A recession is defined by economists as two consecutive quarters of negative GDP growth rate in an economy. It is a confirmation that economic activities in a country has contracted.

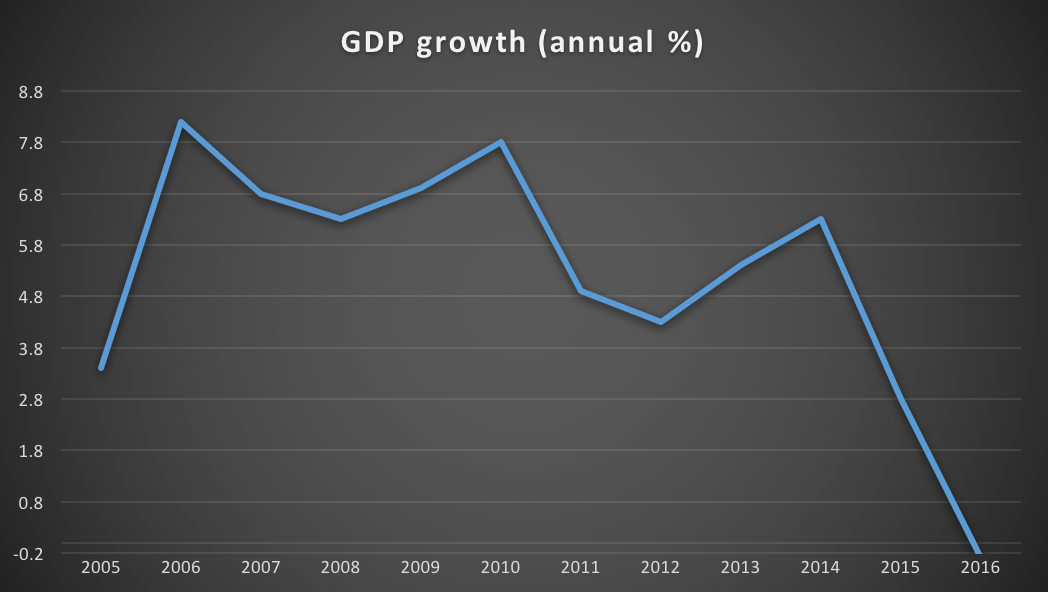

The Nigerian Economy has been in turmoil for the better part of 2015 and 2016 following the drop in the price of crude oil and the negative impact it had on government’s revenue. This resulted in a dip in Nigeria’s foreign reserves triggering a gradual and continuous depreciation of the value of the Naira. This then triggered a rise in the cost of goods and services, reduction in consumer expenditure, lower profits for companies and a rise in bad debts in the books of commercial banks.

By the end of the first quarter of 2016, the National Bureau of Statistics reported that Nigeria had recorded a negative GDP growth rate. As we await the GDP report for the second quarter of 2016, analysts are already anticipating the confirmation that Nigeria is now in a recession.

We bet by now you have been inundated with news of a recession and what it could mean for Nigeria and tour business. But how should small businesses respond to the threat of S recession? Nairametrics hopes to address this question by suggesting a list of things businesses could do to deal with the impending recession.

Review your funding structure

A recession typically starts by ravaging through the balance sheet of companies focusing on the company’s sales, profitability and then cash balances. Your business starts to record a decline in revenues followed by losses and then you start to run out of cash to pay for recurring expenses. This has to be your number one priority as the moment you start to experience cash shortages in your business then it’s clear the recession has caught up with you. To avoid being in this situation, you would have to immediately review your funding structure. This involves identifying where most of your cash comes from, how much you have in your bank account and how much you are owing (debtors plus suppliers). If your business is heavily reliant on bank overdraft or short-term loans, then you have every reason to be very meticulous about how that money is spent. You should also take care to further improve your relationship with your bank or creditors because not doing so means they could stop funding you once it’s time to rollover the loan.

Cut staff overheads

We hate to say this but employee cost represents a significant portion of company overheads and will need to be reduced during a recession. Recessions are associated with declining sales so for every N100 of revenue that is lost to a recession you may have to find a way to replace it from staff overheads. One way to be compassionate would have been to reduce staff salaries so more people will remain in their jobs. Unfortunately, the market doesn’t work that way as those you even seek to protect may not even be willing to take a pay cut just to save a colleague’s jobs. He who wears the shoes knows where it’s pinching.

Get a sound Finance Team

This should have been the first really especially in a recession but better late than never. Most companies in a recession tend to focus more on improving their sales force as they fight back dwindling market share. They somehow forget recessions are cyclical and will need some time to run its course. A sound finance team with an eye for business development can be very useful to keeping a company afloat in times of recession. They can use their training in business intelligence to focus the marketing team on where there are opportunities, what needs to be cut and how to run on a lean and efficient balance sheet.

Keep cash in forex

This might not apply to all businesses considering that some make money in foreign currency whilst others earn in Naira. For businesses who earn in forex, now more than ever, you have to keep most of your excess cash in dollars to ensure that you have the perfect hedge to fight off inflation. When your currency is in a continuous state of depreciation and inflation is rising unabated every single Naira you hold loses its value faster than you can replace it. Thus, if your business earns solely in Naira then your best bet is to avoid aiding the depreciation by leaving it idle. If you need to save, keep it in an interest bearing account that is at least higher than inflation.

Avoid Investing in Capex or what ties cash down

During a depression smart companies cut down on spending on items that do not immediately generate cash. Examples are spending on capital expenditures. Capex include equipment and machinery, motor vehicle, land and building etc. which we know are an important part of the business process. However, during an economic downturn spending on items such as capex that take time to generate cash are not necessarily good ideas. You have to bear in mind that sales are tanking and recurrent expenditure is rising as such to remain afloat you need to have enough cash. During a downturn cash is king.

Cut down on Investments

Just as above, you also need to cut down on investments such as buying news businesses, expanding market share or adding new production lines. Of course there are exceptions and this depends what opportunities are available. Companies with a significant cash hoard take downturns as an opportunity to buy struggling targets for expansion or kill competition. If you have a strained balance sheet (after reviewing your funding structure) then don’t even think about investing in new businesses.

Reduce inventory

Inventory are stock of goods kept for sale to your customers. They are considered as assets when you are sure of selling them within the shortest time possible. On a flip side, they are considered a liability if you haven’t sold them within the shortest possible time. Your accountants (remember what we said about having a crack finance team) should be able to tell you clearly the maximum inventory levels you must keep to ensure you do not carry extra liabilities. If you are into a business that produces, then make sure you produce what is exactly or close to demand. If you buy wholesale to sell retail or buy retail to sell to end users, then make sure you are buying the quantity you can sell and nothing more. This is not the time to tie cash down in inventories you can’t sell.

Avoid promos and huge marketing expenses

It is important to keep customers happy at times like this as they are very fickle and mindful of what they spend their money on. Naturally, your marketing team might suggest that you offer promotional deals and/or expand your marketing budget. We strongly feel now is not the time for that. If you must offer promos, then do so on excess inventories that you have found hard to sell and have not to plans to replace them quickly. If that is not the case, then why not focus instead on improving customer service. You are better off investing on existing customers than spending money looking for new customers who are frankly not just in the mood.

I’m not an expert, but I know good stuff when I see it. Great tips.