NEM Insurance Nigeria Plc recently released its 2015 Q1 results showing pre-tax profits of N2.7 billion up 68 percent from the N1.6 billion reported a year earlier. For most investors of NEM this was a blow out results.

But for more discerning investors who are by now accustomed to NEM’s knack for reporting good interim results, only to declare a whopping loss in the final quarter of the year, this result left more to be desired. Most investors don’t mind as NEM typically makes the shortfall in expectation by declaring dividends that eventually prop up their share price. After all, seeking alpha is all we look forward to except there is something else we haven’t yet seen.

NEM’s current results takes financial reporting to a new dimension that we still can’t comprehend at Nairametrics. At a first quarter profit of N2 billion, NEM is basically telling investors that it made more money in the first quarter of 2016 that it did in 2015 and 2014 combined. This was hard to stomach and we could not defer this clarification to the end of the financial year, when it typically (as we suspect) correct all misrepresentation associated with the results. NEM, we feel may have taken this to whole new level.

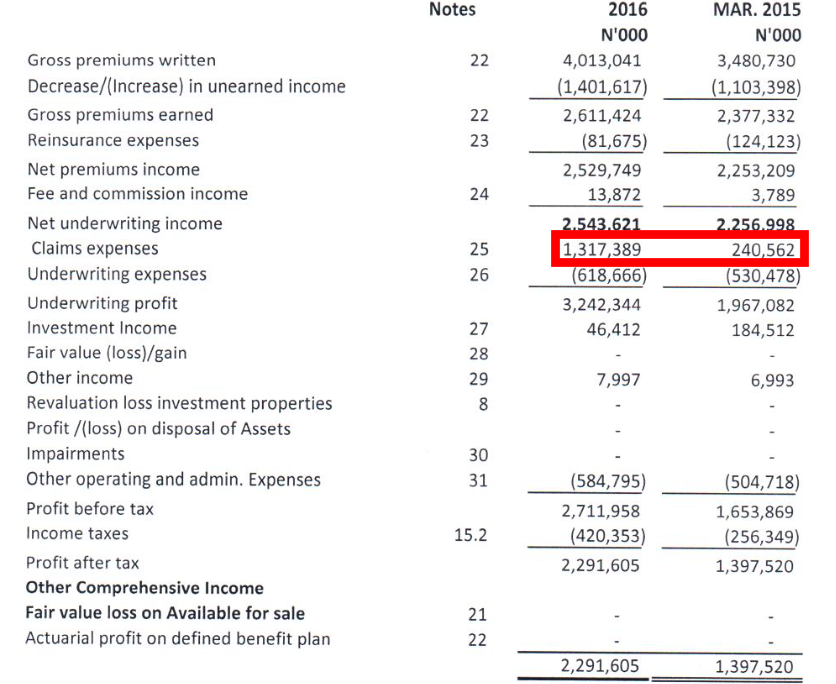

Whilst discerning the results, our analysts revealed that the company was able to post this monster profit in the first quarter for a singular reason. Claims and Expenses for the year was reported as N1.3 billion but rather than classify it as an expense the company reported it as an income. Strangely, they did the same thing back in Q1 2015 reporting “claims and expenses” of N240.5 million as an income and in 2014 reporting claims and expenses of N18 million as an income . We sought to inquire if these were claims refunded in the notes to the account but got no clear-cut explanation. The closest we saw was a note that explained claims and expenses as “consist of claims paid during the financial year together with the movement of provision for outstanding claims”.

Some analysts inform us this could mean that claims that they had thought they would expense probably did not occur as such it was reported back as an income. For all intent and purposes, this should be disclosed more appropriately assuming this was the case. The exact movement schedule should also have been disclosed. Nevertheless, we doubt this was the case. Some other analysts explain to us that even if these claims were to be income, the word “expenses should have been exchanged for ” net claims received”. This makes us conclude (rightly or wrongly) that something must be terribly wrong with this result,

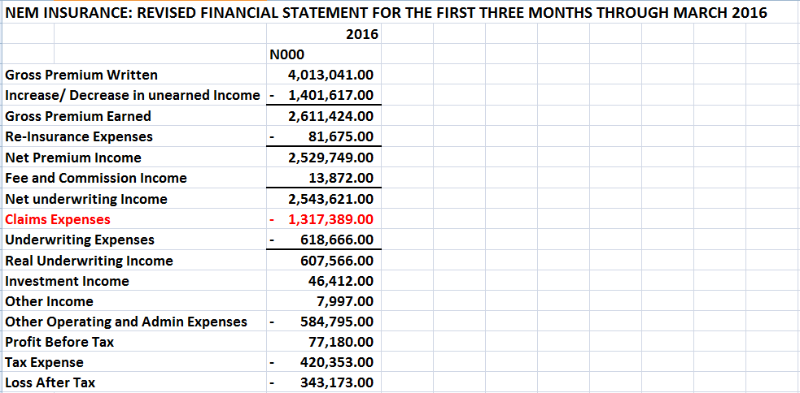

If our suspicion is correct then by writing back the claims, NEM may have overstated underwriting profit to the tune of N3.24 billion instead of disclosing it as N607.56 million. In fact, Q1 results may have resulted in a pre-tax profit of about N72 million and loss after tax of N342 million (See below).

We are bewildered by this result and sincerely hope that our analysis is wrong. Emails sent to the NSE and NAICOM on this issue and did not get a reply.

We hope our good friends at NEM are reading this article and will be magnanimous enough to explain to us what those claims and expenses actually are. And if you are an NM reader with connections to NEM, kindly pass the message across. Investors are waiting anxiously.

YOUR LAUDABLE ANALYSIS OF NEM FIRST QUARTER RESULT IS HIGHLY APPRECIATED. MY ADVICE TO NEM’S MANAGEMENT IS TO SHOW CASE AND PRESENT A CLEAN CLEAR RESULT THAT WILL NOT PRESENT A MANIPULATED FINANCIAL REPORT TO THE SHAREHOLDERS AND THE PUBLIC AT LARGE. NEM SHOULD COME OUT TO DEFEND THE ANALYSIS AS PRESENTED BY THIS PUBLICATION.

I appreciate your analyis. However, from the undewriting result per class of business, it appears that what really happened was that there was a significant decrease in provision for outstanding claims. (see page 4 of the link below

https://www.nse.com.ng/Financial_NewsDocs/13359_NEM_INSURANCE_Q1_MARCH_2016_FINANCIAL_STATEMENTS_APRIL_2016.pdf

Exercpts of the Underwriting result

Direct claims paid ( 868,683 )

Decrease in o/s claim prov 2,163,057

Reinsurance recovery 23,015

Net Claim Incurred 1,317,389

thui

What can be inferred is that there was a serious overprovision in 2015 4th quarter and the question is why? May be to avoid tax and dividend payment for the 2015 account

I am glad that this is not a one man fight anymore. I have been very critical of NEM’s financials for a long time. I do not know how both the NSE and NAICOM can accept the junk that NEM spews out on a quarterly basis. What is the use of asking them to render financial statements quarterly only to allow them to file what are obvious garbage.

What Tunde Oke said in the write back of supposedly excess provision for Claims and Expenses for 2015 is correct as far as the mechanics of the financials is concerned. My opinion though is that there is something more sinister going on. I believe having announced a bad result for 2015, NEM wants to shore up it’s share price and wrote back the provision to increase the Net Income. Those provisions will come back at the end of the year.

For two years running now, NEM has shown a sundry receivable of about N1 billion in its first quarter report. This receivable is not related to premium and you wonder who it is receivable from. At the end of the year, the receivable disappears but the Re-insurance premium expense suddenly jumps up compared to what it was in the 3rd quarter. It is as if the company waits and assumes the risks on its insurance books for the most part of the year only to suddenly wake up towards the end of the year and re-insure the risks. This makes no sense at all.

I am going to be very blunt here. From what I can see of NEM’s financials over the period that I have been monitoring it, the managers of this company used to fleece this company through the brokerage firms by not remitting insurance premium collected to the firm. I believe the managers own the brokage firms. That is why NEM had huge bad debt provision and eventual write-off relative to its gross premiums compared to its peers. Now that the law has taken away that avenue, it is now the re-insurance expense they are playing with. The money is taken out earlier in the year, put on the balance sheet as Sundry receivable and reclassified as re-insurance expense at the end of the year. I challenge anyone at NEM reading this to prove me wrong.