It is interesting to note that a significant share of the recommendations making the rounds today on fixing the petroleum sector had been clearly articulated and documented over the past 15 – 30 years by a number of think tanks led by the Nigerian Economic Summit group NESG.

For example the deregulation of the oil and gas industry as articulated in the NEEDS document in 2003 had amongst its key objectives the “deregulation of the downstream petroleum sector, phasing out of petroleum subsidies and the sale of the refineries”.

Decades later, we are still having a debate whether or not to carry out full implementation of these reforms.

The Fix the Refineries chorus as a cure all for the sector, gets more puzzling when the demands of Labor and other civil society groups, are put side by side with the Rhetoric of the Government.

The NNPC has stated that the refineries would begin to work optimally after engaging the original constructors of the refineries for the Turn-Around Maintenance.

Labor and Most Civil society groups that engaged in the last street protests have also demanded that the nation’s refineries be fixed as a precondition, before a hike in the pump price of petrol or deregulation is attempted.

It seems that both labor and the Buhari Government have formed a rare consensus about the need to fix the nations refinery’s, however most analysts believe that the call by both sides to fix the 4 NNPC refinery’s, is a way of throwing good money after bad.

Bismarck Rewane, renowned Economist and CEO of Financial Derivatives Company believe that a deregulated price regime is more important than any move to fix decrepit refineries.

“Until the deregulation is done whereby the pricing is not fixed by the Government but by the markets, I do not think that people will invest in the downstream,” he stated in a recent interview.

Other analysts argue that the fixed price of petrol in Nigeria that creates an opportunity for arbitrage will undermine any attempt to fix Nigeria’s Refineries or build new ones.

“Several proposals for the construction of Greenfield refineries from international and Nigerian investors have been submitted. The best known is the Dangote Group’s plan for a huge refinery and petrochemicals complex in Lagos State. We would not expect these projects to come to fruition without deregulation,” FBN Capital analysts led by Gregory Kronsten said in a recent note.

For NNPC Low Margins plus Fixed Prices don’t add up

Refiners the world over operate on razor thin low margins, therefore In order to realize the highest refining margins the refinery manager seeks to pay the lowest price for crude oil, maximize the yield of the higher value products (e.g., gasoline), control operating costs and receive the highest price for its refined products on a sustained basis.

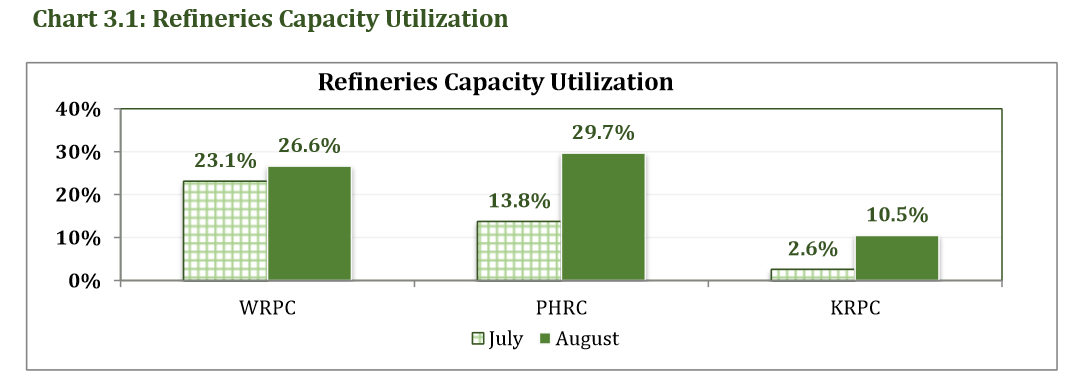

The NNPC and its refining companies which are operating at about 10 percent capacity utilization (Table 3.1) are however unable to operate on any of these 4 basic principles as they currently, pay International prices for crude oil, are unable to control operating costs, and are unable to maximize the yield on the high value product (P.M.S) because they receive the lowest non inflation adjusted prices for it.

Consumer prices rose 11.58 percent in 2008, 12.54 percent in 2009, 13.72 percent in 2010, 11.08 percent in 2011, 12.2 percent in 2012, 8.5 percent in 2013 and 8.4 percent in 2014 according to IMF and NBS data.

This means a Refiner operating in Nigeria that’s unable to pass on price increases at least equivalent to the rise in CPI will soon go out of business.

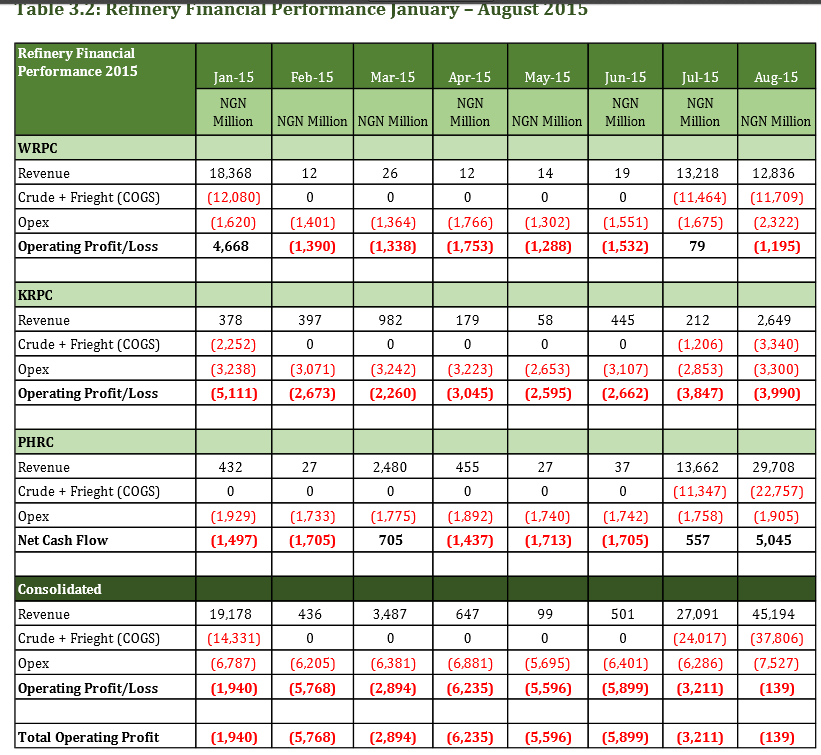

This is already evident in the losses reported by the 4 refineries (see Table 3.2 above)

![[Nigeria’s Refineries] How Nigeria Keeps Throwing Good Money After Bad](https://nairametrics.com/wp-content/uploads/2015/10/Kaduna-Refinery.jpg)

You never knows in Nigeria,deregulatuion of downstream of Nigerian oil industry,can happen in a simple way,it can only happens,when Nigerians starts to trust their govt because Nigerians have undergone extreme shock economic policies,and Nigerian have not recovered from that,a couple of years ago,bank interest rates was deregulated.in other words,the economy is not moving in any way. it’s oligarch economy.during the advent of the new democracy,some Nigerians investors with hope, wanted to build new refinery,but it came to nothing.

To built a new refinery should/or can be a sort of joint-endevour between the N.N.P.C/govt and any investors.if there is subside,the govt can determine the level of subsidy or the profit to be shared amongst them.after is there no Nigerian head of state,that have not allocated oil field to their family,frends,or in-laws. did not Mr Etete awarded oil field to himself,when Gen Abacha was in charge,now ? Nigerians will see the delusion of removing oil subsidy in Nigerian domestic market,which Nigerian head of state from Niger State,that awarded oil field to his in-law from Kano State.that president obasanjo took over from ?.where is the trust in Nigeria ?

Almost all oil exporting countries subsidizes their domestic market.when the Russian president Mr Putin,on coming to power,was asked by foreign investors,can you remove the subsidy in the domestic market, he said it’s impossible,to remove this subsidy will lead to collapse of Russian economy.

Nigeria do not have a comprehensive social security to absorbe,any fall-out of removing this subsidy,nigeria have about 11 car production plant,which can be easily converted into full car production within a year,there is a Nigerian from north Nigeria that designs cars in America,for ford or G.M.in essential Nigeria will continue to experiences petrol shortage for the next 15 yrs,and again Nigerian population will surpass 200 millions within the same period,and Nigeria will consumes almost the same or more about 2 million barrel each day that it exports .is Nigeria prepared for this and that.

Thanks for your comments Chizoba. Well written