Brexit shocks roil global financial markets: Yesterday, the United Kingdom voted to leave the European Union in a vote which sent shock waves across global financial markets this morning. Following the announcement of poll results, the UK pound fell (as much as 11%) to the weakest level in over three decades of $1.3229 while the FTSE 100 tumbled 7% in early morning trades.

- In the immediate aftermath, the UK should trigger Article 50 of the EU Treaty resulting in two years of negotiations for a bilateral treaty with the EU, though initial comments from Leave campaign leader, former London Mayor, Boris Johnson, suggest a reluctance to rush into divorce talks. According to OECD, an exit from the European Union could cause economic losses of as much as 7.7% of GDP in a bear case scenario while the IMF assumes base case losses of up to 5.5% of GDP.

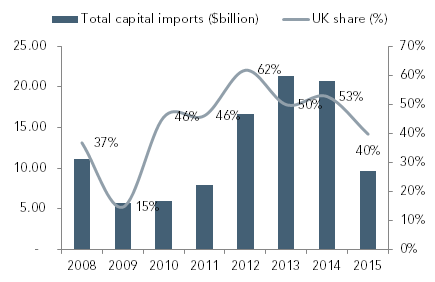

- Minimal trade impact, but capital flows to Nigeria at risk: In terms of trade links to Nigeria, the UK accounted for 4.2% of exports and similar magnitude of imports in 2015 leaving scant scope for any negative implications via trade. For capital flows, uncertainty over the status of international financial firms operating out of the UK and the prospect of further referendums (in UK and across the EU) should drive emergence of ‘flight to safety’ theme leading to capital outflows from risky emerging and frontier markets (EM/FM). The UK accounts for slightly under half of capital flows to Nigeria over the last five years.

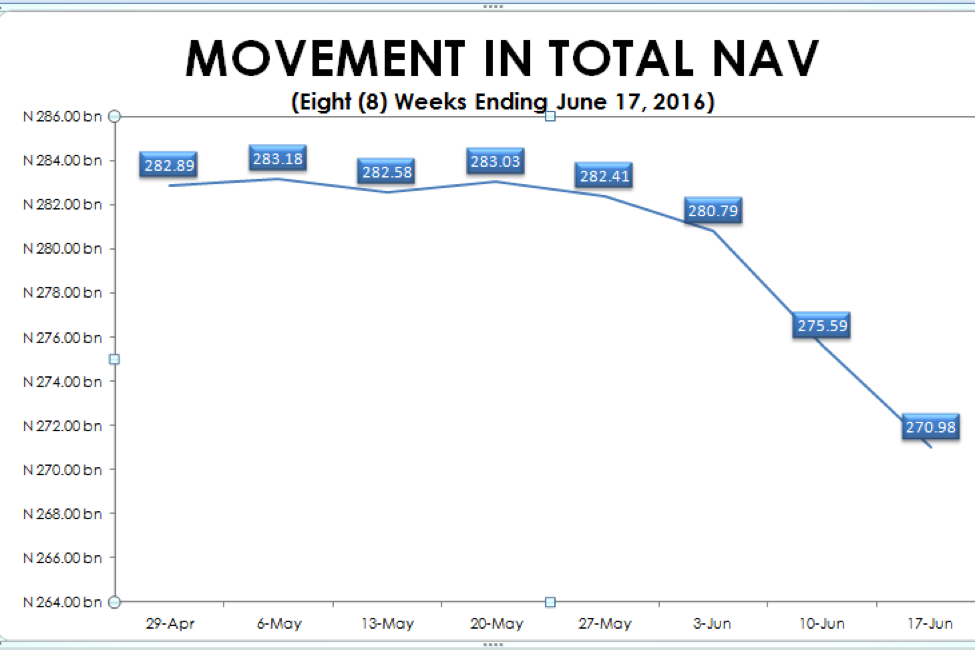

- Muted effect on equities, but raises scope for yield uptick: The foregoing points to weaker FPI inflows to Nigeria with attendant negative impact on the recent incipient market recovery, but FPI activity across domestic financial markets had already declined significantly since 2014 following the collapse in oil prices and FX market curbs likely tempering the fall-out for Nigeria. Beyond the immediate aftermath of Brexit, we believe prevailing local concerns (FX policy change, weak GDP growth etc.) should continue to dictate movement across domestic equities. On the other hand, the increased aversion to riskier debt across global financial markets should dim prospects of proposed Eurobond issuance leading to greater reliance on domestic sources to plug the budget deficit.

Source: ARM