Transcorp Plc Ltd, a Nigerian company whose business is the investment in and operation of portfolio companies in the hospitality, power, agro-allied and oil & gas sectors reported unimpressive results today, with total comprehensive income for 2015, down by 56 percent to N1.4 billion from N3.3 billion in 2014.

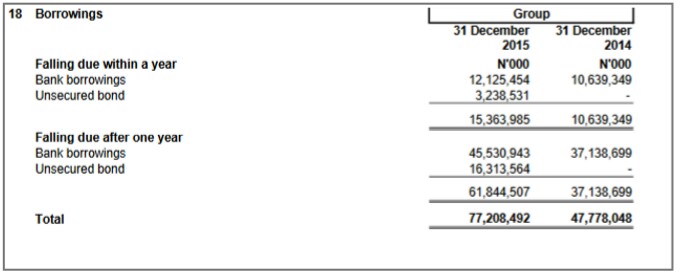

After going through the 50 pages of notes attached to the results, what struck us at Nairametrics was the huge debt burden the company is carrying.

Transcorp had N40 billion in revenues but spent N12.8 billion as finance costs.

The firms total debt burden was N77.2 billion up 61.8 percent from N47.7 billion in 2014.

Fig 1 : Transcorps total borrowings

The Company says in one of the notes on page 40 that it “has over time liquidated or disposed off some of the collateral securities pledged for different borrowings with the bank. This represents a violation of the loan covenant with the bank.”

This could be a troubling sign for us at Nairametrics that cash flow management and liquidity is an issue for Transcorp.

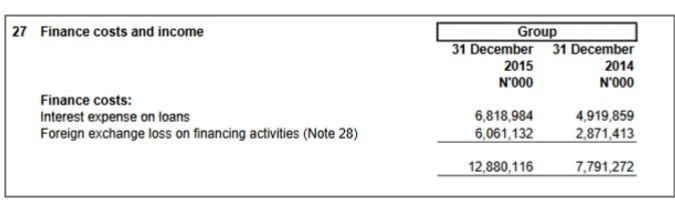

Another troubling issue is the foreign exchange losses amounting to N6.06 billion that Transcorp reported.

Fig 2

According to the firm “The movement in foreign exchange differences is as result of the decline in the value of the Nigerian Naira against the US Dollars by N41/$1 from December 2014 to December 2015.”

With the naira expected to depreciate against the dollar in coming months if oil prices don’t recover, this could pose further problems for Transcorp in the future.

Transcorp has about $221 million (N41.5 billion) in foreign currency loans outstanding but derives 100 percent of its revenues in Naira, making the firm highly exposed to FX losses.

Please see below my view on your article:

Issue 1: Trancorp’s debt burden – (Transcorp had 40bn in revenues but spent 12.8bn as finance costs. The firm’s total debt burden was 77.2bn up 61.8% from 47.7bn in 2014)

(1.) There is no reason to be concerned about Trancorp’s debt because the company has sufficient capacity to service its debt obligations

(2.) Trancorp’s core operation is entirely cash based, hence there is sufficient capacity (based on current operations and ongoing expansion) to service existing debt. The projected annual cash flows from the hotels currently being developed are in excess of 35bnn which is almost 3 times estimated annual interest expense.

(3.) Further, if you study the 2015 cash flow statement, you will notice a 396.6% jump in cash and cash equivalents, with cash flow available for debt services more than 2 times finance costs. This expected to increase to more than 4 times upon completion of ongoing projects.

(4.) According to the financial covenant in its most recent bond offering, Transcorp is expected to maintain a maximum Net Debt to EBITDA ratio of 3.0 times. From these latest numbers, this ratio 2.1 times, which is well within acceptable limits. All other financial covenants such as Debt Service Ratio, Interest Cover as well as Secured Indebtedness as pre-agreed with investors are all currently being kept. The writer can cross check the Prospectus against the numbers reported.

(5.) The finance cost of N12.88bn comprises of the of “Interest Expense on Loans of N6.88bn” and “Exchange Rate Loss of N6.06bn”. With over N24bn currently generated from operating activities (which is forecasted to increase upon completion of the hotel projects and from increased capacity from the Ughelli Power as well as additional cashflow from the Oil & Gas operations), Transcorp can cover its loan payment by at least four times.

Issue 2: Exchange Rate Loss Issue – (The company recorded an exchange rate loss of N6.0billion)

(1.)The exchange rate loss is related to Transcorp Power. All the players in the sector took an exchange rate loss following the devaluation of the Naira. Hence, this is not peculiar to Transcorp.

(2.) In fact, exchange rate loss is a common phenomenon in reported numbers of companies given current macroeconomic headwinds. Most companies that have released results so far have been directly and indirectly impacted by the devaluation of the Naira in the last one year. However, it is likely that players in the power sector (which is a priority sector) will be given preferences in terms of access to FX as part of ongoing plans to revitalize the sector.

(3.) MYTO tariff has exchange rate mechanism built into it which when is fully implemented will help reverse some of the exchange rate losses experienced by Power Companies

Thank you

KF

Interesting. I think Transcorp has a story that is compelling. Only time will tell

Great response KF

KF is doing a great job, I think Tony needs to promote you because it is long over due.

You guys will soon approach your shareholders who do not care about, I guess you have started rehearsing the next growth story which you will tell them.