Market players looking at a trade may well start putting Dangote Cement on their radar.

The largest stock in the NSE by market capitalization has been consolidating around the N180 per share mark since April 2nd, (See Fig 1) which tells me it is about to make a big move in either direction, and I am betting higher.

Fig 1: 1 year chart Dangote Cement

Source Bloomberg

Bull Case for DANGCEM

Technical

Technically the stock chart looks sound with little or no resistance until the round number N200 per share level.

On a five year chart we see a huge run up in the stock from the N100 per share mark in early 2012, the peak at around N250 per share in mid 2014 and the more than 50 percent retracement to the recent bottom at near N140 per share.

I believe weak longs have been shaken out and the stock is set to test its former highs around N250 in the next couple of months, although the next target would be the N200 per share level.

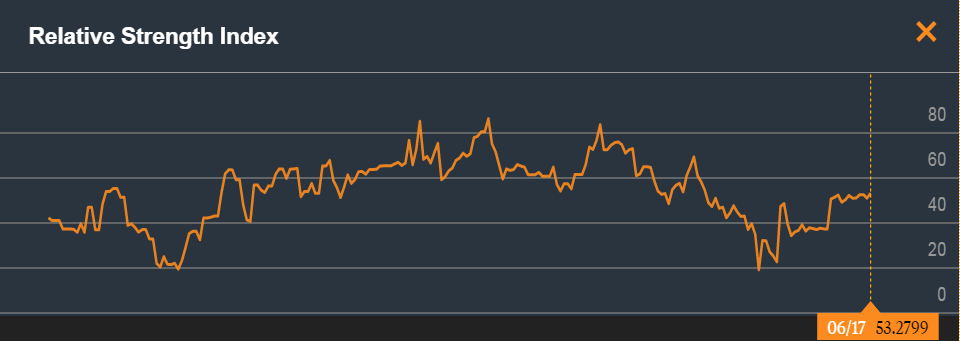

RSI in the 50s show it’s neither oversold nor overbought.

Fundamental

DANGCEM trades at a P.E ratio of around 17 times earnings and P.S ratio of 7.6xs. While not cheap it can justify its lofty valuation by being one of the most profitable Cement companies in the world (gross margins of 62 percent in Q1, 2015), combined with its low debt levels.

What is really exciting though and under most investor’s radars is the one – two punch of DANGCEM nearing the end of its African expansion cash outlays and the rest of Africa plants starting to contribute to earnings and revenues.

We think DANGCEM could significantly begin to return cash to shareholders once its expansion plans are done.

Sentiment

I like to look at Sentiment, combined with technical and fundamental analysis to get a complete picture of the stock story.

The Nigerian Cement names are not really loved right now by most analysts due to the tough macro environment and weaker oil prices.

RenCap in its recent note (May 11) had a N205 per share target on Dangote.

Bottom-line

You can buy DANGCEM here right now with a N200 per share short term target. In the longer run (6 months) this is ultimately going much higher.

Fig 2: 5 year chart Dangote Cement showing RSI

Source Bloomberg

PAT MELIK

Disclosure – The author of this article owns shares in Dangote Cement Plc and does not plan to buy or sell shares in Dangote Cement Plc in the next 48 hours. The author of this article wrote it themselves, and did not write this article on behalf of Dangote Cement Plc , its associates or representatives. The article is purely their opinion.

[ANALYSIS] Why Dangote Cement should be on your watch list: Market players looking at a trade may well start p… https://t.co/smW7dsrUad

[ANALYSIS] Why Dangote Cement should be on your watch list https://t.co/5Q7TOG1wtC

[ANALYSIS] Why Dangote Cement should be on your watch list https://t.co/ih7VDrsEPp https://t.co/qS7oHREZZu

[ANALYSIS] Why Dangote Cement should be on your watch list https://t.co/o8m2bek0kR https://t.co/wxBQItPuzy

[ANALYSIS] Why Dangote Cement should be on your watch list https://t.co/g8AEBVr8OT https://t.co/qPt2jiKep2

[ANALYSIS] Why Dangote Cement Should Be On Your Watch List

https://t.co/wG753RCESb