On June 20th, 2016 the Central Bank of Nigeria launched the new flexible exchange rate policy that ushered in the floating of the Naira effectively shutting down decades long policy of holding on strong to an exchange rate peg.

Analysts expected the exchange rate between the Naira and the dollar to be determined fully by the market and not by the Central Bank or indeed any single force. Unfortunately, what we observed was that in the first two weeks of floating the currency, we saw nothing close to an exchange rate peg. The exchange rate was thought to be “rigged” as this article clearly explains.

Understandably, the Central Bank will take some time to shake off its love for losing what was very dear to it. It had for years jealously help on to a pegged exchange rate so it obviously was yet to dawn on them that with this move, the Naira will face up to the wrath of free markets.

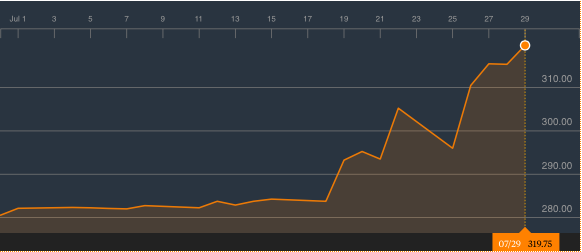

Source: Bloomberg

Things have changed since then and the Central Bank has eventually shaken off its hold. As the chart above depicts, it appears we have now seen an exchange rate that bears the hallmark of being a floating currency. The week of the 18th of July finally saw the CBN allow the market to take charge. Should we be happy about this?

We believe so. An exchange rate that is left to market forces will in the short run burn the Naira. However, that will give the CBN and the Government enough leverage to put policies and structures in place that will attract foreign investments. The government needs foreign investors to help kickstart a revival of the economy.

The government needs to see a rebound in our external reserves (currently at $26billion) to the $40b levels and requires both growth in revenues and investments in the economy to achieve that. A market determined exchange rate helps push that mission closer to being achieved. In the long run we should be better off, provided we focus on economic policies that play to our core strength.

We believe, investing in Education (Tertiary and Vocational), Information Technology and Manpower development play to our core strengths. A population of over 180 million potentially English speaking people is by far our strongest asset.