The CBN has effectively entered a quantitative easing cycle to prop up an economy is at risk of further decline.

After completely ruling out the devaluation of the currency, the CBN is finding that it has fewer options in its arsenal to spur growth in the economy. Its most recent trick is to cause a flush in banking sector liquidity by staying out of the market, when it previously intervened to mop up liquidity.

Yields: dropping like it’s hot

The CBN has taken an easing stance:

It has reduced cash reserve requirement from 31 percent to 25 percent, to enable banks have more funds to lend to the economy (this more than offset the debit from the system due to the TSA implementation).

The CBN also did not rollover its Open Market Operation (OMO) program in the recent past week. It did not mop-up extra liquidity from the banking system, and banks could now be stuck with piles of cash that they have to find uses for.

Interest rates across the money market and government debt market have taken a plunge in recent days, showing the extent of the new high levels of liquidity in the system.

The average monthly 90-day Treasury bill yield has fallen from 14.9 percent in August to 9.3 percent in October.

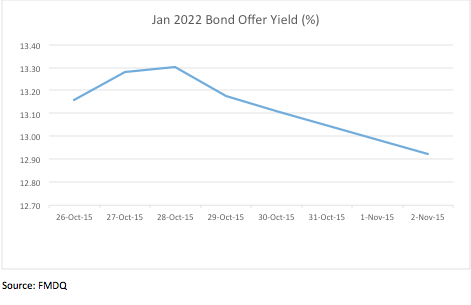

Bond yields have also fallen.

… Most of the extra bank liquidity is finding its way back into short-dated securities, not into new credit

According to analysts at CSL, the CBN is trying out this new and experimental variant of Quantitative Easing to spur lending to the real sector to avert growth decline.

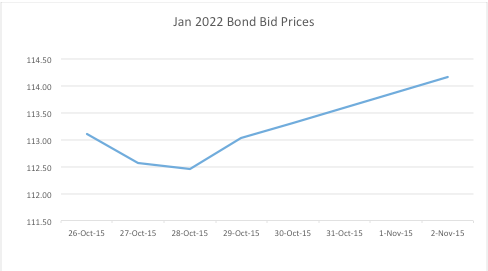

But with the new liquidity, banks are increasing their demand for paper securities like bonds rather than increase lending to the real sector (at least for now). Bond prices have been bid up in the process due to the increase in demand from banks.

It seems that the reason for this is that banks have not been assured of the surefootedness of this policy, given the penchant of the central bank for policy flip flops. Hence they are waiting to see how long new this liquidity drive will last.

This is why they have flocked to short dated securities to park their funds.

The new move to spur lending to the economy might be getting set to fail at the outset because banks are not willing to lend from a market/credit risk perspective, mostly due to the scarcity of good quality borrowers in the market.

With the economy slowing down, there is the high risk of NPLs growing even more than it already is, because businesses could find loan and debt service repayments tougher due to the slowdown in businesses.

What will happen when the system is flooded with much more liquidity and there are no more means for the cash to be deployed?