It hasn’t been a great year for the markets so far this year. The NSE Allshare index is down around 3.46% year-to-date. With volatility at 7.3%, less inflow from foreign investors due to the depreciating Naira, and the market looking more bearish, it becomes a challenge finding winning investments.

However, even in a tough and rough markets, one can still find good and profitable investments. Investing in mutual funds, while providing for downside risk hedging through diversification, can provide opportunities for growth

For those looking for growth, a look at the best-performing mutual funds year-to-date may be worth the while.

New Gold Exchange Traded Fund (Etf)

Source: Quantitative Financial Analytics

Gold has been doing pretty good this year, gaining over 26% YTD. It should not be surprising then that our number one mutual fund performer is New Gold Etf. The fund provides investors the opportunity of investing in the gold bullion market without the necessity of taking physical delivery of gold. This year, the fund is up a staggering 105% with a risk return ratio of 10.55 to 7.51

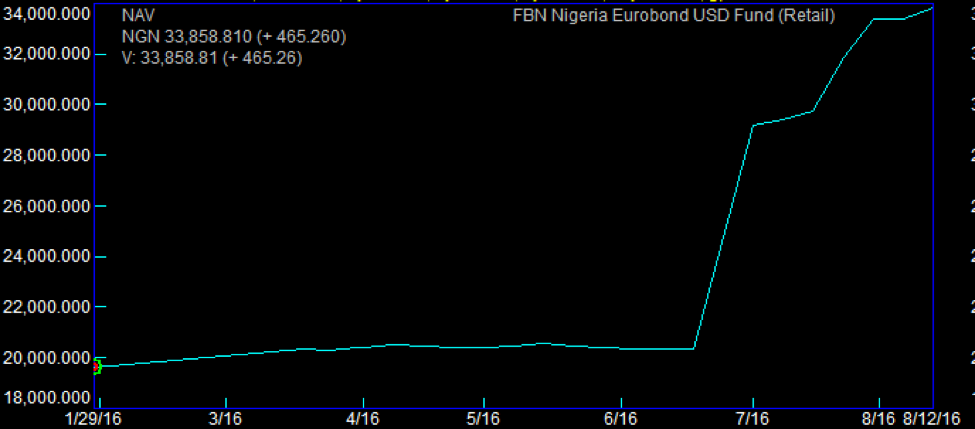

FBN Nigeria Eurobond USD Fund (Retail)

Source: Quantitative Financial Analytics

Though it is not unusual to see a bond fund as one of the best-performing mutual funds, it is not surprising that one of the best performing funds this year is a USD denominated fund considering the gains that the Dollar has made against the Naira.

The FBN Nigeria Eurobond USD Fund (Retail) is a Securities and Exchange Commission registered, actively managed open—ended Unit Trust Scheme that enables the unit holders to invest in a fixed income fund that invests predominantly/ in USD denominated debt instruments issued in Nigeria. This fund up 73.64% year-to-date, although most of the performance comes from translation gain. Translation gain is the gain that results when amounts stated in one currency are translated into another currency. The fund has a risk return ratio of 11.52 (return) to 6.05 (risk).

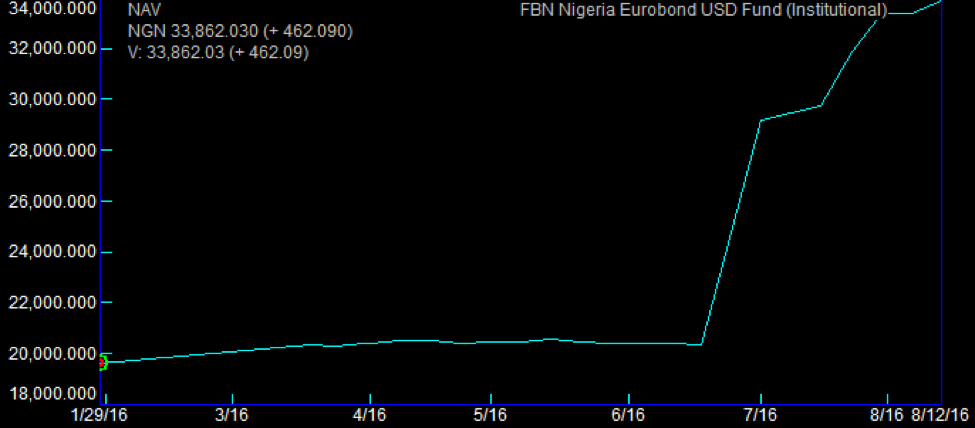

FBN Nigeria Eurobond USD Fund (Institutional)

Source: Quantitative Financial Analytics

Like the FBN Nigeria Eurobond USD Fund (Retail), FBN Nigeria Eurobond USD Fund (Institutional) is a Securities and Exchange Commission registered, actively managed open—ended Unit Trust Scheme that enables the unit holders to invest in a fixed income fund that invests predominantly/ in USD denominated debt instruments issued in Nigeria. This fund up 73.62% year-to-date with most of the performance coming from translation gains. The fund has a risk return ratio of 11.52 (return) to 6.05 (risk).

Conclusion

Though the markets have not been much of a blessing this year, there may still be opportunities for investors. As the above list of high-performing funds proves, there is always a pin in a hay stack, that if and when discovered, could mean so much to a portfolio.