Jide is a bachelor and works for a high brow consulting firm in Victoria Island. He currently earns about N7 million per annum with about 3 years working experience. Since he started his job, which he loves so much, he has lived a moderate lifestyle living with his parents and taking public transportation to work.

Lately, he has been getting visits from account officer of some micro-finance and commercial banks selling all sorts of loan related products to him. Jide’s work place and his low-key lifestyle makes him a prime target for these bankers who are under pressure to meet their targets. They offer him a N5 million loan for 4 years at an interest rate of about 26% (all in).

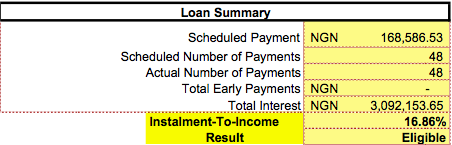

Jide, now looking to step up his lifestyle believes perhaps now is the time for him to take on one of these loans. A N5 million loan will currently get him a second-hand vehicle and also leave him with enough money to rent an apartment for 2 years. His N7 million per annum salary also looks likely to cover the 5 million loan provided he gets to pay it over four years. Being a careful person he decides to run the numbers to see what it comes to.

Jide could not believe his eyes. The N5 million loan will cost him about N3 million in interest payments over the 5 year period. Thus by the end of 5 years, he would have paid off over N8 million in loans and interest for a car and rent that was nothing close to an investment.

Sadly, this is what a lot of Nigerians are set to face with the new interest rate regime. In fact, this is what life has been for Nigerians looking to lift into the coveted middle class segment of society. You basically enslave your self when you start at this level. Loans are not entirely bad but we always advise that you work out the amortization schedule to see how this works out for your take home pay. A N5 million loan today and repayable over 4 years at 26% interest rate is a N168.5k debit on your account every month till the loan runs out.

Why not try the spreadsheet below and see how your amortization works out for whatever loan amount you desire.

How about saving N170,000.00 every month for 2 or 3yrs and buy whatever you want? Car debt, loan to pay debt are dead debts – as in, they don’t generate Naira returns that can be used in repaying the original loan. At the end of the day, the loan taker may just be living above his means if he’s not very careful, thank you.

You don’t even need to save as much as N170,000.00 every month… save N150,000.00 monthly in a simple savings account @5%p.a compounded will earn you almost N6,000,000 in 3years. If you go the t-bills or bond route, you will have even more than this.