

Remember also that this weekly round-up was conceived to improve transparency and understanding of the Nigerian oil and gas sector.

In line with the Minister’s commitment and this weekly round-up’s purpose , we hereby present the draft policy for your review and consideration. Please Click here.

Send your comments to Adegbite.Adeniji@petroleumresources.gov.ng and copy adeniji@advisoryng.com

How much did NIPCO buy Mobil stake?

The round-up has been sniffing around for the details of the Mobil-NIPCo deal and we think we have some unconfirmed answers. There is a huge disclaimer around this and you are strongly advised not to make any investment decision on it as we will not be liable for any loss on your part. If you make some gain, we can forward you our bank account details. First there is a rumour that a certain General with a learned wife is involved in NIPCO and the deal was around $120 Million. Reminder!! !!! This is unconfirmed.

Seven Energy and NDPHC Deal

After years of delays, Seven Energy owned by affable Phillip Iheanacho executed a gas supply deal with NDPHC, the parent company of the NIPP power plants. Seven Energy launched into the Nigerian gas business when it was not fanciful yet but they are ahead of the game now. By the time Iheanacho matures his development of the Anambra basin, he would have opened up a new frontier for gas production in Nigeria. There were reports that the deal was the first to be supported by the World Bank Partial Risk Guarantee but we can confirm that this is not true. Anyway, wishing the duo of Seven Energy and NIPP a wonderful business relationship.

Niger State, it’s time for a re-christening.

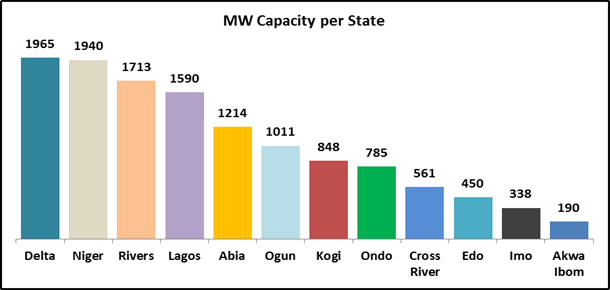

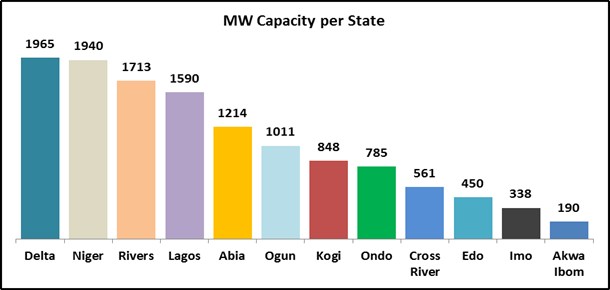

Niger State’s nickname is the ‘Power State’. That choice is understandable since the major hydro power plants which used to dominate power supply, Kainji and Shiroro were located in Niger State. Now, the game has changed.

To determine the new ‘Power state’, we would consider only installed nameplate capacity. It’s a transparent metric and fairly indicates potentials. Available capacity would have been a better measure but it’s very dynamic.

Delta state is the new ‘power state’.

The Bedouin Oil Man

Al Naimi, the boisterous former Saudi Oil Minister was retired earlier in the year but his memoir is already off the press. It was released yesterday, November 3 titled ‘Out of the Desert: My Journey from the Nomadic Bedouin to heart of Global Oil’. Coincidentally, we have started a personal crusade of asking every big man we meet these days if they are writing a memoir. One confirmed he was writing one with the title, “Living on the Margins”. He wants to retire before completing it. Please join me in encouraging any big man you know to write a memoir.

Deepwater Horizon

We saw the movie at the cinemas during the week and it was awesome. Moments of little tears and anguish as those guys faced a battle to save their lives and the rig. The BP guys were just plain cruel. The movie however brings to fore the extent the industry goes just to ensure civilisation doesn’t grind to a halt. This industry is not appreciated enough. Did I tell you that we were just two in the whole cinema? The other guy even left before the end of the movie. We are on our own.

See ya next week.

Follow Ade Damola on twitter @Damoche and follow his Medium Blog here

Excellent round up again Ade. Too bad I missed the NHS conference.

The estimates on how much was paid for Mobil’s majority shareholding in its Nigerian downstream business is close to what I’d heard an analyst said it was worth earlier this year.

With Mobil’s divestment, TOTAL is now the only IOC left in the downstream sector. I wonder how long they’d last before they pack up also?