- United Bank for Africa (UBA) Plc has successfully raised N11.5 billion from the capital market through a rights issue. The rights issue of one ordinary share for every existing 10 was made to shareholders at N3.50 per share.

- UBA said in a statement tuesday that it has successfully completed the issue following the approval of Securities and Exchange Commission (SEC) and Central Bank of Nigeria (CBN).

- According to the company, this additional equity, UBA has fortified its capital base ahead of the full implementation of BASEL II, which requires higher capital buffer for Banks, to accommodate credit, operational and market risks inherent in the business of financial intermediation.

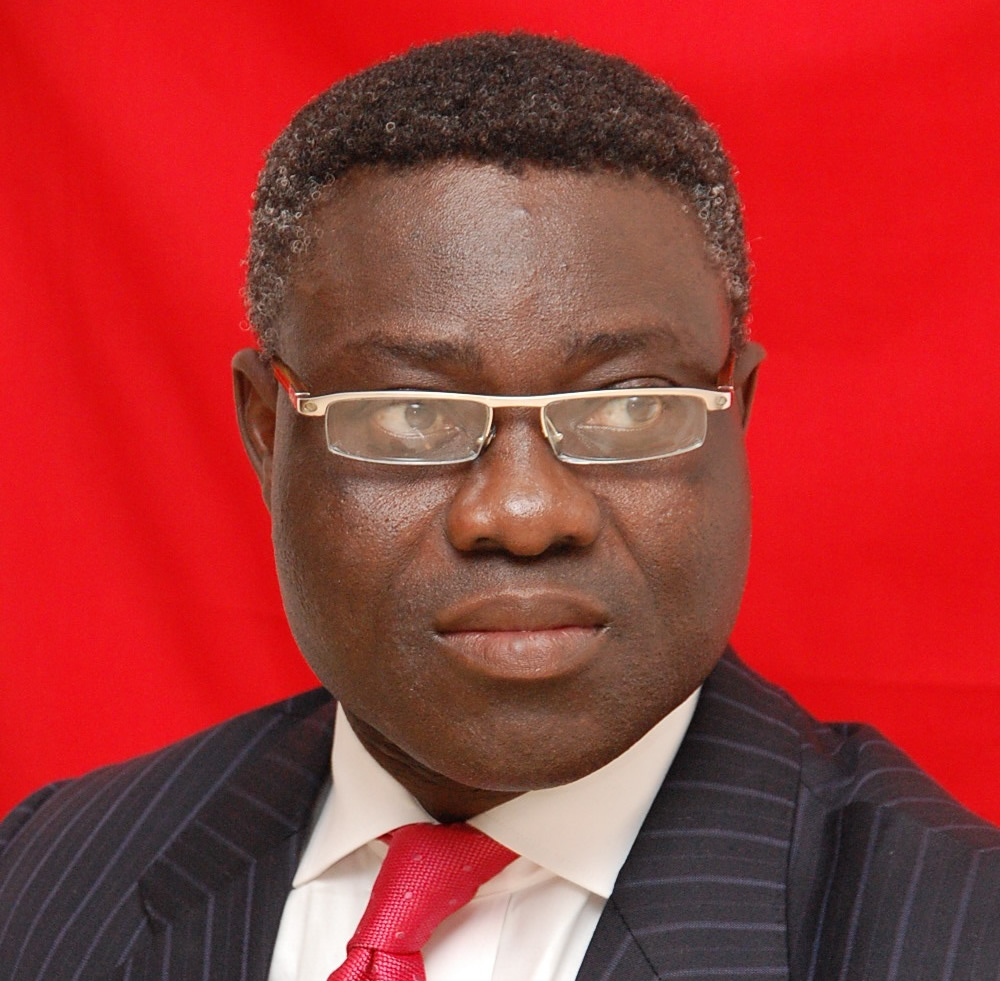

- Commenting on the issue, the Group Managing Director/CEO of the UBA Plc, Mr. Phillips Oduoza said:

“I am pleased with the successful completion of this Rights Issue, as it provides further leverage to exploit our growth potential. On behalf of the Management of UBA, I appreciate the shareholders for their strong commitment towards the growth of our dear bank and for the unwavering confidence reposed in us in building a great Pan-African institution. We will remain true to our promise of delivering superior and sustainable return to all stakeholders over the near to long term, just as we are committed to the development of the African economies where we operate.”

- Speaking in the same vein, the Group Chief Financial Officer, UBA Plc, Mr. Ugo Nwaghodoh said this additional equity provides further capital buffer for us to grow our business over the medium term, with a strong positive outlook on delivering our performance guidance for the year.”

- UBA, in December 2014, had also successfully raised N30.5 Billion Tier-II Capital through the issuance of Seven-Year Fixed Rate Unsecured Notes, maturing in 2021.

UBA Succeeds with N11.5 Billion Rights Issue