We expect the impact of the foreign loans on FX reserves (and by implication the naira) to be very small, probably negligible. However, we expect its impact on the government’s capex spend, and by implication growth to be more meaningful.

- When countries FX revenues fall substantially, they are inclined to raise external financing. Which does two things: i) it helps shore up FX reserves, and in some cases slow the depreciation of the currency; and ii) it brings in funds to help a revenue-constrained government finance the budget deficit.

- Earlier this month, the presidency announced that the cabinet had approved plans to borrow externally and the plan was awaiting parliamentary approval. The government plans to borrow from the World Bank, the African Development Bank, Japan International Co-operation Agency, and Export-Import Bank of China. In addition, the government is considering a Eurobond issuance.

- The financing gap for the FY16 NGN6tr budget (which will be implemented until May 2017) is N2.2tr or $7bn.The initial budget showed that the government planned for foreign borrowing of NGN984bn, which is $3bn at today’s FX rate vs $5bn at the FX rate when the initial budget was released in late 2015. When we met with the World Bank in May, we were told that the government was in talks with them and the AfDB for loans of $1.5bn and $1.5bn respectively. At the time, the $2bn difference in external financing was expected to come from a combination of bilateral lenders and a Eurobond. As the 60% depreciation of the naira, against the dollar, since June, has effectively reduced the foreign borrowing requirement in dollar terms, the loan amounts from the various creditors may have changed.

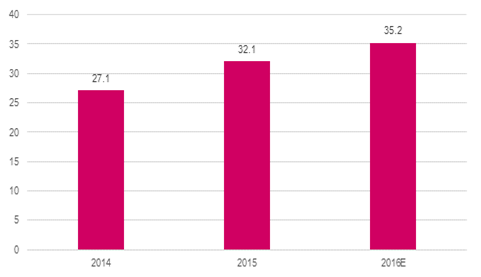

- Nigeria’s debt/GDP ratio of c.14% is very low when compared to its peers (vs 50%+ in Kenya). However, Nigeria’s high debt service/revenue ratio of 35% explains why the authorities will need to be cautious when increasing its borrowing requirement. Otherwise debt servicing will crowd out spending to priority sectors, including healthcare and education.

Figure 1: Public debt service/revenue

Source: IMF, Nigerian authorities

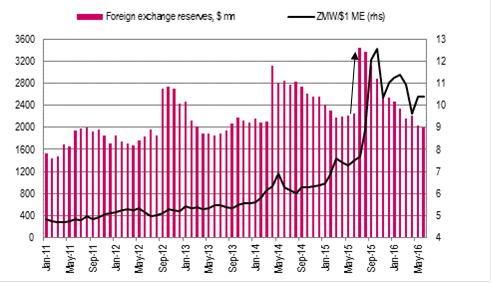

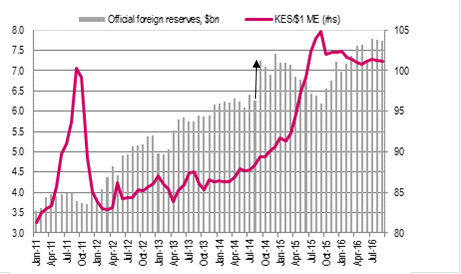

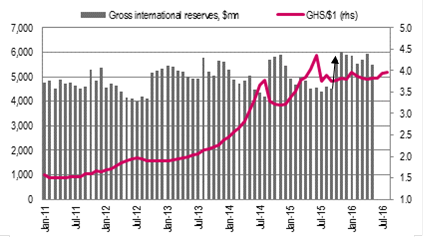

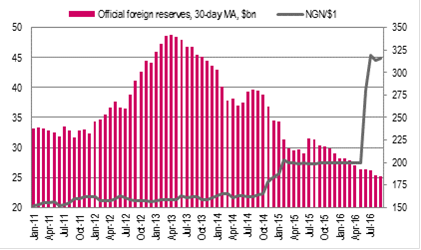

- The impact of this external financing on Nigeria’s FX reserves will not be as pronounced as it was in Ghana, Kenya and Zambia, simply because Nigeria the incremental effect of the foreign loans on the country’s FX reserves will be relatively small. The most recent Eurobond issuances in Ghana (October 2015), Kenya (June 2014) and Zambia (July 2015) [see arrows in Figures 2-4] resulted in these countries’ FX reserves increasing by 34%, 20% and 50% respectively. If Nigeria were to raise $3bn via foreign borrowings at one go, FX reserves would improve by a smaller 12%.

Source: Central Bank of Kenya

- FX implications: the impact of the inflow of foreign loans is likely to be transitory. In Kenya and Zambia we saw FX reserves bounce for two months, whereafter they fell as the funds were mobilised for the budget. Only in Zambia did we see the local currency, the kwacha, strengthen against the dollar, on the back of the FX inflows. However, that was in part due to the bigger relative impact of the loan on FX reserves. In Ghana, the inflows also bumped up FX inflows significantly, which in part helped stabilize the cedi. Notably, tight fiscal policy under the new IMF program also explain the cedi’s new found stability. Kenya’s Eurobond inflows did not stem the depreciation of the shilling, partly because sizeable share was drawn to repay debt. In Nigeria, we do not expect the foreign loans to have a material and lasting effect on the FX rate, because the incremental effect on FX reserves is small and they will only provide a transitory bounce.

- Fiscal impact will be more significant: The foreign loans will allow for the execution of the capex budget to begin in earnest. They can potentially spur investment and lift growth. The foreign loans will be spent on infrastructure, especially power, agriculture and healthcare, according to the presidency.

- Conclusion: The foreign loans will provide a temporal bounce to Nigeria’s FX reserves. We expect the impact on the country’s FX position, and by implication the naira, to be small. We expect the fiscal impact to be more significant, especially as it will allow for capex spend to resume, which is positive for growth.