If you are an investor in Nigeria’s capital markets then it probably pays to listen to Nairametrics.

We flagged the potential margin compression coming to Dangote Cement in our earlier piece on the firms FY 2015 results which can be found in the following link

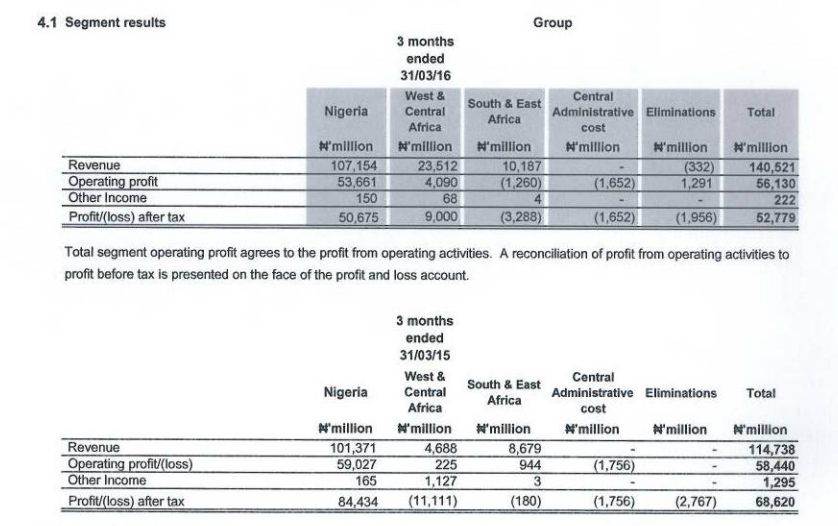

In Dangote Cement’s First Quarter 2016 results just released today some of our fears about margin compression are being realized (See Fig 1 below)

Source: Company Financials

In the Q1, 2016 results Dangote Cement reported Operating Profit margins of 39.9 percent on revenues of N140.52 billion and operating profits of N56.1 billion.

This compares to Operating Profit margins of 50.9 percent in Q1, 2015, when the firm recorded revenues of N114.73 billion and Operating profits of N58.44 billion.

It is usually a red flag for investors when a company’s revenues are going up while margins are going down.

For Dangote Cement the problem lies in its abnormally high Nigerian margins, which have nowhere to go but down, when combined with revenues from other regions of operation in Africa.

As a matter of fact the South and East African operations of Dangote Cement widened it’s after tax losses to (N3.2 billion) in the most recent quarter.

The next obvious question is what would be a good valuation for Dangote Cement.

We have previously maintained that the firm should not be trading at more than 2.5 x trailing sales for past four quarters, (a valuation higher than most global peers who trade between 0.7 and 1.5x sales but a little justified since Dangote can still be called a growth company).

Applying this metric would give us a company valued at N1.293 trillion or $6.4 billion, which is 52.8% less than it is valued today.

Our conviction comes from the fact that Dangote Cement sells nothing but a commodity, and like all commodity producers from Intel’s computer chip to the RIMMs Blackberry to Cement manufacturers, once your margins peak there is only one place for the company stock to go.

Watch out below!