FBN Holdings hit the markets with a surprise profit warning yesterday; although for Nairametrics readers it should not have come as much of a surprise as we have consistently flagged the poor manner in which Nigeria’s largest lender by assets was being run.

Anyway, today we decided to look at the books of other Tier – One lender’s to get a clue as to who will follow FBNH in issuing profit warnings as a result of spiking bad loans due to high exposure to the oil and gas sector.

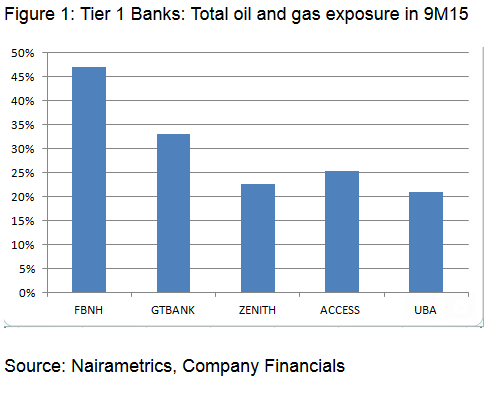

According to Moody’s 24 percent of Nigeria’s banking system loans are related to oil & gas, however FBNH had as much as 45 percent of its loan book as at the 9 months, 2015 period exposed to oil and gas as can be seen from Fig 1.

Extrapolating banks third quarter results gives insight into the banks that are likely to issue warnings as a collapse in oil prices squeezes their debtors.

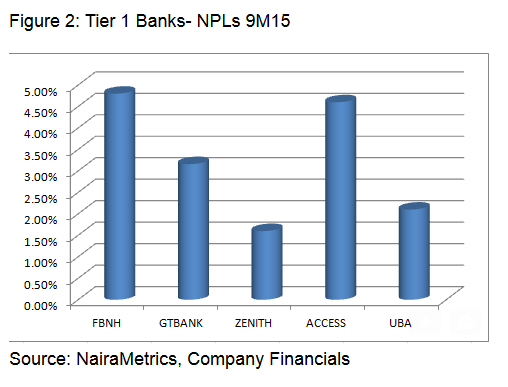

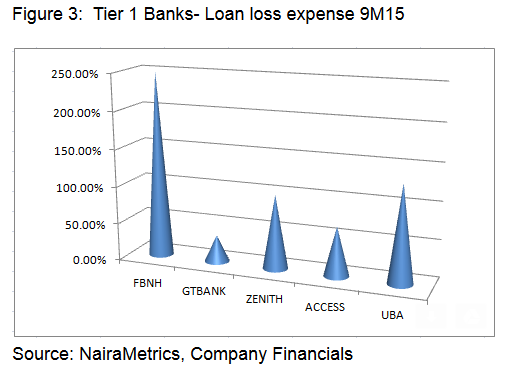

First Bank Nigeria Holdings Plc may be the most vulnerable to economic headwinds as its proportions of total loans to oil and gas sector in the third quarter of 2015 was 47 percent, the highest in the industry. Nonperforming loans NPLs was 4.8 percent, approaching the 5 percent threshold; Loan loss expense otherwise known as provision for impairment also increased by 248 percent for the period.

GTBANK, Zenith, UBA, and Access Bank, had oil and gas exposure as a percentage of their total loan books of 33 percent, 22.60 percent, 21 percent, and 25.3 percent respectively.

NPLs were 3.16 percent, 1.60 percent, 2.10 percent and 4.60 percent respectively. Africa’s largest economy has been hit hard by the more than 70 percent drop in the price of oil to near $32 a barrel.

The central bank introduced capital controls to curb dollar flight as it imposed currency restrictions instead of devaluing the naira to allow liquidity flow. The policy of cutting dollar supplies to save the reserve from further depletion is hurting the profits of lenders and it also makes it difficult for their customers to source enough forex to service business obligations.

Foreign currency loans make up around 40 percent of total loans in Nigeria’s banking sector. Economic growth slowed to 2.8 percent in Q3 2015, from 6.4 percent in 2014, while inflation has risen to 9.6 percent, according to the Bureau of Statistics (NBS).

Nigeria’s external reserves stood at $27.840 billion as at February, down 30.5 percent from N40 billion in early 2014.

So there you have it and if that wasn’t enough, Moody’s said in a new report on the sector released today:

“We expect the rise in problem loans from a reduced capacity of oil & gas borrowers to service their debt will continue, as will higher loan-loss provisioning attributable to oil & gas loans. Reduced government revenues and lower economic activity have increased government arrears to the corporate sector, which pressures banks’ asset quality and will reduce loan originations and thus lower profitability.”