Wapic Plc, a Nigerian Insurance Company recently declared dividends of 3kobo per share out of an earnings per share of about 10 kobo. The company is therefore paying just 30% of its profits as dividends which will cost the company about N401 million.

This might be small for shareholders of the company but when you consider that they had not paid dividend in years then surely they should be a relieved. The company also just reversed its negative retained earnings of -N449 million into a positive of N660 million. The dividend being paid is also about 61% of retained earnings leaving the company with very little buffer. But could shareholders have gotten a better deal?

A further look at the company’s results suggest there are areas where significant savings could have been made. Most Nigerian businesses are fond of incurring high operating expenses to the detriment of shareholder dividends/value. Wapic’s opex lines is another classic example.

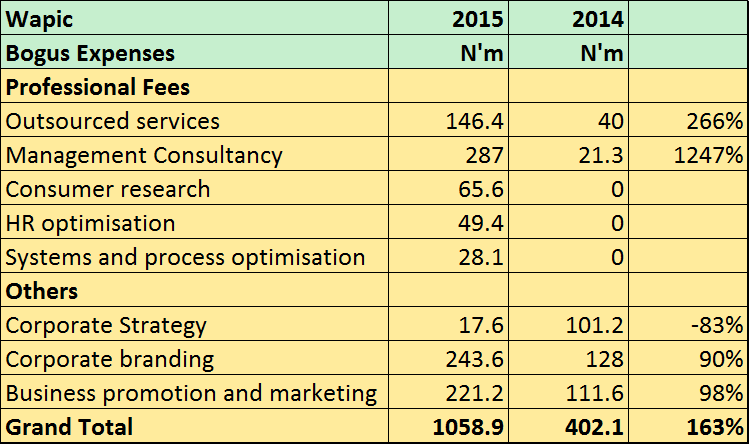

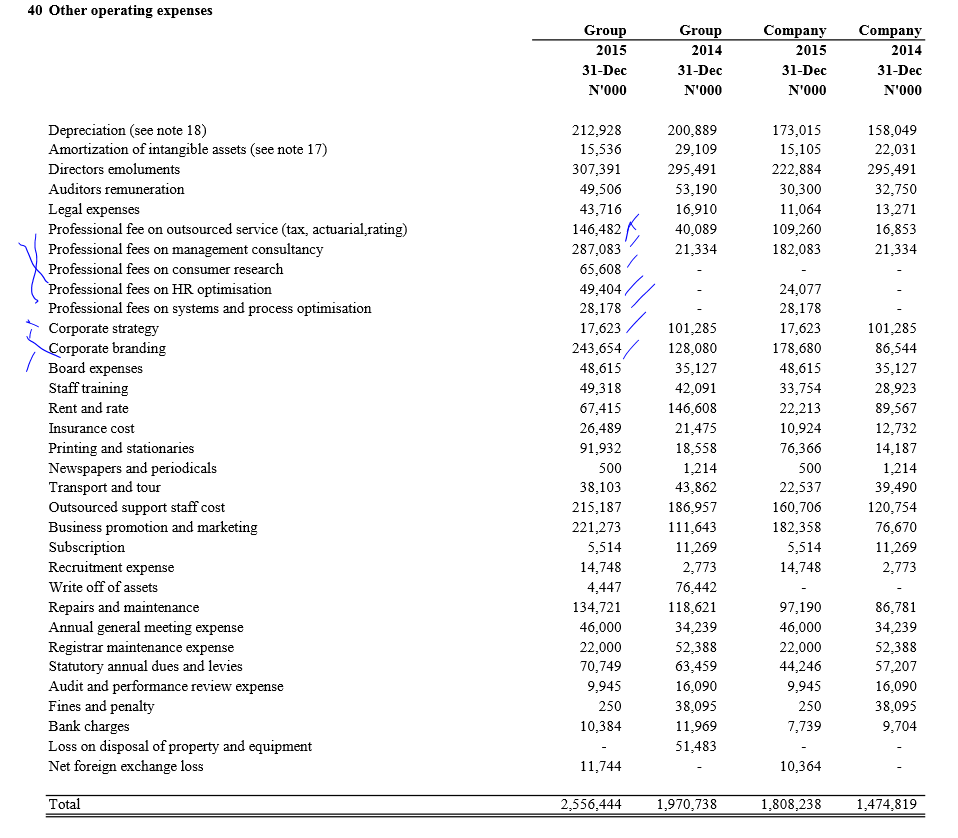

The company spent a total of N3.4 billion in operating expenses in 2015 up 13% from 2014. Out of the N3.4 billion about N2.5 billion was spent on “other expenses” compared to N1.9 billion in 2014. Breakdown of the N2.5 billion reveals some bogus expenses in need of explanation.

From above, it will be hard to convince shareholders that another N500m could not have been saved and paid out as dividends. Apart from the N146.4 million spent on outsourced services the company also reported another N215 million on “outsourced support staff cost” (not included in the list above). So what exactly is the company’s 210 staff doing (which includes 13 management staff)? Staff cost by the way was about N924 million.

Compared to its peers, Wapic also performs woefully when it comes to expenses. The company is currently spending about 79% of its Gross Operating Income on operating expenses. Custodian and Allied, NEM, AIICO and Mansard spend about 42%, 50%, 64% and 19% respectively (using 2014 results) respectively. Wapic spent 98% in 2014.

The company’s profits also presents its own set of concerns for shareholders. Included in its profits is about N1.5 billion made up of Gains on asset values and other income. This income is not backed by cash. For example N1.1 billion of that amount represents gains from revaluation of its investments in Coronation Merchant Bank. These are accounting profits

and does not represents actual cash inflow. Yet the company, essentially paid dividends out of this revaluation.

Source: Company Financials

Wapic currently trades at 50kobo and has remained at that price for months. It once rose to 60 kobo last year but never beyond that. At 3 kobo per share the current dividend represents a dividend yield of 6%. In this current market, investors look for yields in the double digits for small cap stocks. Africa Prudentials for example proposed a dividend that yielded about 14%. It will take more than 3 kobo to move this share price beyond 50 kobo.