#TheNumbers for the week ended May 13, 2016

Commentary

Bullish sentiments held sway with the market closing at levels last seen in the opening week of 2016. Thus, trimming the YtD decline to -769bps from -2127bps at the height of the market sell-off in January. The performance was driven by the market’s reaction to the signing of the 2016 appropriation bill and the release of cash for capital projects which commenced on Friday. Also, the government’s decision to somewhat deregulate the downstream sector gave the market a boost, as investors placed major bets on the oil marketing firms on expectation of higher margins.

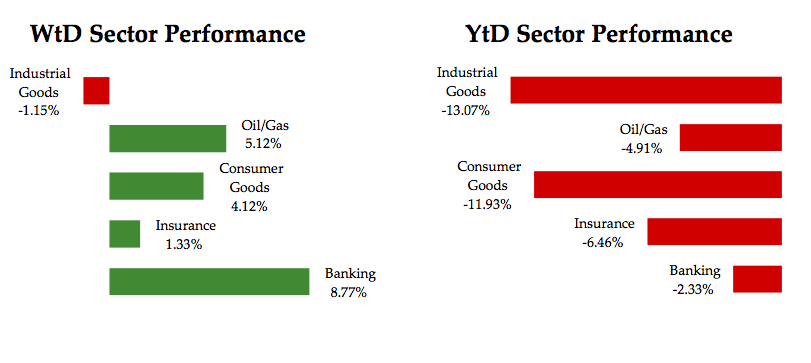

The session was higher with the All-Share Index adding 288bps to close at 26,441.03pts. The gains came in from all sectors with the Industrial Goods sector being the only exception. The Banks surged by 877bps with the tier 2 banks leading the way, seeing the most gains. In the same vein, the Consumers (+412bps) were higher on sustained demand for the likes of TIGERBRAND & NB. The Oils saw gains of 512bps. While the Industrials dipped 115bps on weakness in the paint makers and the likes of WAPCO & DANGCEM

Volumes were sharply higher, with turnover jumping 125.75% WoW. The week saw a turnover of 1.826bn shares valued at N14.468bn. The biggest trade for the week was an off market cross of 244.23mn shares of ETI valued at N4.75bn. The trade was executed at N19.43 (a 22.5% discount to its CP: N15.06) by offshore investors. Outside of these, the action was mainly in the likes of GUARANTY, ZENITHBA, NB, ACCESS & FBNH. Also, word on the street is that a significant portion of the buying that lifted the market came in from local prop traders.

Source: FT.com

Market Snapshot

- All-Share Index: 26,441.03pts

- Market Cap (NGN): N10tn

- Market Cap (USD): $46.19bn

- Total Volumes Traded: 83bn

- Total Value Traded (NGN): N47bn

- Daily Average Value Traded – WtD: N89bn

- Daily Average Value Traded – YtD: N18bn

- Advance/Decline Ratio: 54/17

Sector Performance:

Market Screeners:

- Top Risers:

TIGERBRANDS (+50.13%; N6.99); DIAMONDBNK (+44.29%; N2.02) & FCMB (+30.30%; N1.29)

- Top Decliners:

UPL (-14.21%; N4.89); MRS (-9.73%; N40.47) & CAVERTON (-30.30%; N1.51)

- Top by Volumes Traded:

ETI (251.85mn); ACCESS (218.03mn) & FBNH (192.67mn)

- Top by Value Traded:

ETI (N5.44bn); GUARANTY (N1.51bn) & ZENITHBANK (N1.22bn)

- New 52-Week High:

ETERNA (N3.03); MOBIL (N175.00); TIGERBRANDS (N6.12) & UNIONDICON (N12.89)

- New 52-Week Low:

GOLDBREW (N0.85); MRS (N40.47); UPL (N4.43) & PORTPAINT (N1.88)