Unconfirmed reports reaching Nairametrics may have fueled further speculations that the flexible exchange rate market introduced by the CBN Governor, Godwin Emefiele, is being manipulated.

According to an email exchange purportedly exchanged between members of the Banker’s committee, obtained by Nairametrics, some commercial banks appear to be conniving to influence the currency market. Here are a few excerpts of the exchanges;

Key outcomes for us to note as follows

- CBN has directed that Minimum tenor of currency forwards be 60 days. This comes on the back of banks doing 2, 4 and 7 day forwards outside of the official rate in order to fill orders at a higher rate.

- If the CBN Funds are used for settling LC’s then for every LC that is settled a new one of 50% of that value must be written. Sources tell Nairametrics that this is simply a continuation of current in-force rules.

- Banks will not be able to sell to BDC’s going forward as double cheques are being written.

- Same goes for buying currency from corporate…double cheques are being written to make up value (Olam specifically mentioned here).

- Banks may not bid for Dollars at a rate exceeding N315 for amounts less than $1.5 m, but on large amounts banks should call him (Emefilele) to agree upon a different rate should they wish to trade higher (basically to manipulate the official rate at a level Emefiele decides).

- Any banks lacking clarity on exactly what the regs around the currency are should call Herbert (possibly of Access Bank) for clarity.

Whilst the email exchange is yet to be confirmed independently, our source reveal it was obtained from someone with access to email exchanges within the bankers committee. The email exchange also aligns with rife speculations about a rate ceiling imposed on bidders by the Apex bank.

Controversies have currently bedeviled the recent flexible exchange rate market introduced by the Central Bank in June 2016. First the exchange rate remained fixed at around N280 to the $1 for almost a month even though the black market, which has continued to be referenced by traders, traded at around N335 to $1.

It took several analysts accusations that the newly floated currency is being rigged for the CBN to eventually allow the market to determined prices that now saw the exchange rate depreciate to about N315.

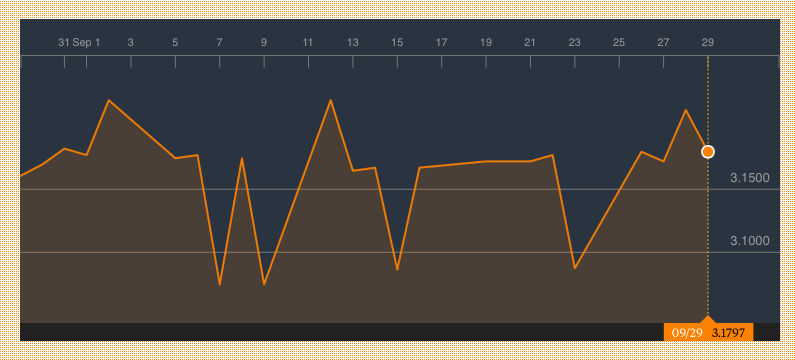

Source: Bloomberg

It has hovered around that rate for weeks now, as the chart above indicates.

In contrast, the parallel market has depreciated to multiple lows reaching a new low of N470/$1.

One of the major reasons why the exchange rate disparity between the parallel market and the interbank rate is liquidity.

With commercial banks ‘refusing’ (as the BDC’s claim) to sell forex remittances to BDC’s, a lack of liquidity at the retail end of the market has sent rates up on the streets of major cities in Nigeria.

Another reason of course is a clear suspicion of the manipulation of the interbank market, in a bid to control the exchange rate, thus discouraging corporates from selling their forex in the official market.

They then turn to a virtual black market to sell their forex benchmarking their price at the black market rate which many believe is more market driven.

The email above, if confirmed to be true, further validates rumours that the current interbank market which is said to be floating, is actually being controlled by a group of commercial banks with clear instructions from the CBN.

As usual, we do not expect authorities to investigate or confirm suspicions that the market is being manipulated by some people with vested interest.

Vested interests are raking in billions in arbitrage from this market and so it favors them to continue to widen the disparity. They present a deceptive view of an interbank market where rates are stable to pacify a President with socialist inclinations about markets, while allowing the economy burn. The exchange rate at the black market is on its way to hit N500 in the next couple of weeks as the handlers of our economy continue with a rogue handling of the forex market.

Not entirely surprising as we continue to try and re-event the wheel of finance as we have always done in our economy.

its simple economics when a lot of money starts to chase few dollars then the price will go up.

One event that comes to mind was in 1992 when George soros decided to short the british pounds and the government decided to support the value of a falling currency. The rest was history, and our government appears to be doing the same.

When the fundamentals are against your currency, all you can do is just to allow free market operations to drive the price and then hope that the fundamentals turn around to favour you, rather than trying to plan around with the market and invite more trouble.

True comment. For as long as the current economic managers continue to manipulate the currency market the Nigerian people will be the 1ce to suffer for it , while the elite with stacks of dollars will continue to benefit. It is not like the economic managers do not know what to do but they have decided to play to the music of some vested interested while painting a stable currency picture to Mr. President. Its no more news the the dollar will hit N700 b4 December if this situation is not arrested. Please!!!!!!!!!!! let them allow the currency market truly float

I guess those people manipulating and speculating on naira leaked this information, to show that the government’s currency market is not based on demand and supply as being marketed. Their objective is to further create more panic and chaos in order to devalue naira further. To drive it to N1000/$1 before Christmas.

At the end of the day, it is the Nigerian economy that will suffer the consequences via high inflation, high interest rate, closure of manufacturing facilities and further job losses. Further losses of purchasing power, loss of brick and mortar foreign direct investments and further degeneration of social and moral vices

One of the primary reason why our economy is failing right now is because CBN agreed to devalue naira. If Nigeria had stuck with their president’s decision, and agreed to keep their naira peg and not devalue the currency. We will still have stable exchange rate (government rate), high per capital income, moderate inflation rate, predictable economy and others.

As for our CBN governor and board members, I don’t know what to call this. Incompetency or un-patriotism? A competent CBN Governor and boards will ensure currency stability, which every other economic indices relies. Nigerian CBN boards constitutes some of the best global economists, based on education and experience.Why are they having difficulty arresting naira stability? Could it be that CBN governor and board members are serving other’s interest? Could they be compromise?

It is easy to down an economy, but more harder to rebuild it. Our economy is falling like a pack of cards based on the actions and inactions of our CBN Governor. The time to speak up was yesterday. The time for action is now.

Arise, O compatriots

Nigeria’s call obey

To serve our fatherland

With love and strength and faith

The labour of our heroes past

Shall never be in vain

To serve with heart and might

One nation bound in freedom

Peace and unity.

We need to start exporting.