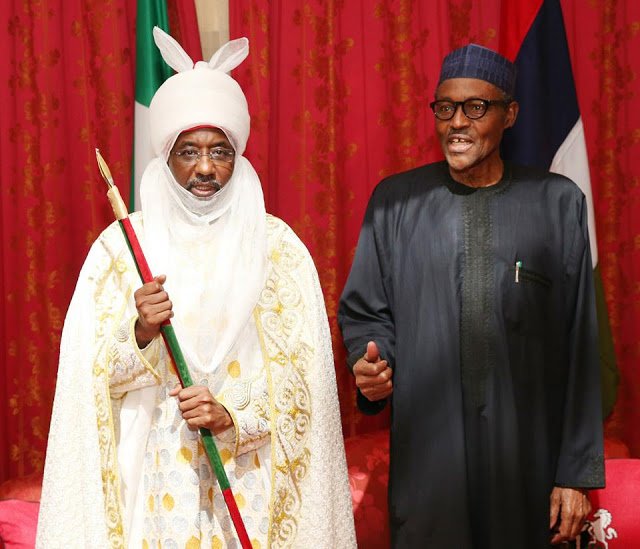

President Muhammadu Buhari risked exacerbating the country’s economic woes and undermining his government’s achievements on security and corruption by endorsing exchange rate policies that were doomed to fail. The Emir of Kano and immediate past Governor of the Central Bank of Nigeria, Muhammadu Sanusi II, was quoted by Financial Times as saying that the CBN is operating a wrong monetary policy regime.

Last year the CBN received Buhari’s public endorsement to impose tight capital controls and pegged the naira at an official rate currently 35 per cent stronger than the black market rate. The policies sparked capital flight and hurt Nigeria’s reputation as a frontier market investment destination.

Nigeria’s economic woes are now being exacerbated, Sanusi argued, with the currency peg and restrictions in the foreign exchange market creating “a lot of speculative and precautionary demand.”

Exporters and investors “are holding on to foreign currency, as no one would sell at the rate the government is setting,” while “the government does not have the reserves to keep the exchange rate at its official level in the market,” he said.

President Buhari has said repeatedly that he will not devalue the naira.

“These policies have been tried in different parts of the world and in this country before, and they have just never worked. No matter what the stated intention behind them, they are wrong,” the emir added.

The gap between the black market rate and the “artificial” official exchange rate will keep widening, Sanusi predicted, until the bank adopted a more realistic policy or the price of oil climbed and dramatically increased reserves.