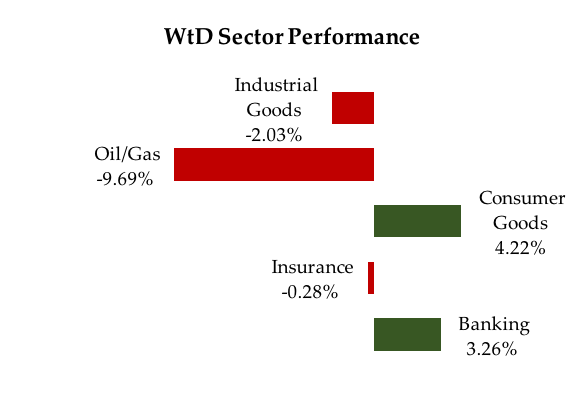

A teeter-totter kind of trading week. The gains however outweighed the losses, thus, seeing the All-Share Index off to a positive close. In all, the market advanced by 85bps to close at 25,062.41pts. Leading the ASI back above 25,000pts were the Consumers and Banks with gains of 422bps and 326bps respectively. Our sense is that, feelers that Nigeria may remain on the MSCI frontier market index were supportive of the positive outcome. Crude oil, which traded above $45/b, also helped sentiments.

Bullish sentiments in NB (a +9.64% WoW rise following 2 session in which it closed at the upper end of the range) buoyed gains in the Consumers. In the same way, TIGERBRANDS (+8.99% WoW) following its return to profitability, also gave the Consumers a lift.

The Banks were led higher by sustained demand for tier 1 banking names – ACCESS (+5.34% WoW), GUARANTY (+5.34% WoW) & ZENITHBNK (+4.53% WoW). Ironically, despite disappointing Q1 2016 earnings from FBNH (+8.43% WoW), the bank also closed the week on a high note.

On the other hand, the laggards were led by the Oils and Industrials which came off by 969bps and 203bps respectively. This was on the back of WAPCO’s Q1’16 loss and sustained selling pressure in FO.

There was a slight improvement in activity levels over the previous week, with a turnover of 1.16bn shares valued at N7.03bn compared with N5.82bn that traded in the previous week. Again the tier1 banks dominated with the likes of FBNH, ACCESS, ZENITHBNK & GUARANTY accounting for c.54% of total market turnover, driven by a few block trades as well as active participation by both foreign and local investors.

Source: FT.com

Market Snapshot

- All-Share Index: 25,062.41pts

- Market Cap (NGN): N62tn

- Market Cap (USD): $43.76bn

- Total Volumes Traded: 21bn

- Total Value Traded (NGN): N11bn

- Daily Average Value Traded – WtD: N42bn

- Daily Average Value Traded – YtD: N19bn

- Advance/Decline Ratio: 32/35

Sector Performance:

Market Screeners:

- Top Risers:

ETERNA (+17.95%; N2.30); AGLEVENT (+14. 63%; N0.94) & HONYFLOUR (+11.43%; N1.56)

- Top Decliners:

FO (-22.09%; N214.35); AIRSERVICE (-18.78%; N1.47) & UACPROP (-13.48%; N3.85)

- Top by Volumes Traded:

FBNH (314.65mn); ACCESS (251.87mn) & UBA (87.74mn)

- Top by Value Traded:

FBNH (N1.13bn); ACCESS (N0.99bn) & ZENITHBANK (N0.93bn)

- New 52-Week High:

UNIONDICON (N11.80)

- New 52-Week Low:

WAPCO (N67.99); PHARMDEKO (N1.95); PORTPAINT (N2.40); NESTLE (N615.26); AIRSERVICE (N1.47); LIVESTOC (N0.81); GUINNESS (N90.25); STERLNBANK (N1.41); UNHOMES (N3.68) & NEIMETH (N0.63)